Was anyone surprised to see #FED chairman Jerome Burns walking on stage today and saying out loud all those buzzwords that for a while have been pretty effective in feeding investors’ euphoria? I wasn’t, after all, it was already pretty clear after the last #FOMC that the real fed mandate is to defend the stock market bubble at any cost (THE NEW #FOMC MANDATE IS NOW OFFICIAL: SAVE THE #STOCKS BUBBLE AT ALL COSTS!).

However, the FED has a big problem now, its policy mistakes are so obvious to more and more investors, and they are starting to stop listening to whatever lullaby comes from FED speakers. At last, investors are beginning to trade based on the real state of the economic environment and not the illusionary one fed non-stop to the masses through made-up narratives.

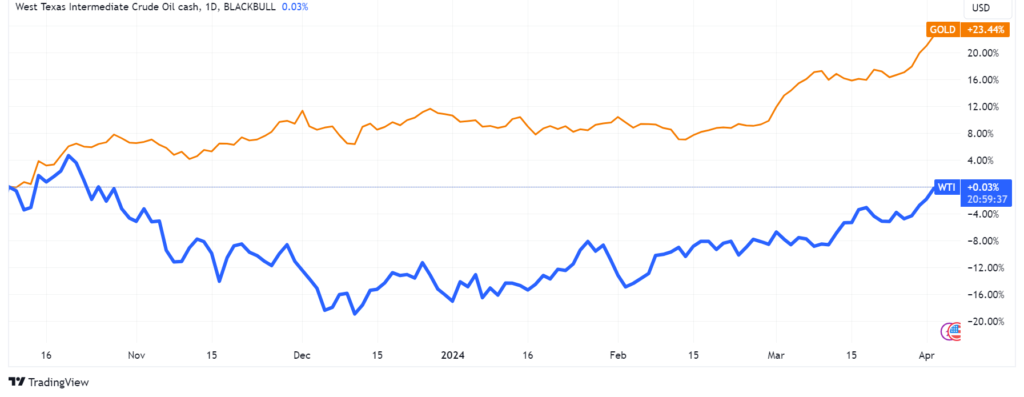

This chart below by itself should be seriously scaring the hell out of many people. Why? The price of gold and the yields on US long-dated treasury bonds rising together is a big warning sign that not only does the market believe the FED lost its fight against inflation, but there is a high chance it will soon lose control on the longer end of the interest rate.

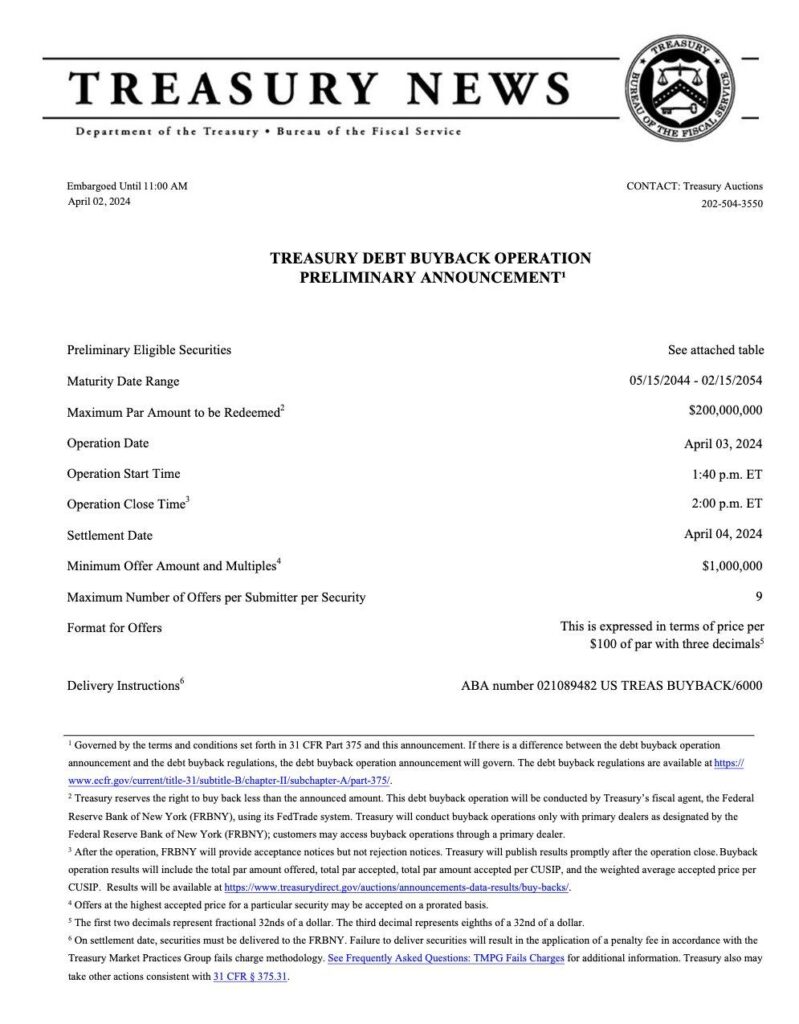

How are the FED and the US Treasury trying to deal with this very dangerous situation? With the sloppiest form of “yield curve control” a human brain could conceive. In a nutshell, the US Treasury is now about to embark on a buyback program where their objective is to repurchase longer-dated US Treasuries (with the help of the FED) from the market. Today, the two entities that are becoming the Stan & Ollie of financial markets ran a first test of this asinine program.

