First of all, who the hell is the latest counterpart added to the #FED Standing Repo Facility: “Norinchukin Bank”?

“Officially,” it is a Cooperative Bank owned by Japanese agricultural, fishery, forestry cooperatives in #Japan. Yes, that’s right, an “agricultural” bank from Japan got a seat at the #FED big boys Standing Repo Facility table on the other side of the world next to the likes of JP Morgan. How come?

Norinchukin Bank is (unofficially) one of the biggest and, because of that, most courted clients by banks, brokers, Fixed Income hedge funds in the world, going under the nickname of “Nochu”.

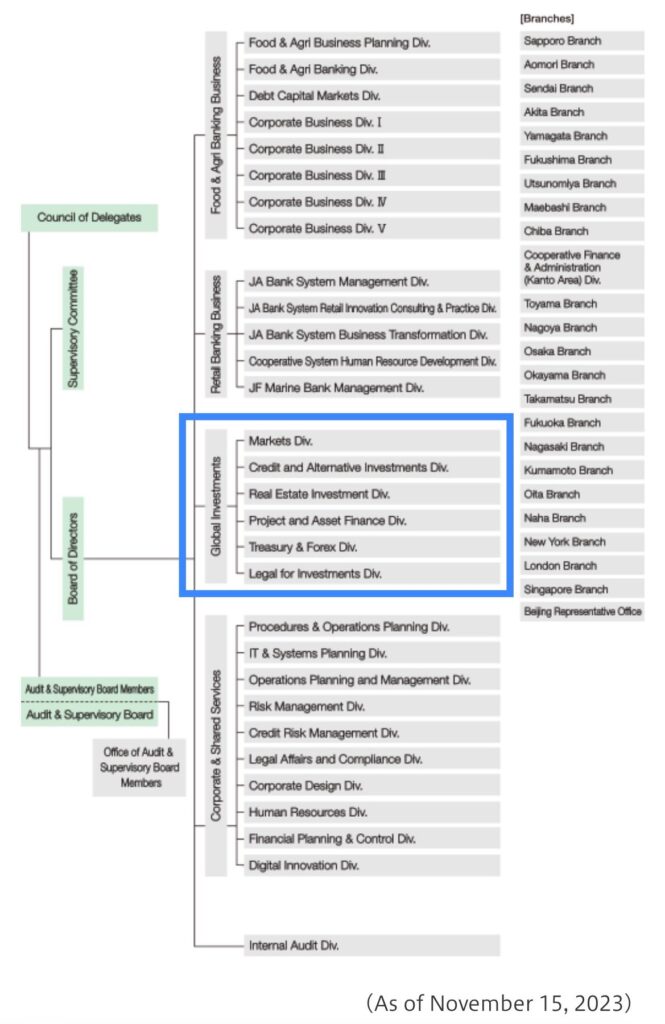

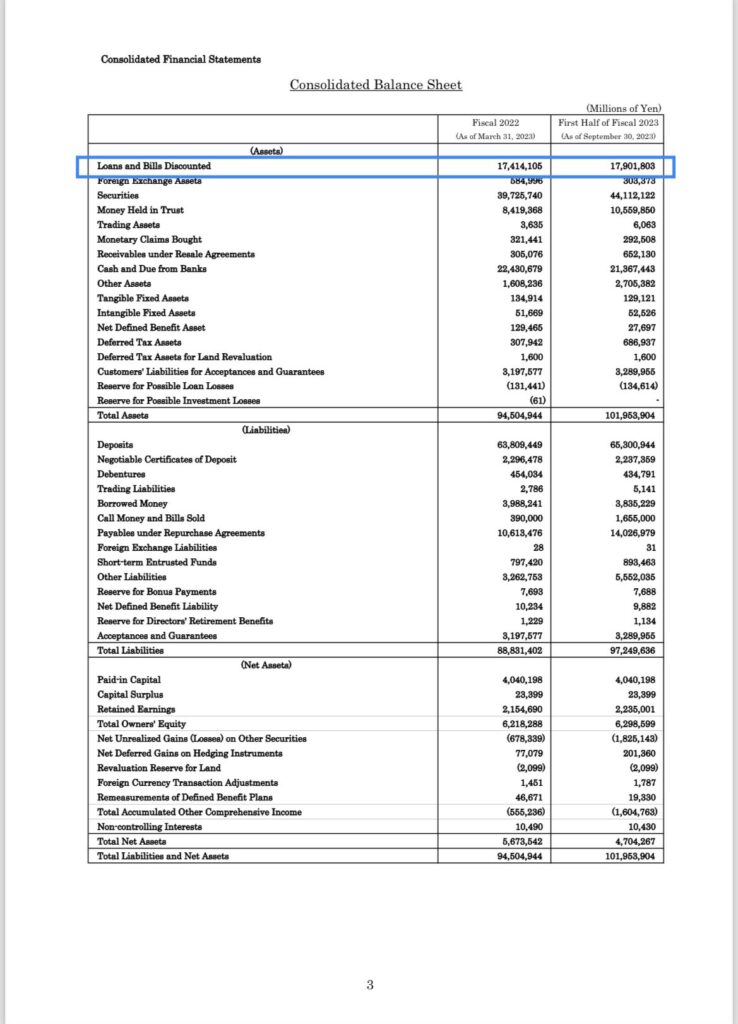

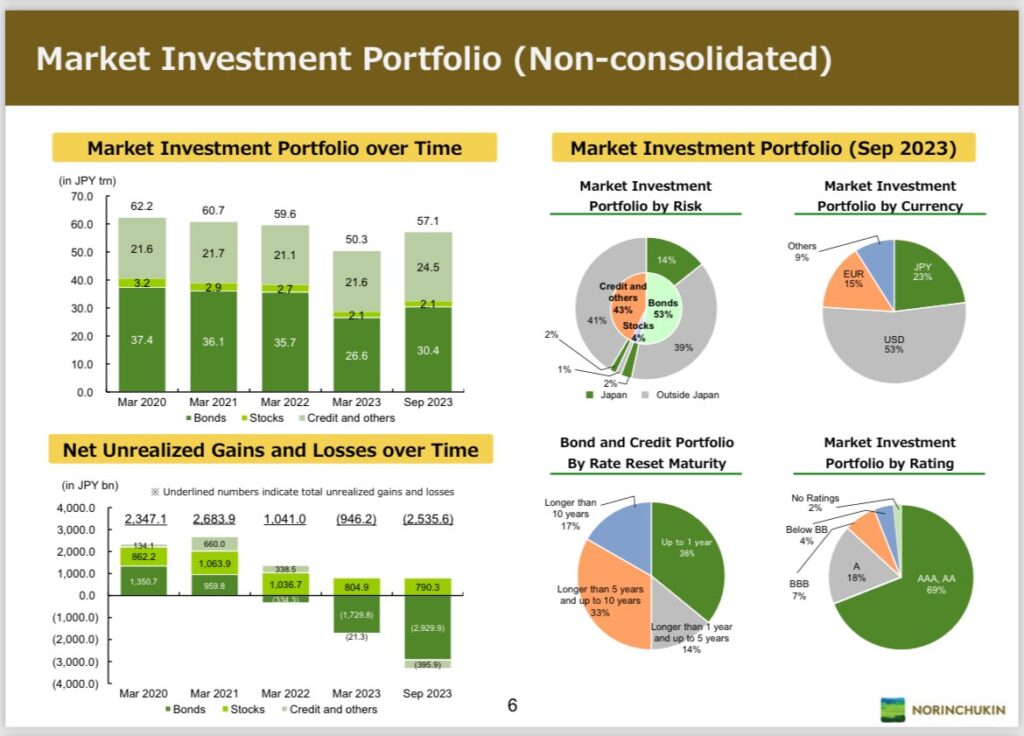

Nochu was founded in 1923 to support agricultural, forestry, and fishery industries in Japan. Well, if that was the case, why do they need a “Global Investments” division [Org Chart 1]? Because “Loans” for farming and fishing (we assume) only account for 17.5% of their 720bn $USD equivalent Balance Sheet (pic 2). And their “Market Investment Portfolio” has a 77% allocation OUTSIDE Japan (pic 3).

