Sorry, folks, but after our beloved Jerome Burns’s performance at the last #FOMC, 2 things are clear:

🚩 The #FED knows they’ve screwed up the fight against #inflation and it’s going to flare back up to a point where (political) adjustment won’t be able to hide what’s obvious in the real world anymore.

🚩 The US #Banking system is not “sound and safe” anymore. As a matter of fact, that phrase has been crossed out in the new #FOMC statement (Picture 1).

At this point, it’s fair to wonder whether the #FED pulled the #BTFP to rip the band-aid off the banking system and try to kill 2 🦅 with 1 🪨:

🚩 Stop the “backdoor” money printing camouflaged as (fake) QT and be serious about tightening financial conditions (“tighter financial conditions” is another sentence crossed out from today’s #FOMC statement) to hope they don’t get a flare-up in #inflation right before the US elections in November.

🚩 Engineer a “controlled demolition” within the banking system early enough to have troubles fixed and forgotten by November (like it happened in 2023).

However, what $NYCB showed to the world today is the #FED (not surprisingly) failed to recognize that not only is the cancer metastasizing within the banking system, but the size of the problem today compared to last year is several orders of magnitude larger, as we discussed one month ago (see post below).

Wait, what’s the link between $NYCB and $UBS, though? The regional bank based in NYC is the one that acquired a good chunk of $SVB’s (toxic) assets that are now poisoning the carrier’s body.

Not only did the Swiss National Bank, surely supported by the #FED and #ECB in the background, engineer the worst bailout ever attempted to the point where the laws had to be changed overnight for it not to be blatantly illegal, but they arrogantly ignored the true nature of the problem: Credit Suisse’s books were cooked and their “Hide till maturity” accounts were stuffed with nuclear waste. $CS was already insolvent for many months and that’s why they fell into a liquidity crisis.

Here’s what $UBS did to make the problem even worse:

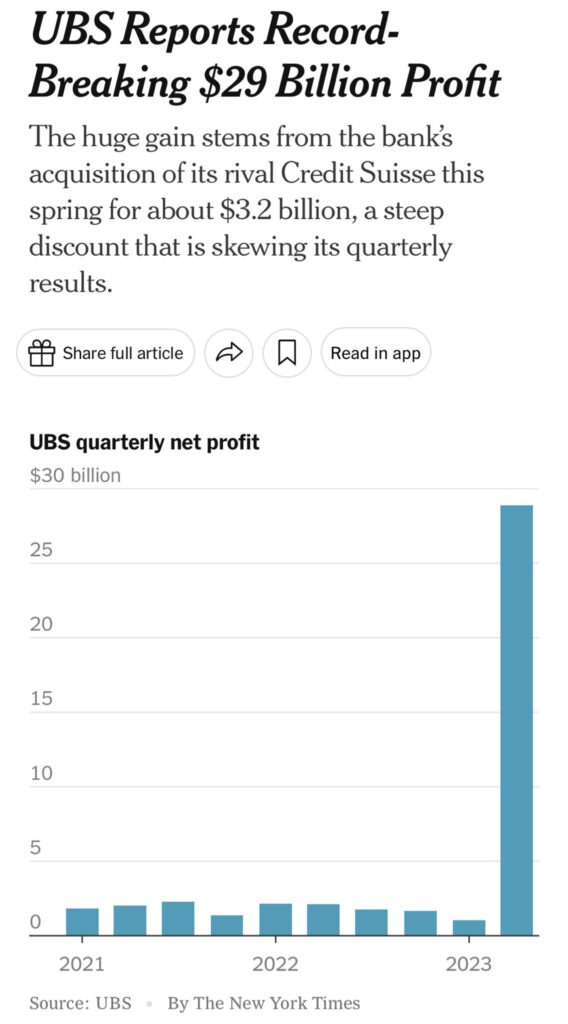

🚩 Even if they bought $CS’s toxic assets for what they were truly worth, they “revalued” them to what $CS said they were worth and voilà! $29bn in profits were made out of thin air and $UBS, now almost double the asset size it was before the merger, doesn’t need to raise capital from the market anymore (Picture 2).

🚩 $UBS paid back to the #SNB the emergency liquidity received (cough cough, because it was too expensive) and even forfeited the “loss protection agreement” sealed with the Swiss government during the merger (cough cough, because it was illegal) – Picture 3.

What comes next? Last November, I already highlighted how $UBS’s accounting was a complete joke (TwitterX). Personally, I expect they will try their best not to break the illusion next week when they will report their Q4-23 results. It seems like “fake it till you make it” or more correctly “fake it hoping you will make it” is the most popular strategy among big banks nowadays. However, like for the case of $CS, investors will expect answers about those tons of ☢️ assets $UBS now hides in its belly and if these won’t come, don’t be surprised if some people won’t feel safe keeping their cash in $UBS…

Read on TwitterX