As I was finishing up drafting this article, a “breaking news” pops up: “SoftBank to get first NVIDIA chips for Japan super computer”. How timely, right? SoftBank just released its quarterly financial statements that leave not much room for doubt: SoftBank group only has cash to stay in business for less than a year.

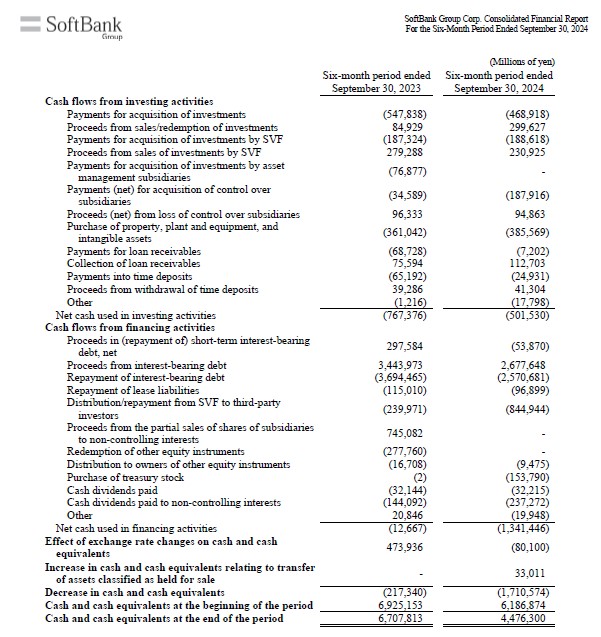

It does not take a full master’s degree in accounting to figure this out, just look at the run rate of cash burn in SoftBank’s cash flow statement.

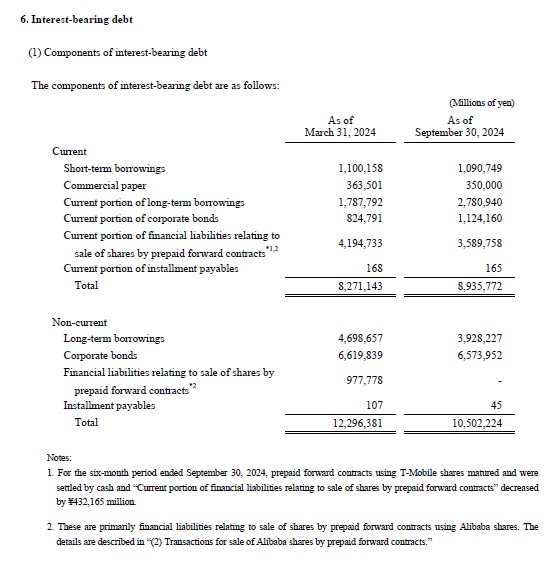

If you put on top of this the fact that ~46% of SoftBank’s interest-bearing debt is due in less than one year, it is clear how Masa Son is walking on a very thin line.

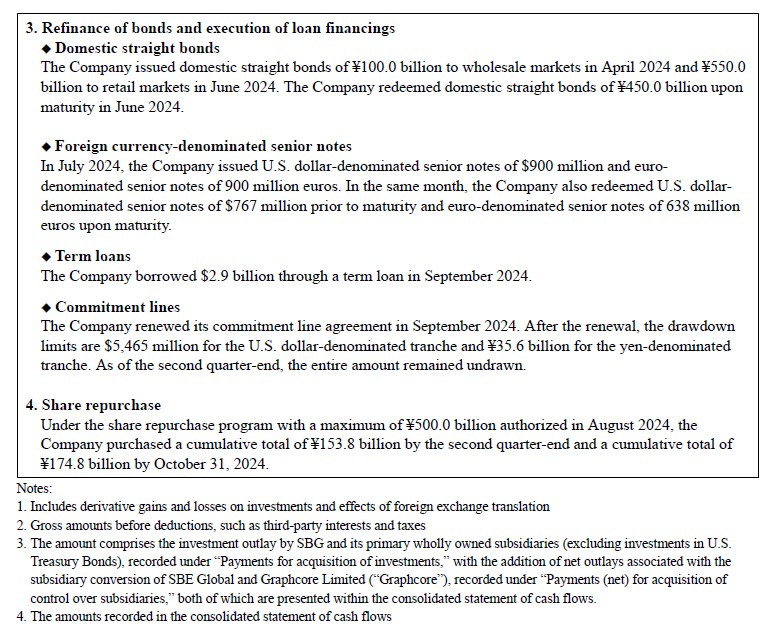

You might ask yourself how SoftBank has managed to stay in business so far. The answer is, that they are simply doing what zombie companies do best: issue more debt to repay the expiring one plus its interest. What happens when there is not enough demand in the market to issue bonds to the public? No problem, banks step up because they cannot take the chance of SoftBank defaulting on the loans already granted to them. As you can read from the table below, SoftBank managed to borrow 2.9 billion USD from banks in the last quarter, and on top of that, banks renewed their “commitments” (that is an off-balance sheet risk exposure so it does not show up in their financial statements) to lend SoftBank up to 5.5 billion USD in one tranche and up to 35.6 billion $JPY (~230m USD) in a second tranche.

Hold on a second, how is it possible that a company that claims to have almost 30 billion USD in “cash and equivalents” needs to borrow 2.9 billion USD more from banks?