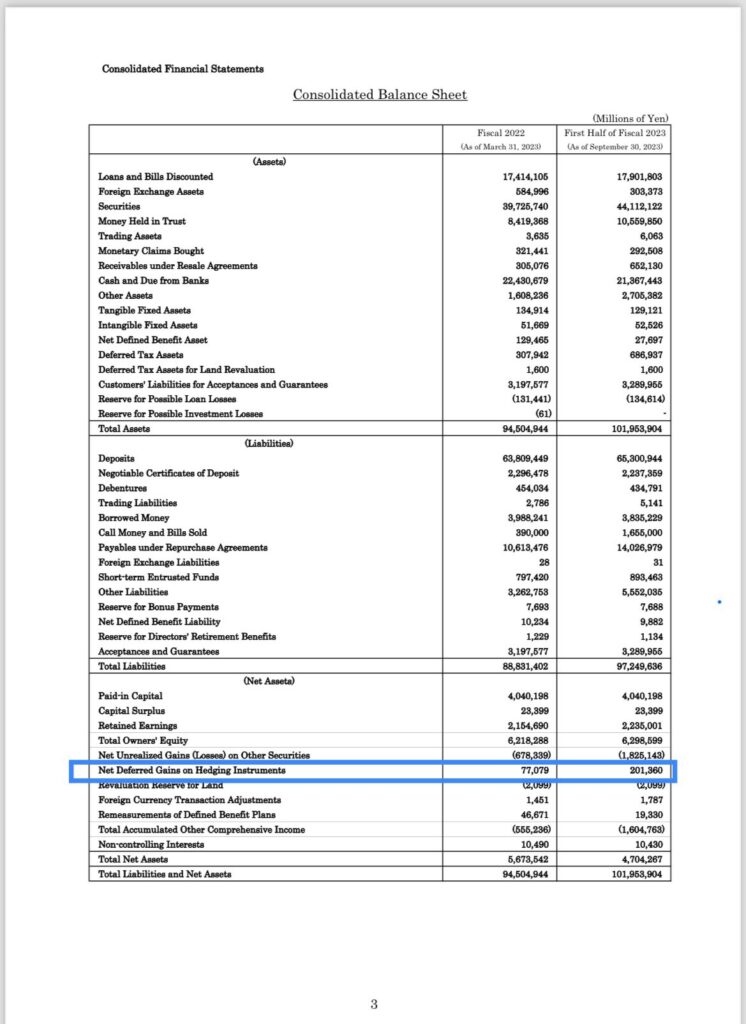

Nochu’s “Global Investment Activities” instead account for 75% of their total assets. Bear in mind one important thing though, Nochu is private and they can cherry-pick what to disclose. Guess how much they disclose above their “Derivatives” activity? Close to ZERO, all they share are the net gains/losses from Hedgings that are irrelevant (pic 4), so for sure the real balance sheet is much larger than the 720bn $USD disclosed.

