In March 2011, the $NVDA CFO at that time, David White, suddenly resigned due to “personal reasons”. The company then took 2 years to find its new CFO, Colette Kress, who has remained in the role ever since. In 2011, David White was 55 years old and had only been in the role of $NVDA CFO for 2 years, so why the abrupt resignation?

🚩 CFOs don’t suddenly resign from their highly lucrative positions in the prime of their careers unless they discover something, or are expected to do something, they aren’t on board with.

Every time I find a red flag that points me towards digging in a certain direction, as you know, I cannot resist doing so 🙈. So, I started digging into $NVDA CFOs’ history.

It didn’t take too long to dig this out: FORMER CFO OF $NVDA FACES FRAUD CHARGES (Picture 1)

In 2003, the SEC filed charges against Christine Hoberg alleging that she intentionally failed to record $3.3 million in expenses relating to a deal with a supplier. As a result of that transaction, $NVDA materially overstated its gross profit and income for the quarter ended April 30, 2000, the SEC claims.

Time to grab your 🍿 ‼️

According to the SEC: “In February 2000 […] Nvidia’s internal forecasting indicated that the Company was not on target to meet the consensus external expectations of stock market analysts regarding earnings per share, revenue, and gross margin. In order to address this anticipated shortfall, Nvidia’s senior management immediately focused the Company on reducing costs for the quarter to improve Nvidia’s net income and gross margin.”

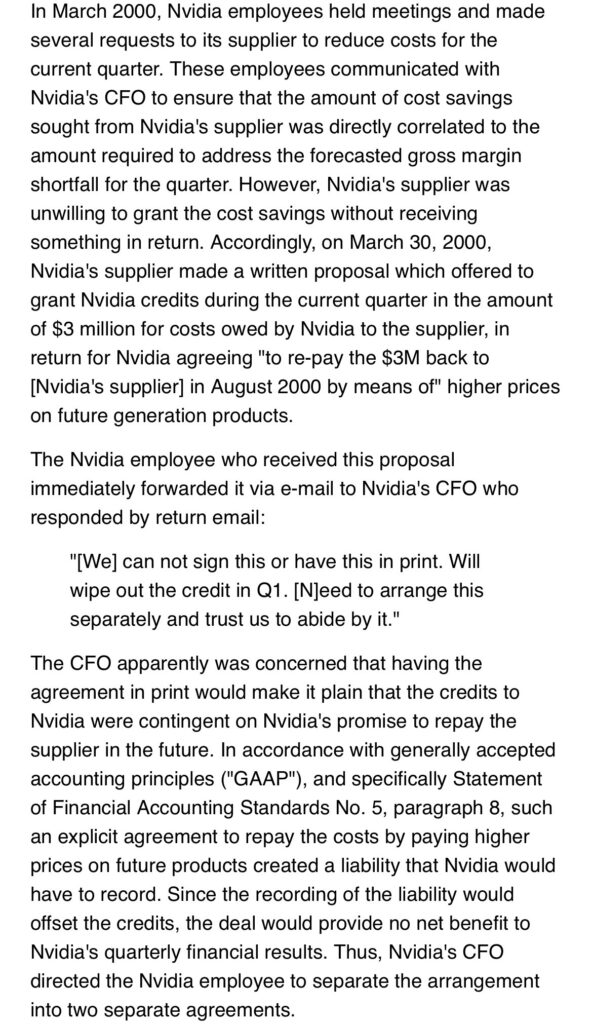

So what did $NVDA’s senior management do? “To Meet Expectations for the Quarter, Nvidia Agreed with a Supplier to Lower Nvidia’s Costs In Exchange For an Agreement to Pay Higher Prices on Future Generation Products”

