Apologies for the delay, but it took a while to go through the 450 pages of the $HSBC annual report. 🙏🏻 However, what I am about to show you is worth a huge bucket of 🍿 let’s go.

🚩 #1 – REPO HALLUCINATIONS

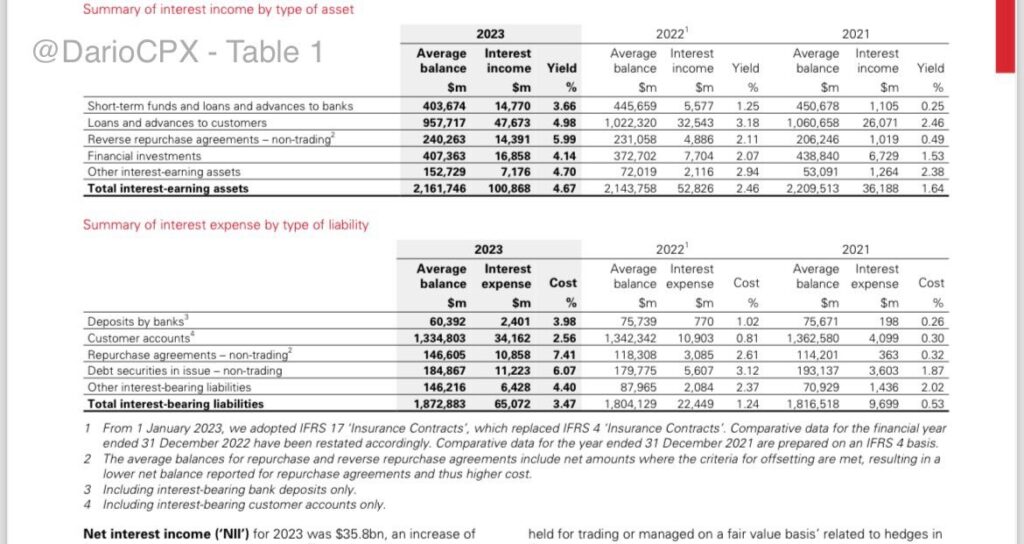

According to its report, $HSBC should be a net lender in the Repo Market for ~$100bn net amount considering 2023 “average amounts”.

However, $HSBC managed to lend at 5.99% interest against borrowing at 7.41% 🤨 How is this possible? Shouldn’t the rates be inverted (i.e., borrowing rates lower)?

Here’s what $HSBC tells us in the footnotes: “The average balances for repurchase and reverse repurchase agreements include net amounts where the criteria for offsetting are met, resulting in a lower net balance reported for repurchase agreements and thus higher cost” – Here, $HSBC is telling us they are reporting a much lower number in their liabilities. ⚠️

Hold on, though. If the amounts offset, shouldn’t the revenue/costs of the transaction be offsetting too?! 🙄 It doesn’t take a MSc in Finance to understand that two transactions are offsetting when almost identical. As a consequence, there is something wrong here. ⚠️