Time to grab your 🍿🍿 😁

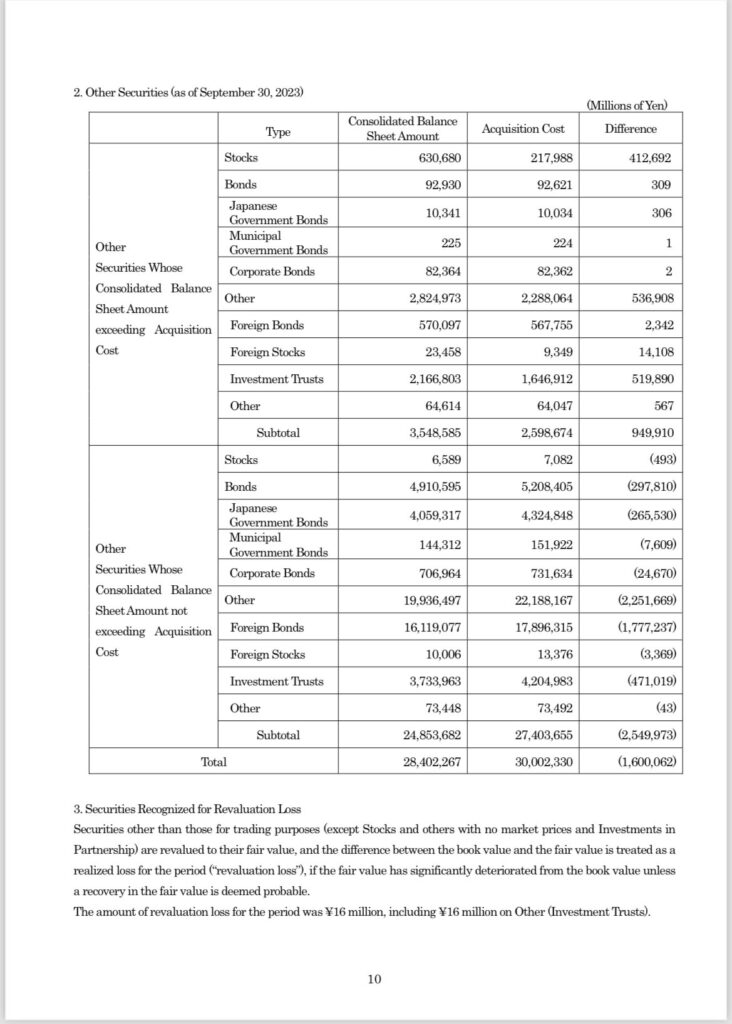

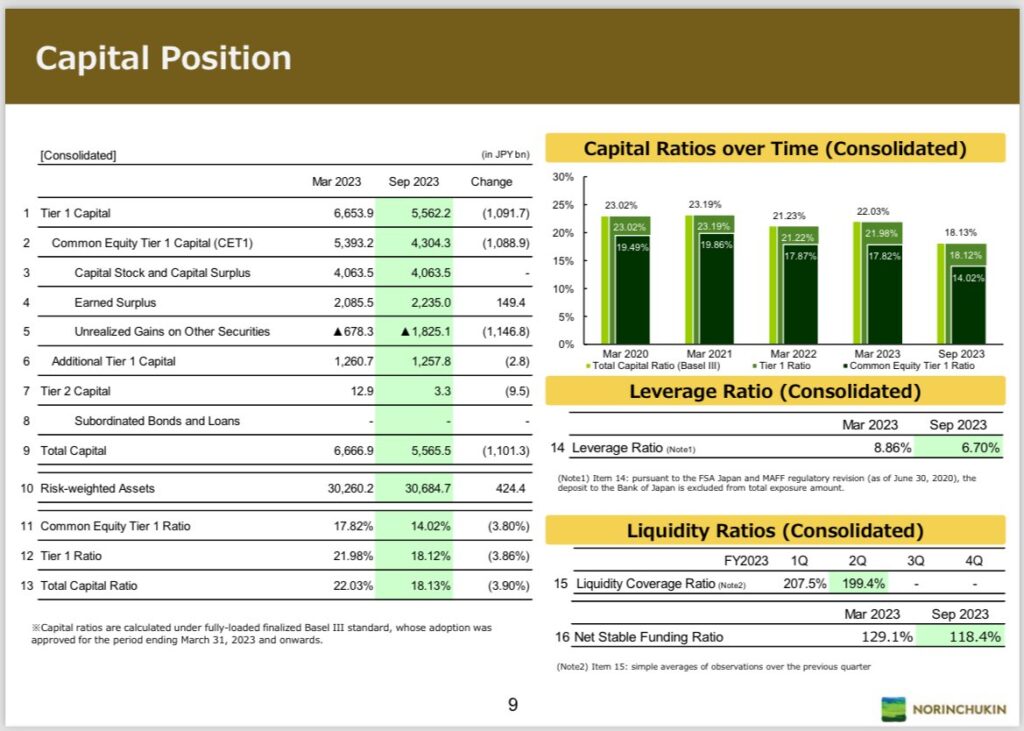

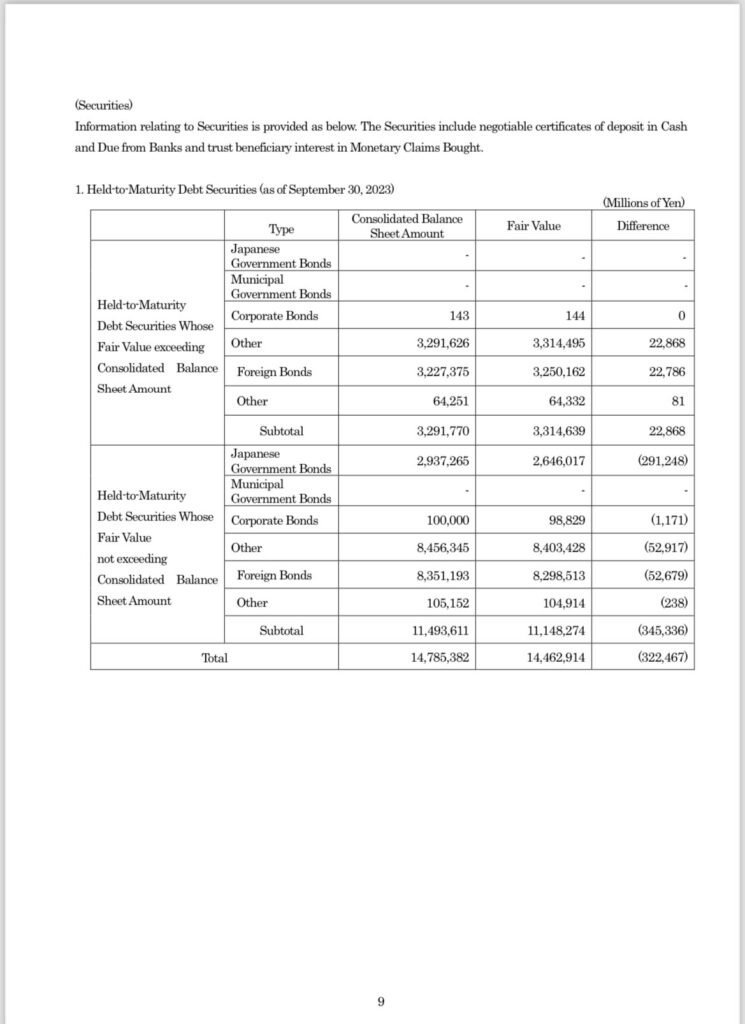

Now, as of September 2023, Nochu disclosed 2.53T $JPY of unrealized losses in its investment portfolio (pic 3). Then why do they need access to emergency repo funding directly with the FED if they still claim such strong capital and liquidity ratios (pic 5)? Because, of course, those market-to-market valuations they have been using are total garbage! Please have a look at their Foreign Bonds “Fair Value” they marked to market in their HTM Debt Securities books as of September 2023 (pic 6). If you look at the “totals,” it’s an even bigger joke with only a 2.1% loss in their HTM books!

