First of all, I would like to praise The Information for its excellent work in doing proper journalism, something that nowadays is more unique than rare, sadly. Let’s start with the explosive article just published and that, of course, barely caught the attention of mainstream media that are being very careful in not upsetting their advertising clients. In “OpenAI Projections Imply Losses Tripling to $14 Billion in 2026” the spotlight has been brought onto the details of the latest OpenAI fundraise where investors paid $6.6bn valuing the Ponzi scheme, sorry the company, $157bn (OpenAI Raises $6.6 Billion in Funds at $157 Billion Value) just one week ago. Here are the 3 most incredible things reported:

- OpenAI doesn’t project to be profitable until 2029

- OpenAI projects to lose $14bn in 2026

- OpenAI projects to incur $44bn of total losses from 2023 to 2028 EXCLUDING stock-based compensation

- OpenAI pays 20% of its revenues to Microsoft

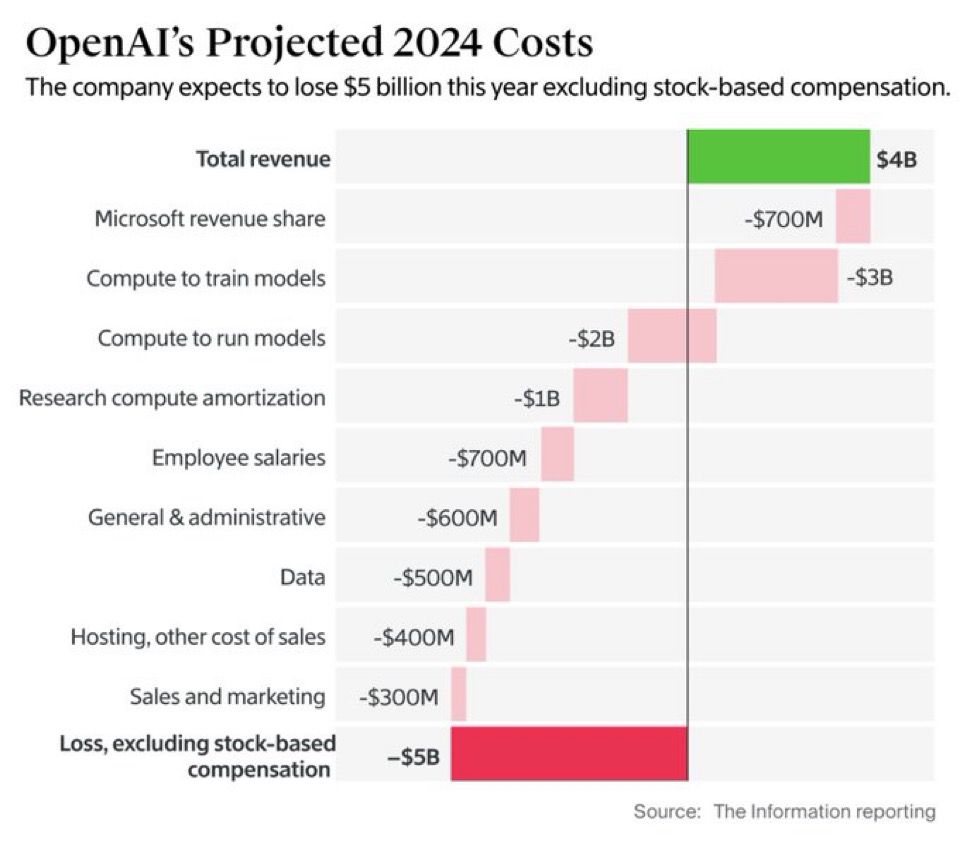

Let’s put some context here. Back in July, news about OpenAI set to lose $5bn this year and projected to run out of cash to operate in 12 months started surfacing (Why OpenAI Could Lose $5 Billion This Year). Then 3 months later, investors decide to pay $6.6bn at a valuation almost double the previous round, knowing that according to OpenAI’s own projections, this money is expected to barely last until Q1-2026.

Clearly, there is something wrong here, very wrong, starting from the form of the fundraising that was done in Convertible Notes and not directly into equity. Why? Currently, OpenAI is a non-profit organization (not a joke). The second odd detail was granting Scam Altman 7% of the equity upon the transformation of OpenAI’s legal entity from a non-profit to a for-profit organization (an event that will also trigger the conversion of the Notes into Equity). The third odd detail of the fundraiser was the restriction imposed on investors to invest in any of OpenAI’s competitors such as XAI or Anthropic. The last odd detail was that upon successful fundraising, OpenAI was granted a $4bn revolving credit line by a syndicate of banks. This will potentially extend OpenAI operations until Q3-2026 when the company will be running out of cash according to its own estimates.

What kind of investor would ever enter into a deal of this sort? No one, in theory, unless keeping OpenAI running provides secondary benefits. What are these benefits?

Among all OpenAI investors, there is one, the largest, that desperately needs OpenAI to stay in business: Microsoft. The relationship between the two companies isn’t a simple one of a customer and a service provider, and I have already addressed the concerning details many times:

- WHAT IF NVIDIA SIMPLY TAGGED ALONG WITH A MICROSOFT AZURE SCAM PLAYBOOK?

