This is it, the point where the #BOJ cannot kick the can down the road any longer has arrived. As you know, I have written many times about the #BOJ, warning of the consequences of their unbelievably reckless actions.

🚩 $JPY CARRY TRADE – THE BIGGEST FINANCIAL TICKING TIME BOMB OF ALL?

🚩 SOMEONE SOMEWHERE HAS TO PAY A HIGH PRICE FOR THE BANK OF JAPAN’S INCOMPETENCE

🚩 GET READY FOR THE LAST BANK OF JAPAN “FREAK SHOW” OF 2023

🚩 JAPAN END GAME – A DEEPLY DEVALUED $JPY AND A WORTHLESS #NIKKEI

The #BOJ is literally now trying to find any possible excuse not to raise rates next week and buy one more month of time in the hope that a miracle happens. Frankly, the boundaries that limit what’s ridiculous and what’s completely stupid to say are being breached almost daily by the #BOJ now. Some examples?

1 – “CONSUMPTION IS IMPROVING MODERATELY ON EASING COST-PUSH PRESSURE, HOPES FOR HIGHER WAGES” – declared Ueda 2 days ago.

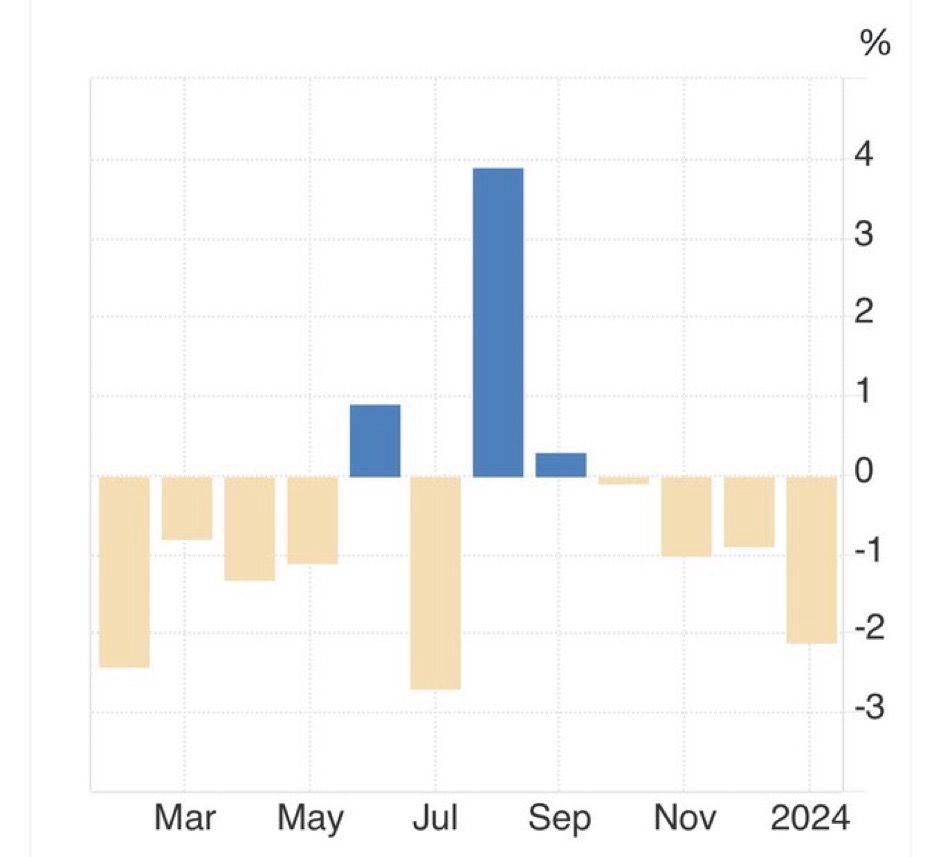

Now look at the chart here representing #Japan household spending MoM percentage change.

2 – “#BOJ board wants more data before rate move” – Said #BOJ governor Fukuri last week.

Fast forward a few days, all major news outlets start reporting that #Japan corporations are now agreeing to hike wages, breaking records that haven’t been seen for more than 30 years. #Japan PM Kishida himself said this out loud yesterday: “LOTS OF FIRMS IN #JAPAN REPORTED BIG INCREASES IN WAGE HIKES”

What I find incredible, and you can read it in my previous posts, is that anyone could foresee many months ago where all #BOJ actions would lead. However, every economist out there was fully on board with the #BOJ, like a bus full of blind people where even the driver, in this case, the #BOJ, is blind too. How do you expect that bus ride is going to end? Furthermore, considering all the $JPY the #BOJ printed and keeps printing, the bus was being driven downhill at full speed with broken brakes.

If someone dared to observe the situation clearly, it was always clear the #BOJ was in a “Lose vs. Lose” situation all the time, the only thing they could do not to change the status quo and inevitably break something somewhere was to effectively do nothing as they did for as long as I can remember. And no don’t tell me they “tweaked” the #YCC last year in a hawkish sign, the very same day they did that and the days that followed they printed the biggest amount of $JPY in the year to repurchase $JGB and effectively hold back long-term rates from increasing. That action sent the $JPY straight back above 150 vs $USD while all (clown) economists out there were stampeding one over the other to put out bullish forecasts on the $JPY after that “hawkish tweak”.

Beware, even if the #BOJ is going to end negative rates they will never be able to afford ending QE and the infinite $JPY money printing because the moment they do so, #Japan will default on its debt and $JPY will be renamed “Japanese Peso”. However, it might not be too late to hike rates as a first step to end QE all together (soon) in order to save #Japan economy from drowning in the very same ocean of fiat money they printed like Venezuela or Argentina (and soon Turkey) did.

This is the only set of choices the #BOJ can take to save #Japan future generations:

1 – Hike rates

2 – End QE (otherwise hiking rates will be totally ineffective)

3 – Start a QT that will keep pace with the balance surplus the government will be bound to achieve (ending the “stimmies” era)

Guess what happens to #stocks worldwide if the #BOJ begins to care about its own people in #Japan and stops feeding the global $JPY (ponzi) carry trade leverage? Kaboom! 💥

Personally speaking, I think the #BOJ will try all it can to buy time, inventing whatever sort of excuse, however, PM Kishida is nervous because Japanese voters figured out the last thing that a #Nikkei at All-Time Highs meant was making #Japanese people wealthier. On the contrary, wealth is paradoxically siphoned abroad in the same way it’s happening in Germany, France, and the UK. Where is all this money going you might ask yourself at this point. With US debt growth now measured in trillions and not hundreds of billions anymore, how do you think they are being able to finance that debt with the #FED running QT since about a year now (although when needed they can sneak money from the backdoor to help like it happened with the #BTFP).

To conclude, the #BOJ doesn’t have the luxury of doing nothing and keeping everything in a limbo where everyone has the illusion to get all they want while at the same time they get nothing as well. Will finally ending the abomination of negative rates spark a #stocks crash somewhere like a butterfly flapping its wings can trigger an earthquake on the other side of the globe? You don’t need an answer from me because it won’t take long to see what the answer is going to be.