Yesterday, I posed this question: “WHAT IF NVIDIA SIMPLY TAGGED ALONG WITH A MICROSOFT AZURE SCAM PLAYBOOK?”. Twenty-four hours later, the company themselves replied to the question (I believe involuntarily), and the answer was “YES”.

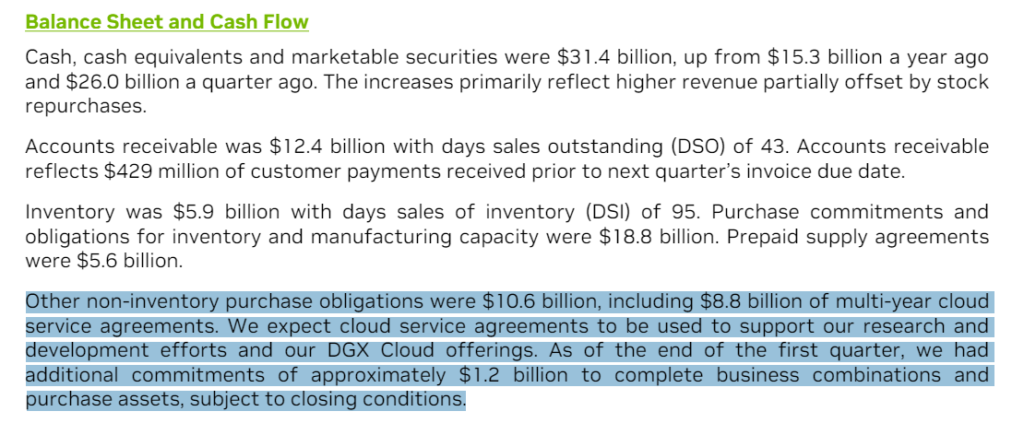

Please take a look at the part I highlighted from the #NVIDIA CFO commentary related to the results just released.

