Imagine a world where people only spend what they earn or where companies borrow to build new factories and use the additional revenues generated to repay the debt. Imagine a world where you have to plan and save enough money in advance to make an expensive purchase or where governments can only spend up to the amount of taxes they collect from citizens. Does this type of world sound perfect and happy? Indeed it would be, but not for everyone. This type of world would be a NIGHTMARE for banks and shadow banks:

- Lenders profit from the interest; if debt is repaid, guess what happens to a good chunk of their revenues? It goes puff.

- If people start to spend within their means, guess what happens to credit card debt? It goes puff.

- Suppose companies use Free Cash Flows to grow their business operations and finance their dividend expenses or share buybacks rather than issuing bonds or taking on loans. What happens to Investment Banks and Brokerages revenues? Most of them go puff.

I can continue for quite some time, but I believe the above list is enough to get the general idea.

What happens when banks or shadow banks lend? This is when money is “printed” into existence, not when central banks create bank reserves out of thin air. On the contrary, when borrowed money is repaid, money is “destroyed”. Banks not only profit from printing money into existence, but they also do so to keep it in circulation in the monetary system. Let me make a simple example here:

- Employee A, Factory B, and Shop C are all customers of BankXYZ

- BankXYZ lends 10,000$ to Factory B to build and run a production plant to make widgets

- Factory B uses the borrowed money to pay Employee A 100$ salary and to ramp up operations before they generate revenues

- Factory B starts producing widgets and sells them to the newly set up Shop C which borrowed 1000$ from BankXYZ as well.

- Factory B generates 1000$ of revenues at a 20% Net margin after paying all costs and salaries. If the company uses the 200$ to pay down the debt instead of distributing the profits to shareholders, BOTH BankXYZ and the shareholders will be unhappy right? What if Factory A distributes dividends or buys back its own shares? Both the bank and the shareholders will be happy. So why pay down the debt?

- What if Shop C pays down its debt? Again, both BankXYZ and its owners will be unhappy.

Now let’s assume Factory B and Shop C shareholders are customers of BankXYZ as well; otherwise, the bank would not have agreed to lend money to their business in the first place. What does the bank do once it sees its deposit account balances increasing? It opens a line of credit to them and this is used to purchase an apartment with a mortgage. The bank lends money again and is very happy because its interest revenues grow, right?

Clearly, you can expand this vicious circle until the total amount of reserves available to BankXYZ.

What happens when the bank runs out of reserves? They need the central banks to print more reserves and make them available to BankXYZ so the vicious circle does not stop expanding.

What happens if central banks stop printing bank reserves out of thin air? The economic growth is immediately capped. Hold on, but what happens if Factory B’s widget is not successful and both Factory B and Shop C don’t generate revenues? It will be quite a pain for BankXYZ to take over and liquidate both businesses’ assets and recover all it can. The easy way is to lend both Factory B and Shop C more money to try again. In this way, the bank does not need to book a loss on the first loan and will cash in more interest from more lending, basically a win-win.

What happens if Factory B gives up and files for bankruptcy after the second attempt to make a widget and sell it? The best option for BankXYZ is to lend money to a bigger Factory C to take over Factory B’s operations. In this way, the borrower becomes bigger, but the amount of money lent will be bigger too, hence more revenues for BankXYZ since Factory C will also take over the previous loans as part of the agreement of the new loan.

What if there is no Factory C willing to take over Factory B? Then BankXYZ will start lobbying for a government bailout and no politician would be willing to vote against it, why? Because the government will be blamed for the loss of jobs and angry employees (now without a job) and shareholders will vote for the competing party to go into power.

At this point, it is obvious that the larger the amount of debt in the system, the more powerful the banking system is to keep the status quo since losses will then impair economic growth. Furthermore, if the losses on loans are too big, BankXYZ will go out of business putting at risk its own customer deposits and as we learned in 2008, no government is willing to deal with that kind of nightmare. Bottom line, do not expect banks to “do the right thing” and stop lending money when no good use of it can be made; it is simply not good business for them. The change can only come from the people who stand on the other side of this (perverse) equation.