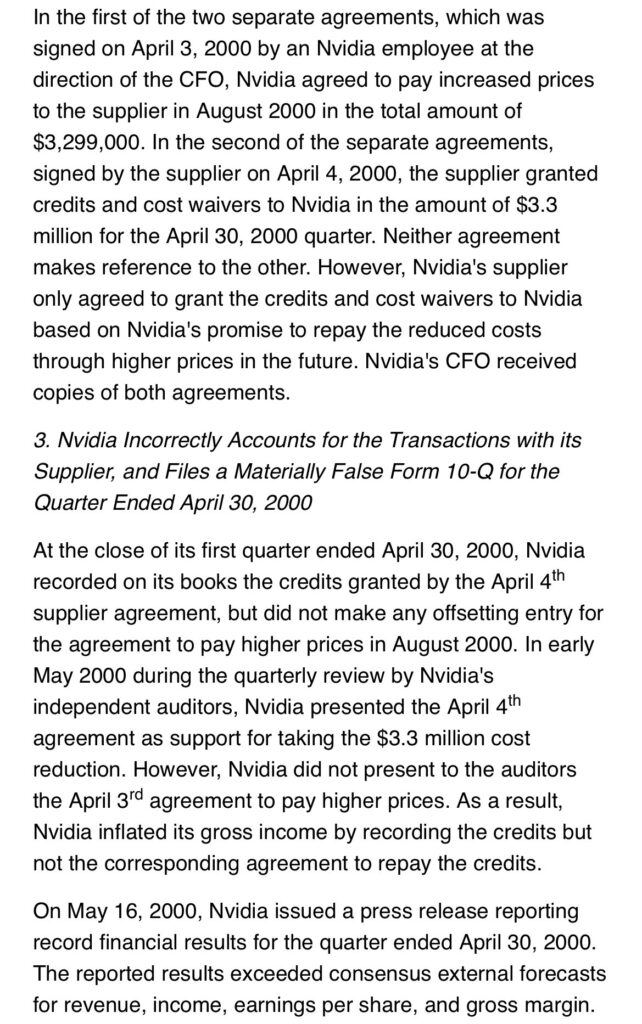

In Pictures 2 and 3, you can see the full details of the shenanigan directly from the SEC archives.

As a result of the illegal transaction, on May 16, 2000, Nvidia issued a press release reporting record financial results for the quarter ended April 30, 2000, beating analysts consensus. On the day of the (fraudulent) results, $NVDA’s stock jumped from 1.654$ to 2.388$, closing at 2.128$.

Fast forward to today, it’s no longer a mystery that $NVDA is already overstating its revenues:

- $NVDA (PONZI) “LIES” UNDER $NVDA’S NOSE (TwitterX)

- $NVDA “Elite Partners” (TwitterX)

- @JG_Nuke on $NVDA round-tripping their cash (TwitterX)

However, a big mystery remains today:

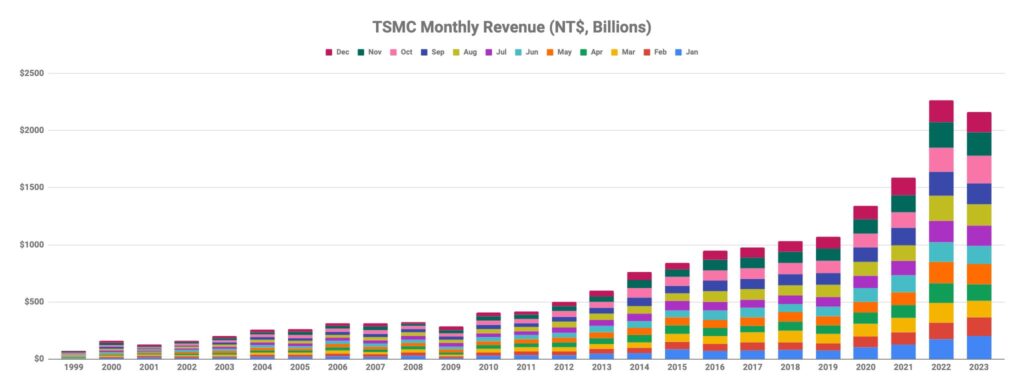

🚩 How come $NVDA’s suppliers are struggling to grow their revenues and aren’t capable of increasing their costs despite such an “overwhelming” demand to produce GPUs from $NVDA ($TSM’s revenues in Picture 4)?

🚩 How can $NVDA charge such spectacular margins for their GPUs for so long, going against the laws of supply chain nature?

Perhaps the answer lies in $NVDA’s past, and if that’s the case, in the future we will see an abnormal increase in costs in $NVDA’s financials that will bring those “sky high” margins back down to earth.