Who doesn’t learn from history is doomed to repeat the same mistakes. If you combine this with out-of-control herd behaviour, then the chances to repeat past mistakes are even greater.

Right now, the number of people taking victory laps because of $NVDA is countless. “The stock is going to the moon, hence I am right”, I am afraid, doesn’t mean anything at all. On the contrary, if that’s all you have to support your thesis, you’d better be aware that what you are truly doing is gambling, not trading. For the same reason, someone will not suddenly be better at predicting the future if they pull off a stream of 20, 30, or even 100 consecutive winning bets at the roulette table. If this actually happens, the person had better ask themselves whether the roulette is broken or rigged (unless they are the ones rigging it). Nevertheless, the streams of winning bets will end at some point.

Congratulations to everyone that made big money so far on $NVDA, but if Isaac Newton went broke, you had better learn from his mistake to avoid falling into the same trap.

Why would one of the greatest minds in history have loved $NVDA today? After you finish reading the below, you will have the answer. Just replace “South Sea” with $NVDA along the way.

The South Sea Company was established by the British Government in 1711 as a vehicle to repay creditors that financed the country during the War of Spanish Succession. How could a newly established company achieve this? The government gave South Sea a monopoly on West African trade. So, indirectly (but by design), the British were planning to repay their debt mostly through the commerce of slaves between Africa and the American continent.

Fun fact: contrary to popular belief, recent accounting documents discovered in UK archives showed that even with a monopoly, South Sea was losing money in its operations.

Isaac Newton was one of the highest earners in the UK at that time, making 2000 $GBP a year in his position of “Master of The Mint” and an additional 1000 $GBP from investment income, totalling 3000 $GBP. This put him almost in the top 0.1% (the top 10% of the top 1%, yes). It is estimated that before the bubble started, his net worth was 30,000 $GBP.