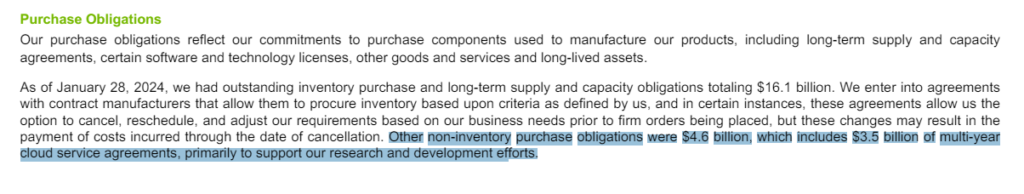

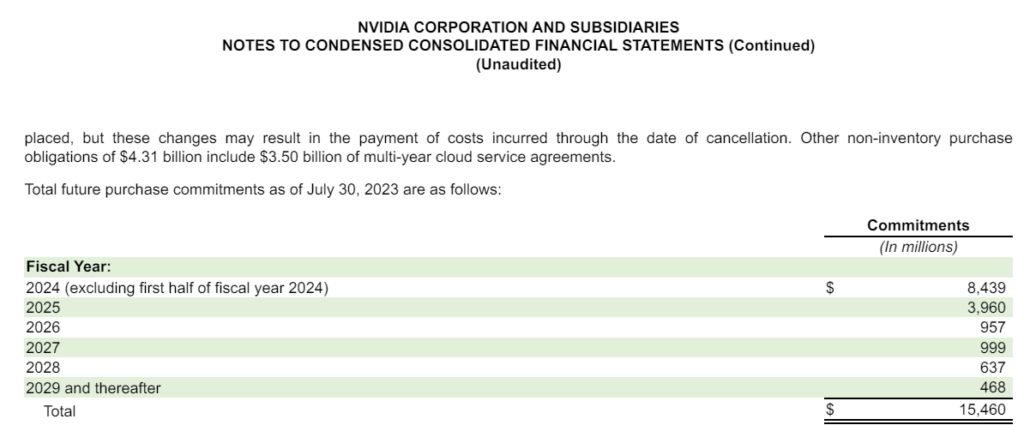

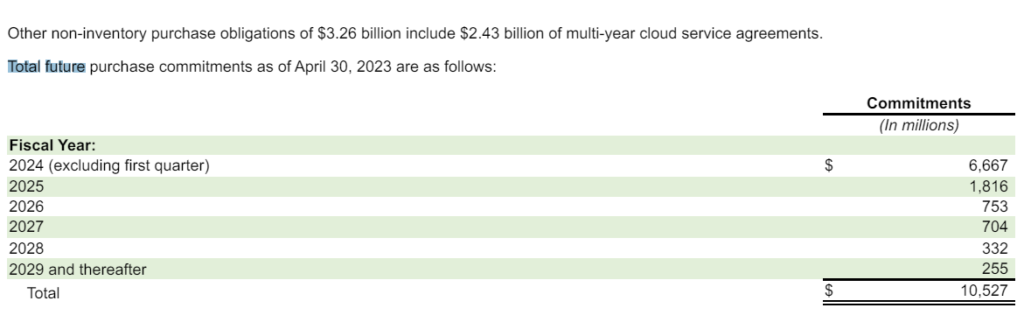

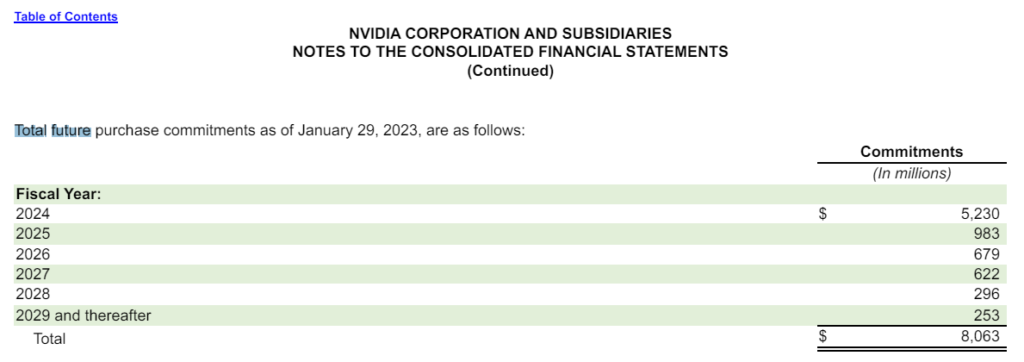

Now, wisely buried in the 10-Q from the previous quarter, let’s have a look at how these “non-inventory purchase obligations” appeared.

Yes, you are not hallucinating; in one quarter, NVIDIA’s future commitments to purchase cloud services for “R&D” increased by a whopping TWO-HUNDRED AND FIFTY-ONE PERCENT to 8.8bn USD.

Hold on a second, is #NVIDIA selling GPUs to cloud providers in exchange for buying back “cloud services” from them, thereby artificially inflating the price of their GPUs? Alright, let’s dig further into this.