Why does this program not only make no sense but potentially can seriously backfire? The reason is that the US government is running a budget (chronically) in deficit, this means that to “buy back” long-dated US Treasuries and have the cash to pay for them, the US government will have to issue an equivalent amount of short-dated US T-Bills paying a higher interest rate (3m T-bills trade at 5.4% while 10y US Treasuries at 4.34%). Isn’t it very obvious now that not only does this program have little to no benefit, but it will also worsen the government deficit (increasing upward pressure on long-term yields) and raise the liquidity risks in the market since financial institutions will now see a substantial increase in short-term bills supply?

Now that we set the stage, it will be easier to understand why after losing control of gold prices, there is a serious risk the very same happens to oil ones.

First of all, the oil price is being heavily driven by an unbelievable amount of derivatives transactions rather than effective trading of the commodity. This is the last warning I posted in November for more details on the structural setup of this derivatives trade that successfully kept oil prices suppressed so far: “An Oil Price Shock Is Brewing”.

Commodity prices are very sensitive to inflationary pressure on the economy and as we have seen above, these are mounting thanks to FED policy mistakes. On another front, derivatives per se are very sensitive to an increase in interest rates since the funding of the contracts becomes more expensive as a consequence of it. These 2 forces combined already represent a strong headwind against the very crowded short oil derivatives trade.

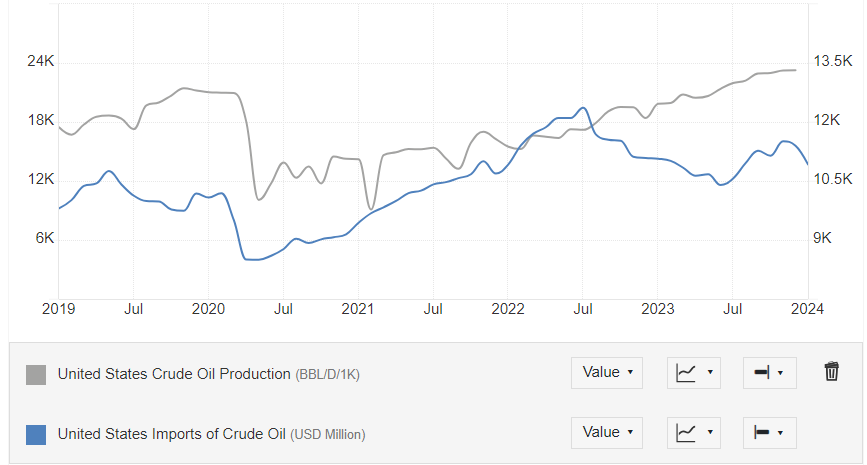

Secondly, being oil prices a significant driver of inflation, as we have seen in 2021, it does not take much to ignite a nasty feedback loop between rising oil prices, inflation, and pressure on wages (since people need more money to pay higher day-to-day expenses as a consequence of increasing oil prices). How did the US administration deal with it at that time? By opening the floodgates of the US Strategic Petroleum Reserves (SPR) and artificially increasing the supply in the market. Once the benefit of dumping SPR in the market started to fade, also because they were running out of them, the US government, in line with the newfound habit of politically adjusting any data that can move financial markets to where is more convenient, started inflating the reports on US domestic oil production that “inexplicably” continues to break records without helping the country with its needs to import crude from abroad.

A clear warning sign that the US administration is starting to become worried about an increase in oil prices (with a consequent spike in inflation right before US elections), is the decision just made public to stop any plan to refill US SPR: US Cancels Latest Oil Reserve Refill Plan Amid High Prices

Last but not least, the geopolitical tensions in the Middle East are mounting after the latest developments of the war in the region Iran is now dangerously on the brink of considering being directly involved in.

Summing all together, the risk of a significant surge in oil prices is rising by the hour, if not by the minute. As the chart below shows, WTI oil prices are not exactly back to where they were when the open conflict in the Middle East started on the 7th of October 2023. Noticeable how gold, the inflation hedge by definition, is up 23% in the same period while no change in price has been recorded as the major driver of inflation throughout the economy (cough cough, because so obviously suppressed).

Beware, position wisely, and make sure you are aware of the risks you are taking because if oil spikes, the chances of volatility coming back into the market with vengeance and wreaking havoc on the super popular short volatility trade will be high.