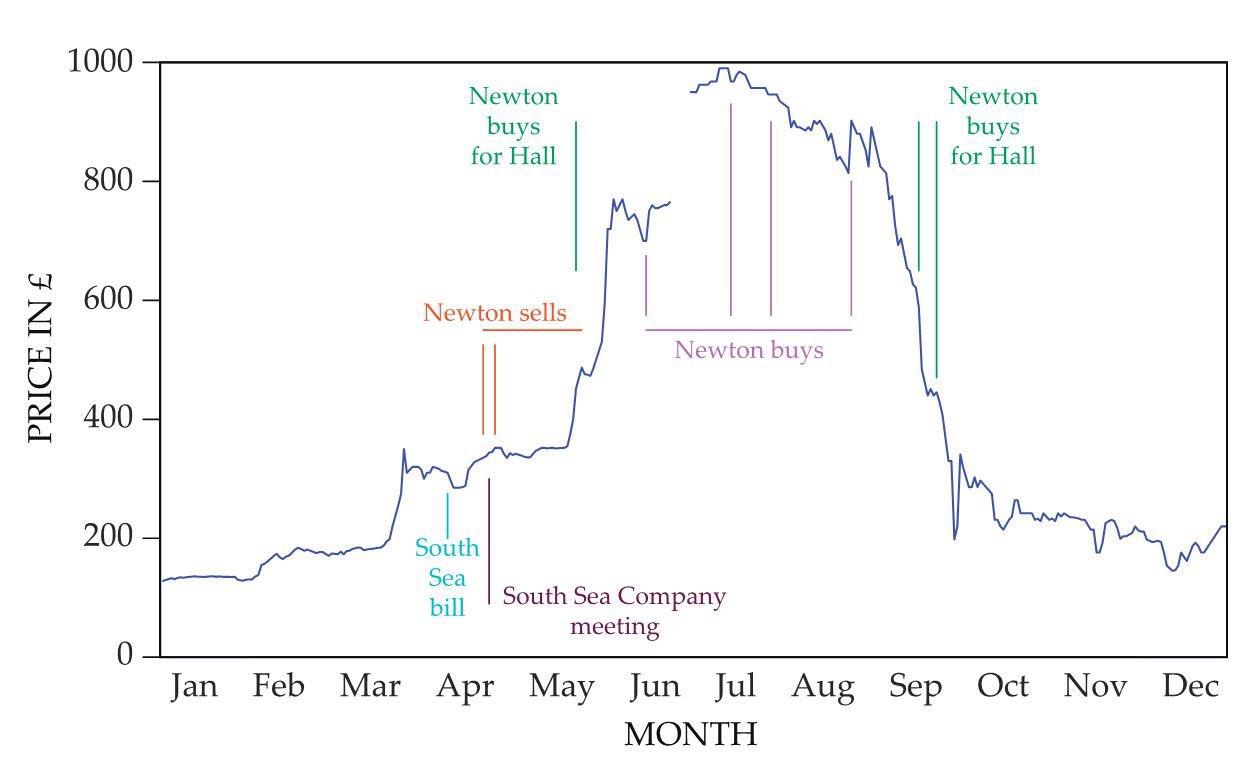

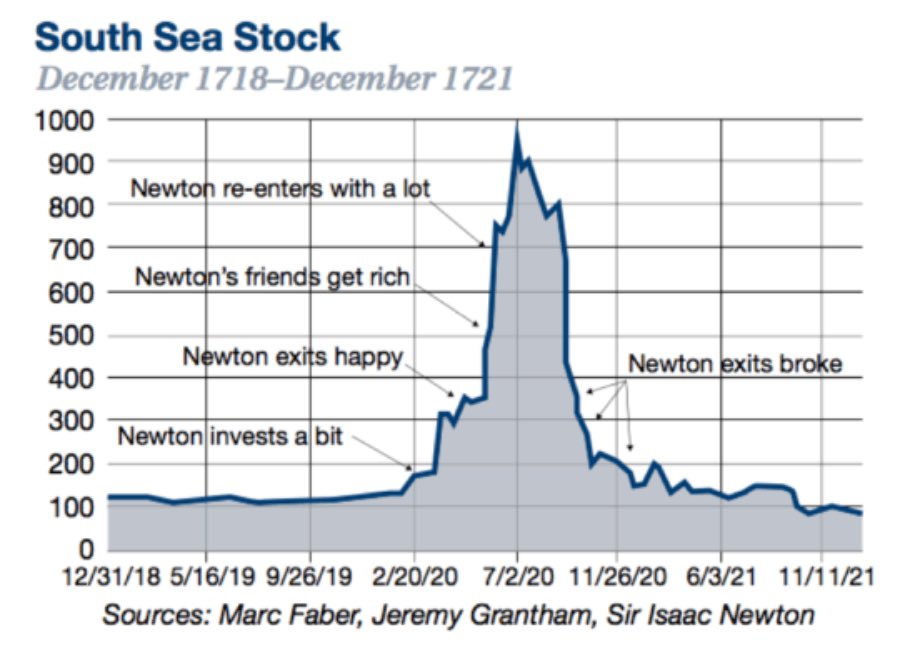

Furthermore, Newton wasn’t a “retail” investor. He was well placed within the country’s elite and had access to plenty of insider information. This is why he was “early” in the stock and made a whopping 20,000 $GBP in profits off it when he sold the first time. Why did he sell? According to the records, there is a chance he attended a “management presentation” of the plan the government had to expand South Sea’s mandate to the management of almost all UK government debt at that time. Newton, a genius, smelled a rat and indeed cashed out.

However, South Sea continued to pay handsome profits despite the new, expanded mandate (and debt) to manage. Why? Long story short, it was a Ponzi Scheme, and South Sea was ultimately repaying old investors mostly with proceeds from issuing shares to new ones.

So why did not only Newton jump back in, but also invest the money of the Thomas Hall estate he was in charge of managing? Very simple, the genius started to doubt his objective assessment that was “proven wrong” by the skyrocketing price, and he felt, almost aged 80, he might not be understanding how to predict the future earnings of “innovative” businesses.

Fast forward, South Sea was a Ponzi scheme, and Newton’s net worth at the end of the saga was estimated to be 20,000 $GBP. So he didn’t go broke, but lost a ton of money.

Currently, there are too many people criticising the forensic accounting work many, including myself, have done. True that one person can be wrong, two can be wrong, but when many out there dig into the same thing, unearthing the same type of rubbish (and presenting evidence for it), then you’d better be careful not to repeat Isaac Newton’s mistake.