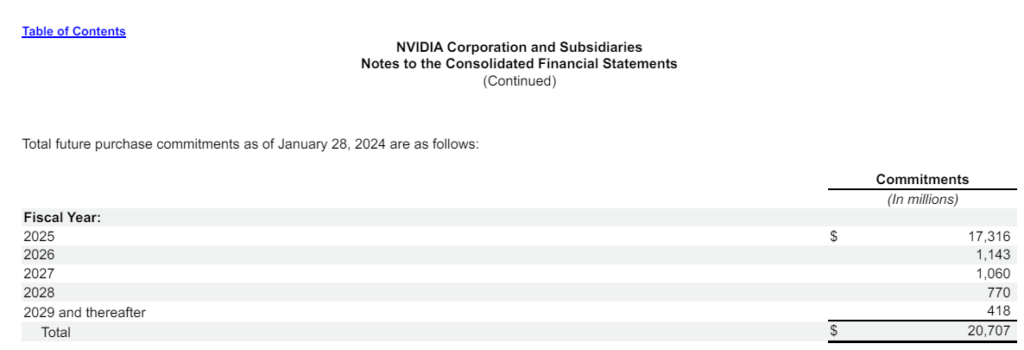

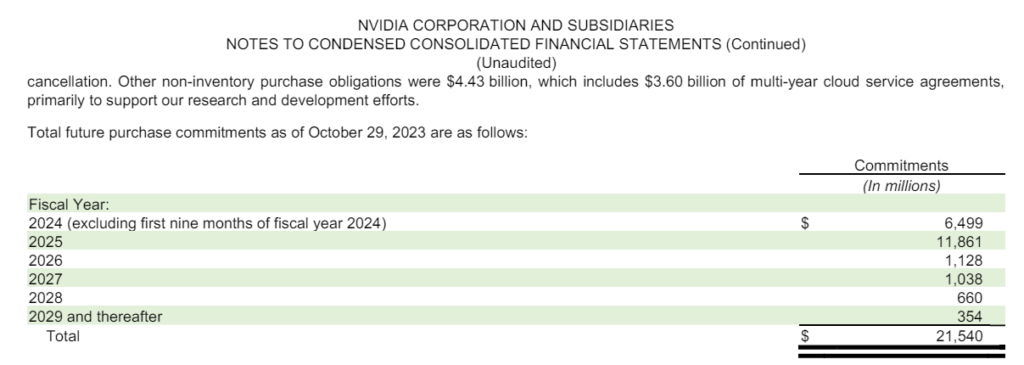

Unfortunately, the 10-Q for the latest results is not yet available, but in every previous one, we find a recap of #NVIDIA’s “future purchase commitments”.

Q1-24

Q4-23

Q3-23

Q2-23

Q1-23

Honestly, isn’t it pretty obvious what’s going on here? Strangely enough, from Q2-23 to the end of Q1-24 (they did not disclose the data in Q1-23), #NVIDIA’s total “future non-inventory purchase commitments” for cloud services increased by THREE-HUNDRED AND SIXTY-TWO PERCENT.

Wait a minute, there is another strange thing in the tables above. In the latest results, #NVIDIA declares:

- 18.8bn$ of future inventory commitments

- 10.6bn$ of future non-inventory commitments

- TOTAL 29.4bn$

This means that #NVIDIA increased the orders with its suppliers to produce GPUs only by 16.7% while total “future commitments” increased by 42%. What about inventory orders compared to one year ago? They grew from 7.24bn$ to 18.8bn$ or TWO-HUNDRED AND FIFTY-NINE PERCENT

Wait a minute, by how much did #NVIDIA’s “Computer and Networking” revenues grow over the past year? 404%…

Basically, #NVIDIA pretends us to believe that:

- Its clients purchase in big sizes never asking for a discount (and do not forget ~50% of the total revenues come from just 4 names: Amazon, Microsoft, Google, and Meta)

- Its suppliers continue producing at the same costs over the years despite the “boom” in order

So clearly the laws of demand and supply do not apply to #NVIDIA unless… the company keeps rebates to clients and production costs increases by its suppliers off-the-book to keep showcasing unrealistic margins in the same way they did, and got fined for, in the aftermath of the dotcom bust: NVIDIA CURRENTLY EMPLOYING THE SAME ACCOUNTING TRICK TO INFLATE ITS MARGINS IT WAS PREVIOUSLY CAUGHT USING DURING THE DOT-COM BUBBLE?

As if the above I described was not already enough, we already know:

- NVIDIA is inflating its sales via client financing. In some very peculiar situations, Nvidia is even a significant shareholder of them, like in the case of Coreweave: NVIDIA (PONZI) “LIES” UNDER NVIDIA NOSE

- NVIDIA is gamma-squeezing its own stock: NVIDIA – THE (FRAUD) SMOKING GUN?

At this point, I believe there is no more doubt that #NVIDIA is only one piece of a bigger fraudulent puzzle.

— IMPORTANT ARTICLE UPDATE —

Below is what I realized after writing the article and first posted about it on X (post)

Isn’t it obvious that #Microsoft and #Nvidia are helping each other to fabricate (fake) revenues? “Microsoft signs deal for A.I. computing power with Nvidia-backed CoreWeave that could be worth billions“

Basically…

1- #NVIDIA invests in #Coreweave

2- #Coreweave buys (overpriced) #NVIDIA GPUs.

3- #Coreweave raises financing using #NVIDIA GPUs as collateral. What do they do with that? They buy more #NVIDIA GPUs, of course…

4- Meanwhile #Microsoft signs a deal with #Coreweave worth “billions” for future use of a cloud infrastructure #Coreweave didn’t even begin to build yet while #Microsoft is, at the same time, loading on #NVIDIA GPUs for Azure that technically is a #Coreweave competitor?!

By the way, who is going to be the major client for Azure AI infrastructure? #OpenAi… where Microsoft invested “paying” the investment with ~9 billion USD worth of “Credits” for… Azure.

Mind-blowing… Literally mind-blowing