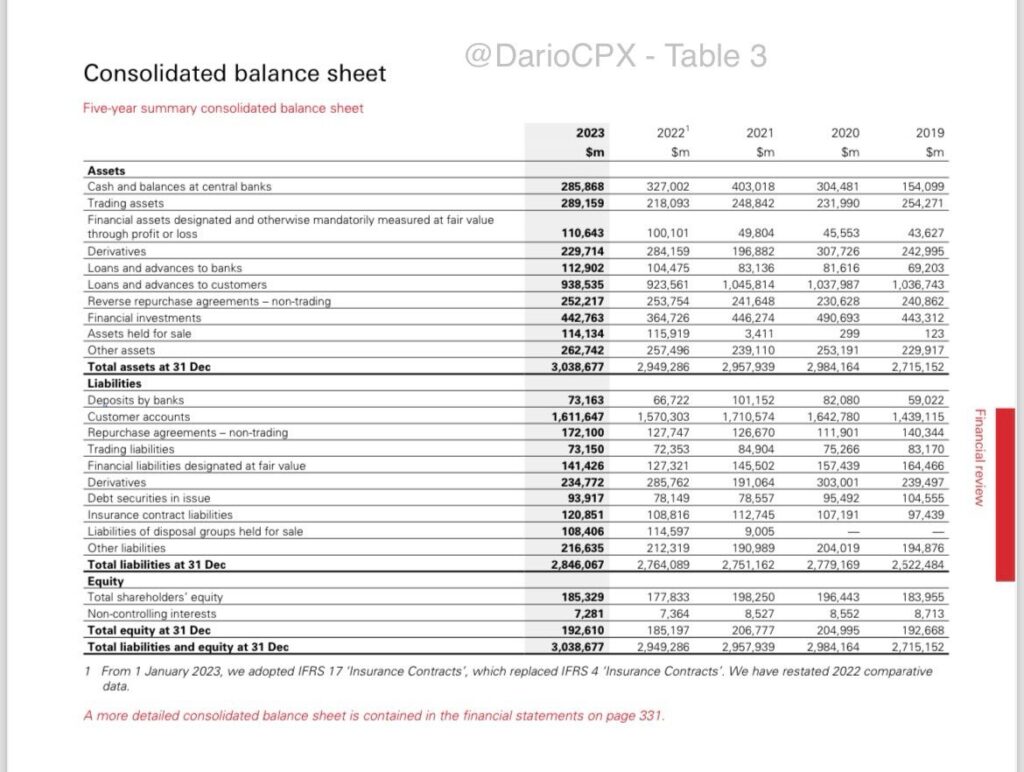

🚩 $41bn USD YOY DROP IN CASH

So while every other bank is de-risking and trying to beef up their cash balances, $HSBC records a ~13% decrease YoY. Worrying, isn’t it? Here’s how $HSBC explains it: “Cash and balances at central banks decreased by $41bn or 13%, which included a $13bn favorable impact of foreign currency translation differences. The decrease was mainly in HSBC UK, reflecting a reduction in customer accounts and repurchase agreements, as well as an increase in the deployment of our cash surplus into financial investments.”

Wait here, so:

– if we exclude FX adjustments, cash is down $54bn, not $41bn, and;