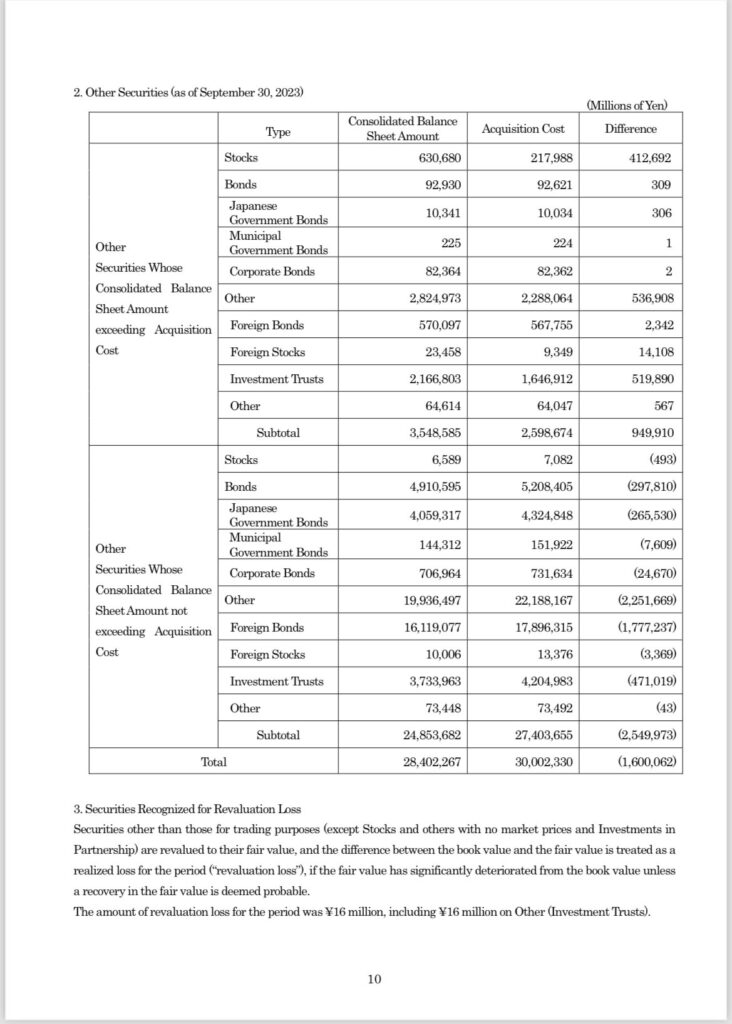

What about their “Other Securities” books reported in their financials at Acquisition Cost (pic 7)? As a whole, Nochu only booked a 5.3% loss.

Do you still think that the 5.5T $JPY total capital they report against their 102T $JPY total assets (sorry, but the “Risk Weighted Assets” RWA is just a regulatory aberration that matters only in wonderland) is still enough here? Of course, it isn’t, and there is obviously a concrete chance that Nochu is INSOLVENT.

Sadly, Nochu isn’t a US bank, so they aren’t eligible for the #BTFP. Then how to rescue them by providing the cash they are badly in need of to make sure they don’t trigger a domino that blows Japan up first and the global #MOAB second? Get them onto the #FED Standing repo facility!

Why can’t the #BOJ step in just printing $JPY instead ? Because Nochu holds ZERO $JGB! Imagine what would happen to the FX rate if the BOJ prints JPY outright, sells them for USD, and then repos Nochu out of their misery… $JPY will tank abruptly!

As of September, Nochu had 65T of $JPY deposits against 63T $JPY equivalent of ILLIQUID ASSETS (Loans + HTM books + Acquisition Cost Books), 73% of them invested abroad. This is one of the most aggressive $JPY carry trades out there, and perhaps now we understand why the #BOJ “hint” to end negative rates only lasted 24h. The moment they end it, Nochu will bleed to death right away.

I conclude with the last cherry on this 🎂 made of 💩, presenting you with Nochu CLOs radioactive ☢️ portfolio where they claim to be invested in “Only AAA rated HTM securities” (pic 8). C’mon, these people really learned nothing from the GFC, did they?