Last week ended with the #VIX closing at 13.49, well below its ~19.50 long-term average, while the CNN “fear and greed” index closed at 40 in “fear” territory. Warren Buffett disclosed his cash “war chest” grew to 189bn #USD and socials have been fantasizing all over the weekend about the stocks he is going to buy next with all that cash, overlooking that his annual message did not fit the mainstream narrative starting from the sale of 113m #Apple shares equivalent to 13% of his holdings.

What I found hilarious in the past few days was reading posts of people quoting Warren Buffet who, in reality, have absolutely no clue about his investment style and how he became so rich and successful consistently through market cycles.

First of all, Warren Buffet does not care at all about charts and he never did. Charts, by definition, are a backward-looking tool that can be useful for risk management purposes but they do not tell you anything at all about the real value of a company in the medium or long term. Why?

- You cannot chart top management quality;

- You cannot chart R&D cycles and whether these will deliver a great product that will not only withstand competition but win consumers and market share in the future;

- You cannot chart the footnotes or “risk factors” in financial statements and project them into the future;

- You cannot chart the buyout of a company and how that will perform in a larger portfolio of businesses and;

- You cannot chart synergies or disruptions.

I find it so funny that people are fantasizing about the charts Warren Buffet might be looking at while he never had a computer in his office to begin with!

Anyone who claims medium to long-term investment thesis about companies and does that using charts is wrong and will always be. Charts are traders’ tools, not investors’, period. So if you want to invest like Warren Buffett, I am afraid you should stop looking at charts if your time horizon goes beyond 3 months into the future.

What has Warren Buffett done every single day for the past 70 years? He reads whatever can help him form his critical thinking and judgment of the real value of an investment, starting from financial statements and any sort of regulatory filing he can put his hands on. Then, subject to that and the prices in the market, he makes his decisions. Because of all these factors I mentioned, Warren Buffett can be ultimately seen as the greatest #BTFD investor of all time.

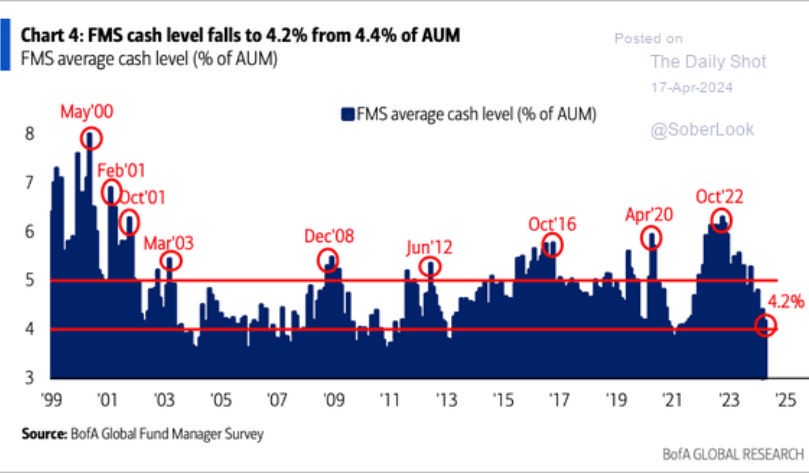

Currently, his overall #stocks portfolio is valued at 336bn #USD against a cash pile of 189bn, which means he is THIRTY SIX PER CENT IN CASH AND EQUIVALENTS. What is the cash allocation of the broad community of investors in the market at the moment? 4.2%, this alone should be telling you A LOT about what Warren Buffet thinks about this market overall (and what was his take in all the recent years of #QE madness).

So now that we understand what the likes of Warren are up to, it is clear that what you should be focusing on now is to stash cash to deploy when sooner or later everyone currently blinded by #FOMO will be fire-selling their #stocks at a discount. This is the key part we will discuss next, buying at a discount.

These are the principles Warren Buffett has been strictly following for the past 70 years:

- Understand the Business: Understand the business you invest in. This includes its competitive advantage, industry dynamics, management quality, and future growth prospects.

Let me be honest here, if you only look at charts and you never read a company 10-K from start to end then you do not understand its business. Period.

- Margin of Safety: Always buy stocks at a significant discount to their intrinsic value. This provides a margin of safety against adverse events and ensures a higher probability of long-term success.

How many #stocks meet this requirement right now? Frankly, I can hardly think of any across the Globe, Asia included.