For example, why does it not make sense to take a mortgage for many decades? I know everyone’s dream is to own real estate, but let’s take a look at the numbers for a 30-year 4% fixed rate mortgage to buy a 1,000,000 USD apartment where the person saved 200,000 USD for the upfront payment:

- Monthly Payment: $3,819.32

- Total Interest Paid during the life of the mortgage: $574,956.05

This means that the value of this apartment needs to grow by more than 57% in 30 years for this to start being a profitable investment for the buyer. Prior to that, the one who makes money is only the bank. Here we are not even accounting for maintenance costs, taxes, and any other expense the owner will need to pay for in 30 years and that will become SUNKEN COST.

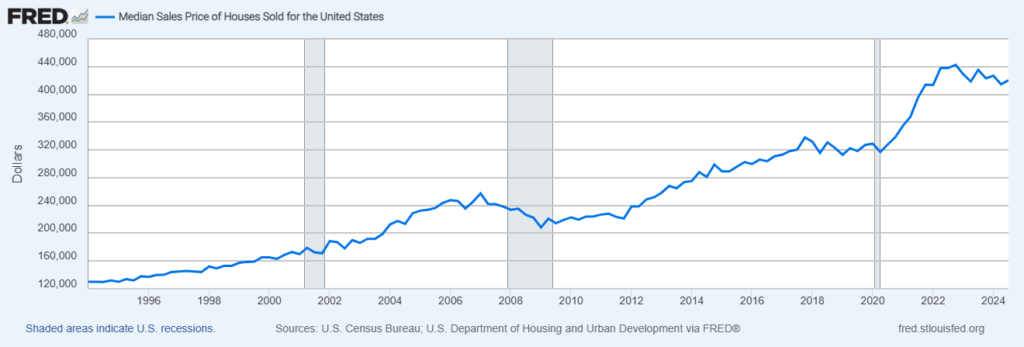

Now if you listen to the mainstream media you believe real estate has been a great investment for the past 30 years (and of course you must expect it remains the same even if the past is never a guidance for future performances) because of this chart.

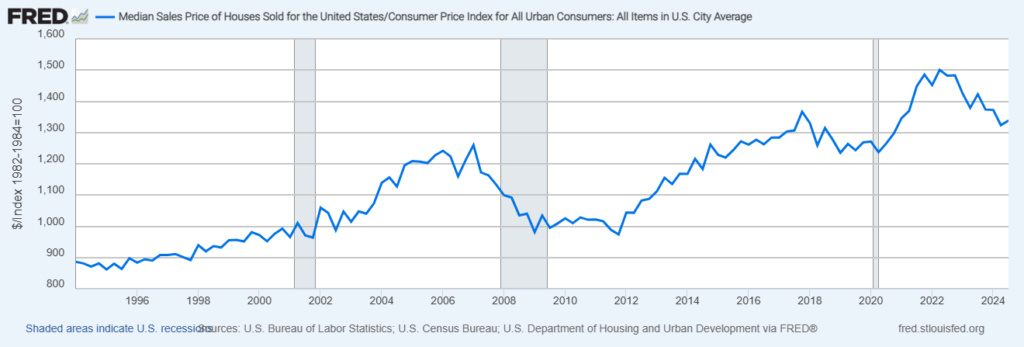

However, what about if we factor inflation into the data? The narrative starts to fall apart as you can see

Beware here we are considering the official inflation data that are notoriously underestimated compared to the real inflation consumers experience.

Alright, by how much did apartment prices go up in the past 30 years adjusted for inflation? 51%. Needless to say that, if inflation remains rather low as it has been from 1994 till today and you take a mortgage like the one I described above, the only winner is going to be the bank you borrowed the money from. Shocking isn’t it? What about if we experience higher levels of inflation and mortgage rates don’t come down from the current ~8%? Yes, real estate will be a very bad investment.

Don’t worry though, the narrative will keep preaching everything is awesome and banks will always be willing to keep lending money otherwise the whole house of cards collapses (on top of their heads). However, at this point, I believe you understand they are making their own interest, not people’s one.

What I described applies to credit cards, buy-now-pay-later loans, corporate bonds and so on. We are simply living in a system where people are not the beneficiaries of the real gains, but their lenders are. Consequently, it’s up to the people to break this vicious circle for their own good, but this will come at a sacrifice of not buying what they cannot afford today and going through the painful process of repaying the debt they should not have taken in the first place. The same applies to governments, that are effectively an extension of the people, but here I strongly doubt they will be the ones making the first move since forcing the population on a healthy and sustainable economic path decreases the chances of staying in power.

JustDario on X | JustDario on Instagram | JustDario on YouTube