The latest Nvidia 10-K is not only remarkable for the outstanding results the company achieved in the last fiscal year, a good chunk of which are very questionable as we discussed so many times (archive), but is also remarkable for the significant amount of risk disclosures and legal disclaimers included compared to the past. Needless to say, this is a big red flag regarding the truthfulness of the financial statements themselves and a clear sign that management is aware they will have a lot to explain in court in the future.

Let’s start with BlackWell, a product for which Nvidia repeatedly denied having significant production issues. If this was the case, then why does the company state with a 6-month delay that in the second quarter of 2025 its inventories were affected by the impact of BlackWell low-yielding material?

The second rather incredible risk disclaimer that has just been included in the latest 10-K mentions the risk of negative publicity potentially arising from “employees posting company data on third-party websites without permission.” Why make such a statement if the company did not foresee any risk of potential whistleblowers leaking sensitive information about Nvidia’s business?

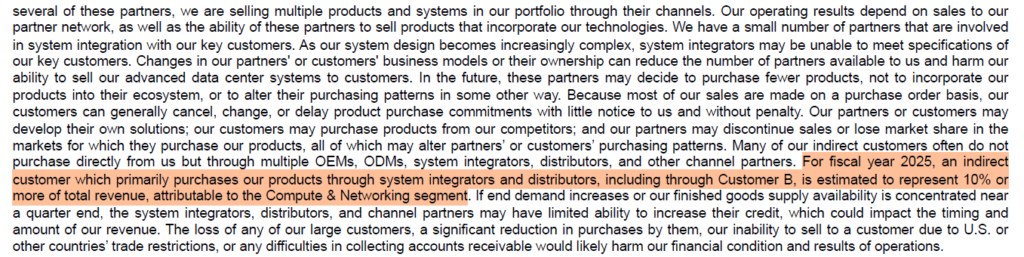

Unlike 2024 when Nvidia disclosed that only one “Customer A” represented 13% of Nvidia revenues, in 2025 three customers A, B, and C respectively represented 13%, 11%, and 11% of Nvidia revenues for a total of 34%.

This significant revenue concentration is something I flagged before since the company was forced to start disclosing it (likely upon the advice of its lawyers) a few quarters ago. However, what is interesting in the latest financials is the company admitting the presence of an “indirect customer” that is estimated to represent 10% of its revenues, some of which are purchased through Customer B which is clearly a distributor and very likely the troubled SMCI. Why can’t this customer deal with the company directly and why does it have to buy so many Nvidia products indirectly? It is fair to question whether this is needed to circumvent sanctions, hence implying that Customer B is involved in questionable practices effectively shielding Nvidia from potential consequences.

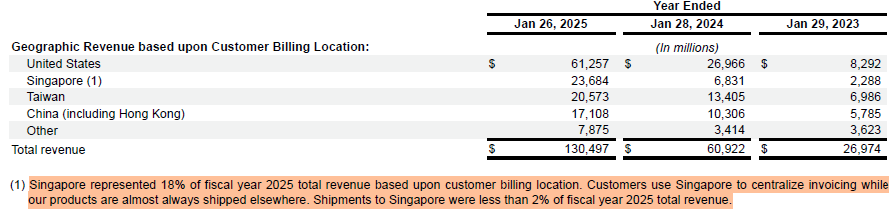

The suspicion that Nvidia is indirectly involved in questionable sales practices is reinforced by the company’s significant use of Singapore as a billing center that grew so big it could not be hidden anymore, and the disclosure has been sneaked as fine print in the current 10-K as you can see.

What Nvidia does not disclose yet is who its end customers are using Taiwan as a billing location similar to Singapore; all in all, the geography of ~51bn USD of Nvidia revenues (~40% of the total) is totally undisclosed and a big red flag on the company’s operations.