- MELLANOX, THE CORNERSTONE OF NVIDIA-MICROSOFT REVENUES ROUND-TRIPPING SCHEME

- MICROSOFT REVENUES “ROUND TRIPPING” PONZI SCHEME IS NOW TOO BIG TO HIDE – THE TRUTH FROM THE CASH FLOWS

In a nutshell, Microsoft has been printing Azure credits “out of thin air” to purchase equity in hyped startup companies, especially OpenAI. Then when these companies use the credits, Microsoft books revenues in its income statement. It does not take a degree in accounting to understand that there is no cash involved in this process, but investors and Wall Street analysts love to see top-line growth without asking questions about where that growth comes from.

Under U.S. GAAP, two companies are considered affiliated entities when one has significant influence over the other but owns less than 50% of its voting shares. “Significant influence” means one company can affect decisions like policies or management without fully controlling the other. In such cases, transactions between these affiliates (like sales or services) cannot be counted as revenue or expenses in the financial statements because they are considered internal transfers, not external business transactions.

What are the criteria to determine if a company has “significant influence over another”?

Significant influence refers to the ability of one company to affect the financial and operational decisions of another company, even though it does not have full control or majority ownership. Typically, significant influence is presumed to exist when a company owns 20-50% of another company’s voting shares. However, even if ownership is below this range, significant influence can still be demonstrated through other factors, such as:

1- Having representation on the board of directors

2 – Participating in policy-making decisions

3 – Material transactions between the companies

4 – Interchange of management or technical expertise

5 – Dependence on the other company for a major aspect of business (e.g., supplies or customers)

There is no doubt whatsoever that Microsoft has a “significant influence” on OpenAI considering criteria 3, 4, and 5. However, as we saw in the previous article, Microsoft accountants used a trick to still inflate Azure revenues making sure the balance sheet squared: they inflated Microsoft’s “Unearned revenues” liabilities account that reached almost $70bn in Q2-2024. The clear Achilles’ heel of all this revenue round-tripping (Ponzi) scheme is, of course, the fact that there is no cash that justifies these transactions. Hence, it is not surprising that now Microsoft requested a hard 20% kickback on OpenAI revenues so they can start filling that gap, hoping that no one pays attention to the financial shenanigans going on here.

OpenAI is effectively a revenue laundromat for Microsoft and the company does not even hide it in its own projections as you can see in the chart below considering “Microsoft Revenue Shares”, “Compute To Train Models”, “Compute To Run Models”, “Research and Computing Amortization” and “Hosting” are all items related to OpenAI relationship with Microsoft.

Of course, Microsoft isn’t alone in such a fraudulent scheme, which, to be clear, has already been replicated with many other smaller startups. NVIDIA has been a partner in it since the very beginning, hence it should not surprise everyone that they participated in this investment round. NVIDIA has only one goal: keep booking orders for its GPUs to keep its stock valuation inflated to a level that is only justified by the fact that every single person in the world will be eating GPUs for breakfast, lunch, and dinner in the future. However, NVIDIA has a problem with one of the companies that has been instrumental in boosting its incredible (albeit fake) growth: SMCI – THE NUCLEAR NOTHING BURGER THAT CAN EXPOSE NVIDIA SHENANIGANS. That the two companies have been cooperating in the same scheme is obvious to anyone paying attention (“HYPERSCALERS” OR “HYPERCHEATERS”? – ADDING HINDENBURG PIECE TO THE BIG PONZI PUZZLE WE HAVE BEEN PUTTING TOGETHER TILL NOW WHILE WAITING FOR NVIDIA EARNINGS), but luckily for them, no one but a few really do nowadays.

SoftBank is another company that participated in OpenAI’s latest fundraise since it belongs to the category of those in desperate need for the bubble not to pop:

- IS SOFTBANK TRYING TO SQUEEZE ARM INTO MAJOR INDEXES TO FORCE PASSIVE INVESTING BIDS AND LIQUIDATE THE STOCK WITHOUT CRASHING IT?

- DOES SOFTBANK NEED THE WEEKEND TO NEGOTIATE ITS BAILOUT?

- IF ARCHEGOS BUSTED CREDIT SUISSE, WHICH BANK WILL A SOFTBANK IMPLOSION SINK?

- Is ARM The Canary In The $NVDA Coal Mine?

The DOJ is already investigating on many fronts, from Microsoft and Nvidia’s questionable buying spree of startup companies to SMCI’s fraudulent accounting. However, all the companies I mentioned are doing such an incredible job combining timely PR, stock buybacks, and extremely sophisticated accounting to keep the fraud from being exposed to the general public that keeps loving them and buying their shares. Mark my words, all this is going to end very badly, ultimately popping the semiconductor bubble and leaving many clueless investors in ETFs, Passive Funds, and Pension Funds significantly damaged (IT HAS NEVER BEEN A BUBBLE IN AI, BUT A PONZI SCHEME IN SEMICONDUCTOR STOCKS SINCE THE VERY BEGINNING). However, similar to the Dot Com bubble of the early 2000s, all this oversupply of computing power is ultimately going to significantly lower the costs for all those startups that will leverage AI to build sound business products and operations, and among these, the future mega-caps will emerge like Google, Facebook, or Amazon did in the aftermath of the internet bubble more than 20 years ago.