One month ago, I wrote about the “PANIC BEHIND CLOSED DOOR” (TwitterX), and at that time, I literally said:

“Imagine what would happen to Joe Biden’s approval rating if the #stocks bubble he inflated to the stratosphere implodes right now. With Jerome out of the game, Joe needed his Janet Tinker Bell to spread some magic dust and make sure the #BOJ didn’t implode [reference to #Japan] and bring down the whole house of cards.”

Fast forward, isn’t this exactly what’s happening?

What Jerome Burns did yesterday is not only an insult to Paul Volcker’s legacy but is a clear statement that Central Banks have completely abandoned their goals of financial and monetary stability to serve a very specific political agenda that clearly doesn’t have as its priority the well-being of future generations.

Coming next year, we are going to have US, UK, and Japan elections with the 3 respective governments in charge dealing with one of the lowest levels of popular support surveyed in modern times. All they have left to hang on is an unbelievable #stocks bubble they keep trying to use as proof of “how good things are” in one of the greatest efforts of brainwashing of the masses.

I bet my butt that they are aware a big institution is in a critical situation RGHT NOW, and to whom pays attention, the signs are everywhere:

» T-Bills market under pressure, now daily, during US overnight hours (TwitterX)

» An unstoppable flow into the safety of money market funds OUT OF #STOCKS (Chart1) that accelerated in the past weeks.

» Critical macro assets like $JPY, affecting trillions of leverage, now swinging like #dogecoin (TwitterX)

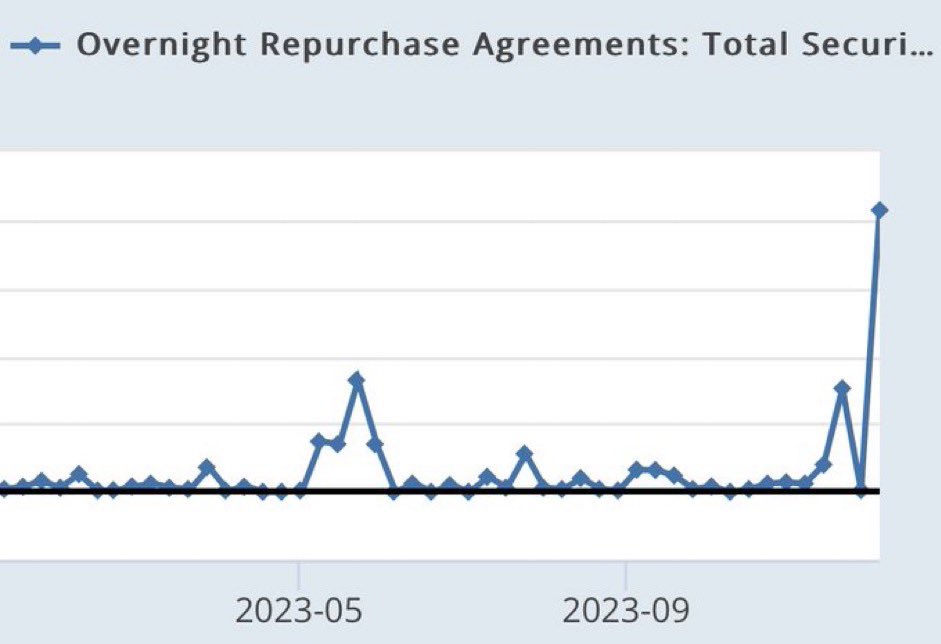

» Overnight REPO agreements spiking at levels that are multiples of when $SVB $FRC and $CS went bust earlier this year (chart 2)

I have highlighted many times lately how #BOJ actions denote an incredible state of panic, and now the fact that all other major central banks are coming to the rescue remarks how critical the situation is, greatly ignoring the fact that ultimately, the population will bear the burden for all these reckless actions.

I am confident that in a few hours, the ECB will do the same because “breaking the ranks” now will undermine all the efforts.

When I wrote the post “a december to remember” (TwitterX), I highlighted how bankers and money managers aren’t investing their personal savings in #stocks, but they are all pretty much in bills or treasuries. Ask yourself why.

I don’t see anything #bullish in what’s going on, quite the opposite, and whoever wants to argue against, please do it (politely) in the comments with factual evidence, and I will be more than happy to swallow back my words.