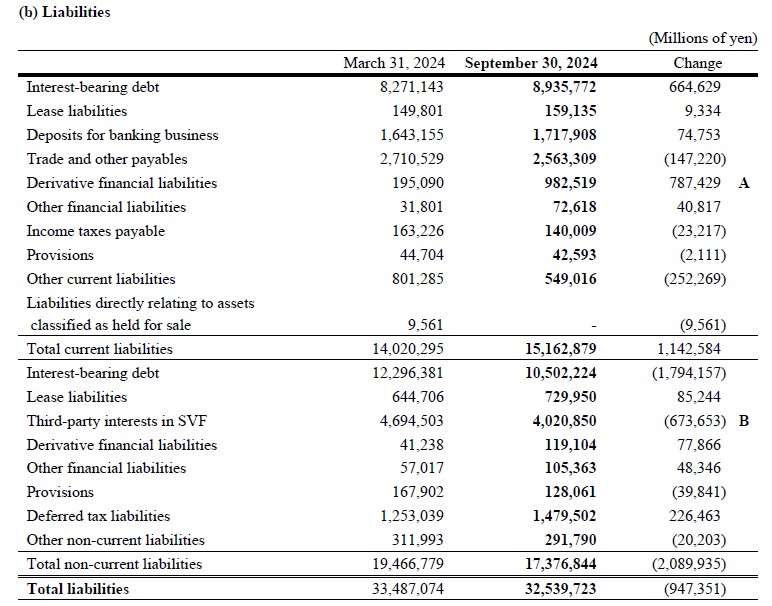

- First of all, even if SoftBank group isn’t a “bank” it actually does some banking business and collects deposits. As of the last quarter, SoftBank had about 11 billion USD equivalent of customer deposits.

- Secondly, SoftBank has a total of about 23 billion USD between Trade Payables and Derivative short-term liabilities

- Lastly, SoftBank has about 58.5 billion USD of debt maturing within a year.

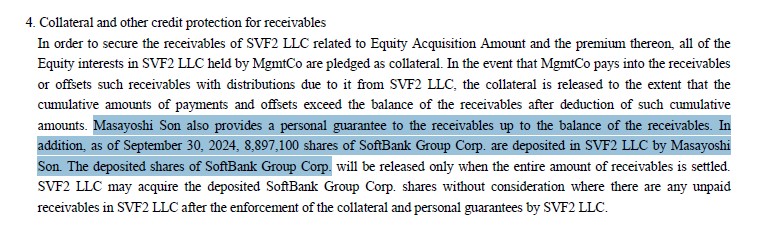

Hold on a second again, doesn’t SoftBank have about 17.5 billion USD of “Trade Receivables”? Here is where things become funky, to say the least. Most of these “Trade Receivables” are money that SoftBank lent to Masayoshi Son to personally invest in the Vision Funds and guaranteed by… his SoftBank and Vision Fund shares! Clearly, SoftBank is in no position to enforce the payment of these receivables since Masayoshi Son will be personally liable and since he does not have all that cash to pay the money he borrowed from SoftBank then, paradoxically, SoftBank will be forced to sell its own shares in the open market to recoup that money.

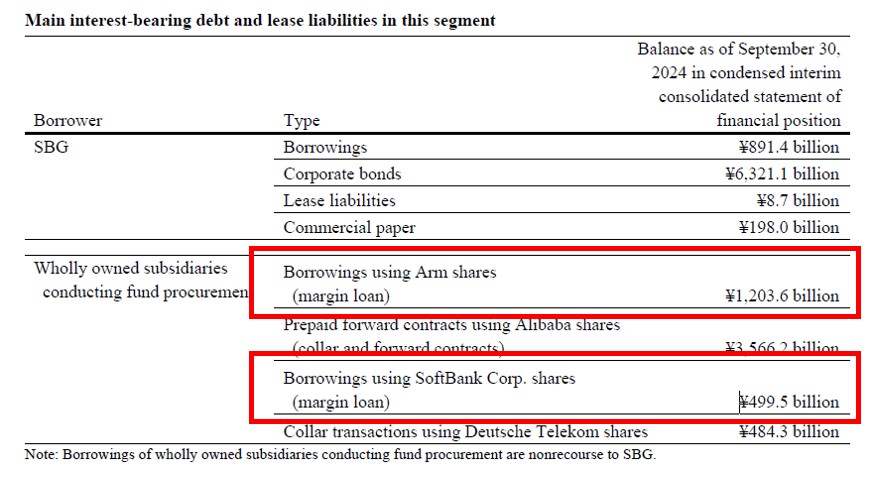

Now tell me, how the hell can SoftBank repay 58.5 billion USD of interest-bearing debt maturing within a year with a cash position, net of customer deposits, of 19 billion USD, and only 5.5 billion USD of additional commitments from banks? Selling ARM shares? Unfortunately, that’s not possible since SoftBank already borrowed against those (fully pledged as collateral) and since they were not enough, it even already borrowed using SoftBank Corp (the subsidiary) shares as collateral.

I have a strong gut feeling SoftBank is holding such a huge pile of cash on the back of commitments signed with banks, the reason why it needed to borrow more to buy back its own shares and keep SoftBank group price inflated like it did in 2020 when they were already close to going bust

Perhaps it is clear why now NVIDIA is coming to SoftBank’s rescue considering they are a very large NVIDIA shareholder and the controlling shareholder of ARM (a key partner to NVIDIA).

JustDario on X | JustDario on Instagram | JustDario on YouTube