- Economic Moat: Look for companies with a durable competitive advantage or economic moat. These could be brand strength, economies of scale, patents, regulatory barriers, or high switching costs, which protect the company from competitors.

Do you think any #Mag7 company fits in this category? The answer is no and the reason is all regulators are scrutinizing them with the ultimate goal to break the monopolistic advantages they were allowed to build and be entrenched into the past decade. Furthermore, from a statistical perspective, the winner of a market cycle is hardly the winner in the following one.

- Consistent Earnings: Focus on companies with a history of consistent and predictable earnings growth over the long term. Sustainable profitability is a key indicator of a company’s competitive position and future potential.

#Apple, for example, refused to provide any revenue guidance for the upcoming quarter, #NVIDIA did the same 3 months ago and many companies are following them on the same path. This is not a sign earnings are expected to be consistent in the medium to long-term time horizon like it or not.

- Strong Management: Assess the quality and integrity of the company’s management team. Focus on companies led by capable and shareholder-friendly executives with a long-term vision.

Is a company focusing on share buyback instead of R&D one that you can deem to have a long-term vision? Of course not, so beware of all those companies spending an obscene amount of resources on share buybacks since all they are doing is favoring current shareholders and penalizing future ones.

- Cash Flow Generation: Analyze the company’s cash flow generation capabilities. Companies with strong free cash flow provide flexibility for reinvestment, dividends, and debt repayment.

Thanks to years of out-of-control #QE, the share of zombie companies around the world is currently at levels never imagined, as we have seen in “TRADERS AND (ZOMBIE) COMPANIES NOW PRAYING #INFLATION IS NOT COMING BACK” all these companies can hardly survive a persistent high #inflation environment. Just stay away from them now and in the future.

- Low Debt Levels: Avoid companies with excessive debt levels, as they can be vulnerable during economic downturns. Prefer companies with conservative capital structures and manageable debt burdens.

Similar to the previous point, companies that are so dependent on rolling over their current debt with new ones, even if not “zombies” yet, will simply perform very badly in the future.

- Price-to-Earnings Ratio (P/E): Look for companies with low P/E ratios relative to their industry peers and historical averages. A low P/E ratio may indicate that the stock is undervalued compared to its earnings potential.

Current P/E ratios are broadly at nosebleed levels in many sectors and if you think about what P/E really means (the number of years needed to breakeven on your current investment), so many companies out there will not allow any investor to see the fruits of their investments within their own lifetime. China and Hong Kong markets do currently showcase “low P/E” levels that might be misleading, why? Because Chinese companies’ margins are being incredibly squeezed right now due to competitive pressures (an example here), this means earnings will decrease and P/E INCREASE from where they are today assuming prices remain stable. The absence of companies trading at “reasonable” P/E levels across the board is one of the best telling signs to understand at what stage of a market bubble we are right now.

- Price-to-Book Ratio (P/B): Consider the P/B ratio, which compares a company’s market value to its book value (assets minus liabilities). A low P/B ratio suggests that the stock may be undervalued relative to its accounting value.

Here something you must be SUPER CAREFUL about is that companies do reflect the real value of their assets in their financial statements. This for example is not the case for banks that “artificially” trade at low P/B ratios simply because they do not assess the real value of their assets properly (”2024 THE YEAR WHEN “HIDE TILL MATURITY” ENDS”)

- Dividend Yield: A consistent and growing dividend can be a sign of financial health and shareholder-friendly management.

Currently, #stocks earnings yield is LOWER than US Treasuries, this alone should be enough of a warning sign to any person considering entering the stock market at the current levels. Furthermore, when a company’s Dividend Yield is greater than the Earnings Yield, it is a sign the management is “squeezing” company resources to reward current investors, penalizing future ones.

After all I described so far, it should be much easier for you to start preparing a “shopping list” of assets you want to purchase in the aftermath of a crash. My personal list will also include #crypto assets since the same principles can be translated in that sector (”VALUE INVESTING ON CRYPTO BLOCKCHAIN PROJECTS”).

Feel free to “trade” this market, but beware you are effectively swimming in a tank full of sharks that are becoming hungrier and hungrier. Personally, I prefer to keep my discipline and a medium to long-term time horizon because I want to be in the position of buying the “next Amazon” or the “next Google” when the timing is right and that’s not now.