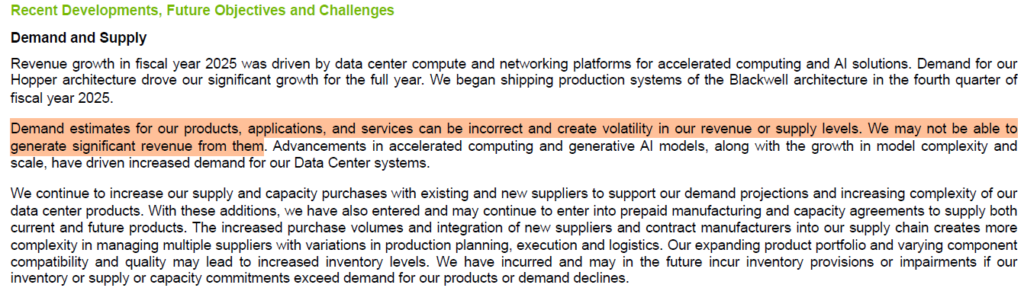

Quite in contrast with the narrative Nvidia management has been pushing so hard to throw gasoline on traders’ animal spirits, in the last 10-K another interesting disclaimer has been included stating that the company can be significantly impacted by mistakes in estimating demand for its products.

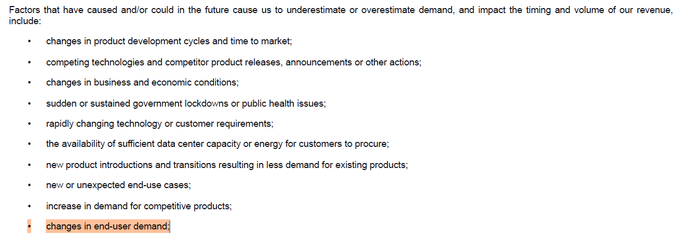

This concern is reinforced by another new disclaimer included and stating for the first time that there is a potential risk of “change in end-users demand.”

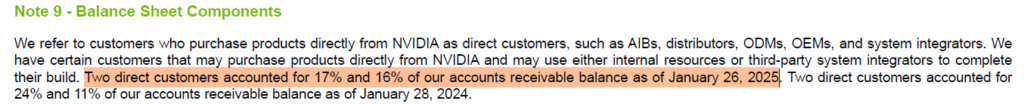

Another significant red flag is the substantial increase in Accounts Receivables from ~10bn USD to ~23bn USD during the year, paired with a jump in DSOs (Days sales outstanding) to 53 days versus a range of 35-40 days in the last 4 quarters. Furthermore, 33% of the Accounts Receivables relate to only 2 direct customers which combined owe Nvidia ~7.6bn USD.

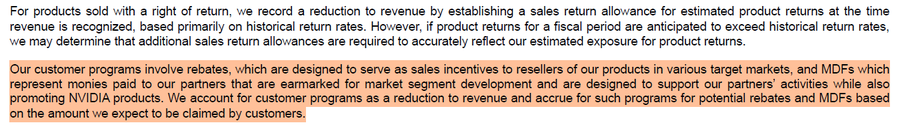

This significant increase in Accounts Receivables is surely due to Nvidia’s practice of accommodating rebates and sales incentives to its resellers, a need that is quite strange when Nvidia management does not miss the chance to declare how tight the supply is for its products along with overwhelming demand for it, isn’t it?

At this point, it is undeniable that the “dark corners” in Nvidia financials (THE DARK CORNERS OF NVIDIA 10-Q REVEAL THE EXTENT OF THE NVIDIA FRAUD) are a clear sign that the company has to increase its efforts to cover up the extent of the fraud it has been perpetrating and the future legal risks associated with it, especially when the US Supreme Court refused to dismiss investors’ lawsuit against Nvidia for a security fraud the company perpetrated in 2018 (US Supreme Court dismisses Nvidia’s bid to avoid securities fraud suit) and that represents a dangerous precedent for the company that will surely have to defend itself from new and similar allegations that will surface in the future.

JustDario on X | JustDario on Instagram | JustDario on YouTube