– the decrease was mainly in HSBC UK?! 😳

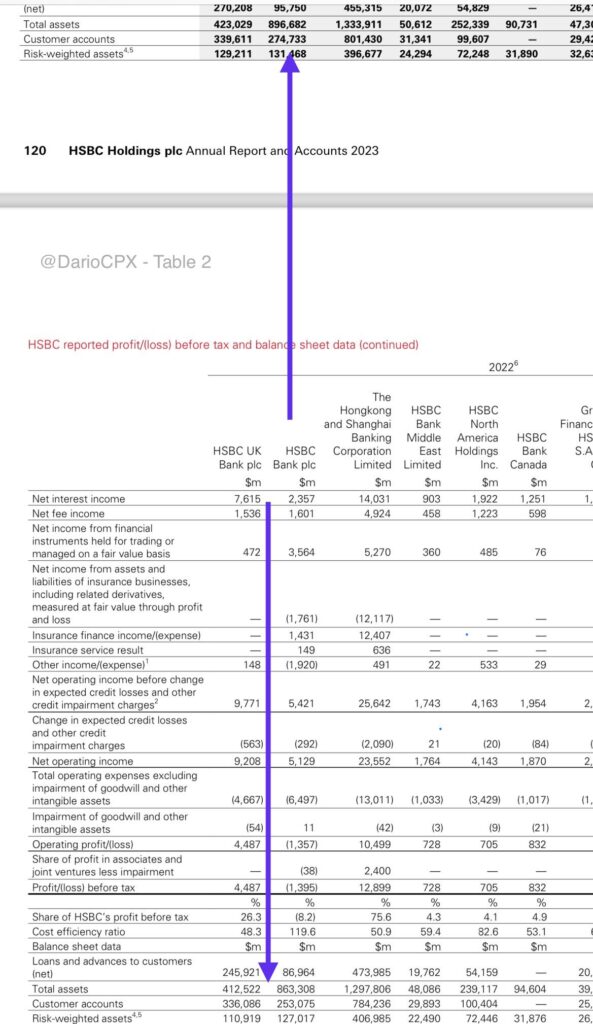

🚨 IF THAT WAS THE CASE, THEN HOW IS IT POSSIBLE THAT $HSBC IS REPORTING AN *INCREASE* IN CUSTOMERS’ DEPOSITS FROM 2022 IN BOTH HSBC UK BANK PLC AND HSBC BANK PLC?! 🚨

Alright, grab the 🍿 here is when things become funny

🚩 While $HSBC reports a $41bn drop in cash from 2022, at the same time, it reports a $41bn *INCREASE* in Deposits! 🙈 And no, it’s not a joke.

What about other borrowing for liquidity?

– Other banks deposited $5.5bn more in $HSBC in 2023 – alright 😉

– $HSBC borrowed $44bn in 2023 from REPO vs Reverse Repo down $1.5bn from 2022

– $HSBC increased its long-term debt by $16bn

So overall, $HSBC borrowed ~$100bn in liquidity in 2023 while its cash dropped $45bn?! Where did all that liquidity go?

And now the fireworks 🎆 🎇

🚩 While everyone else in 2023 recorded steep losses in trading fixed income assets, $HSBC wants us to believe their MTM increased by $70bn 🤡

🚩 What about assets at “fair value”? A $10bn increase 😵💫

🚩 What about lending to other banks while the real estate crisis is mounting? It appears that $HSBC lent $9bn more! 😆

🚩 What about loans to customers when every other bank in the world is cutting on this front? $HSBC lent $15bn more?! Oh, come on 🤯

Total questionable increase in Assets value? ~$100bn, exactly the increase in their liquidity borrows! 💥

Let’s wrap it all up now

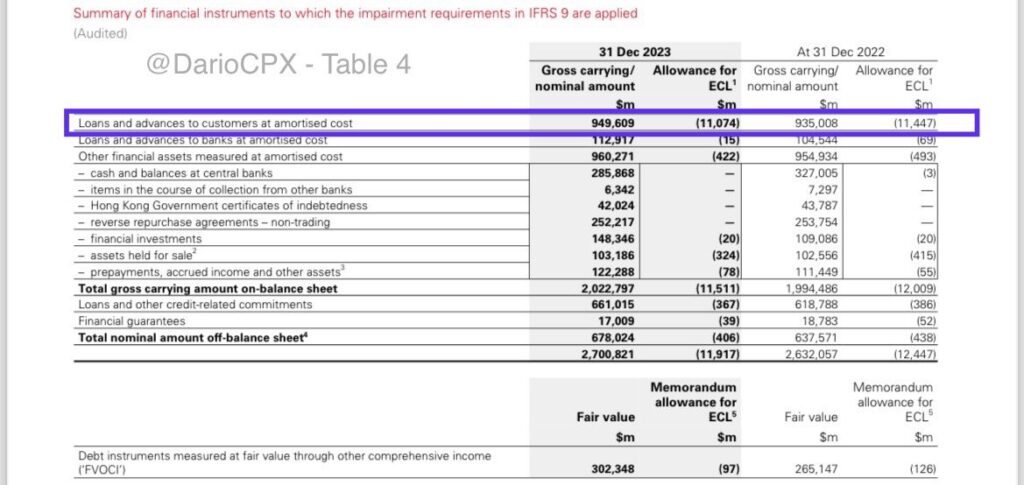

$HSBC has $192bn in shareholders’ equity with ~$100bn of Assets value that is highly questionable and under high pressure to roll their liquidity lines. This is already horrible, and we didn’t even start looking at their ~$1T Loans book that isn’t accounted for at fair value and against which they only accounted for $11bn of allowances for credit losses, an amount LOWER than 2022!

I’ll now leave it to you to gauge the likelihood that answers the question I put forward in the title…