There are times when I believe that if there wasn’t a massive cultural and language barrier between #China and the major Western countries, in particular with the #US (while #Germany would love to deal more with #China commercially if they still had the option to do so), both parts of the world could learn from each other’s mistakes more often.

In today’s article, I will present you with the actual situation of #China’s middle class in 3 sections: “The Lucky Ones”, “The Smart Ones”, and “The Screwed Ones”. So, you can better understand how to deal with the incoming (likely brutal) economic downturn that is about to hit the #US and #Europe, learning from those who already entered it and have been dealing with it for a while now.

Before we dive into the 3 different categories, it’s important to have a clear picture of what characterizes the “modern” China Middle Class:

- Education till the end of the university cycle is prioritized versus learning/nurturing practical skills

- Consumerism and continuously seeking lifestyle upgrades

- Settling in large urban areas

- White-collar jobs

- Parents with little or no debt, a generous public pension (paid by the current workforce), owning at least one real estate property, and a comfortable amount of savings.

- Single child

THE LUCKY ONES – 幸运的人

These are those who managed to grow fast enough in their career to become a 老板 which means “Boss” in Chinese. How did they manage to do so? Not through skills, meritocracy is very rare in China’s corporate culture in the lower ranks of the workforce, but by filling “vacuums”.

Prior to COVID-19, almost no Chinese who studied abroad or even in Chinese universities was seeking to work in the Mainland. Why? Going to Hong Kong, Europe, or the US as a fresh graduate you could earn 3-5 times more at least. Considering this was happening for a long time, there was a “shortage” of graduates to fill the ranks of fast-growing Chinese corporations, both public and private. Consequently, the “seniority” promotions came in much faster as soon as a new batch of fresh graduates joined the ranks since those with enough experience could already be placed in responsibility roles in offices or factories.

Climbing the social ladder in China might not come with massive salary or bonus improvements in absolute terms, but it surely brings in significant perks and privileges (some corporates even provided free or heavily subsidized housing) that put together allow the person to build a good stash of excess savings.

While the Chinese working abroad in “prestigious” investment banks and law firms (showing off fancy business cards when visiting home during the Chinese spring festival), in reality, just managed to cover their cost of living in expensive cities abroad putting aside little or no savings; those who “stayed behind” in mainland accumulated enough savings and started to buy real estate paying higher rates than today, but on a much much lower mortgage value.

The “Lucky Ones” saw their personal wealth grow exponentially every year with the growth of China’s economy, managed to pay off their debt rather quickly, and didn’t feel the impulse of starting to spend on consumer goods or highly depreciating luxury assets and cars since, not having been exposed to this poisoning part of the Western culture, they didn’t feel the need to do so.

Fast forward to today, these people in China have no debt, a very safe job position, and a steady comfortable income to live without much stress.

THE SMART ONES – 聪明的人

In this category, you find those Chinese living abroad who after 2008 were smart enough to understand China’s economy was about to take off (and create a ton of wealth up for taking in the process). These people decided to come back to China instead of dreaming that Wall Street salaries and bonuses could go back to 2008 levels making them rich and realizing their American dream.

These types of people, of course, found jobs back in China at much lower salaries than in London or New York and brought back home little savings. However, what they brought back from abroad was also the fresh knowledge of how to profit from a bubble in the making.

The first thing they did was borrow money from relatives and banks to buy real estate. Once the value of their first home started to appreciate they took equity out of that investment (very popular in the US), used that for the upfront on a new property, and could easily borrow the rest either from banks or often directly from the real estate developer itself. These people were not buying any type of real estate let’s be careful, but those types of apartments that were both close enough to the expanding headquarters of large corporations and banks and were only suitable for one person to live in. Why? In China, even if less so nowadays, married couples do not rent an apartment, and when they cannot afford to do so their relatives often buy it for them to avoid social shame. However, a single person just graduated from university and likely changing jobs after 2-3 years was the perfect target for rental income.

The even smarter people kept doing this, ignoring the #fomo bug from Chinese #stocks in 2014-2015 that caused tens of millions of people to lose all their savings (and join the vast army of Chinese “gig workers”).

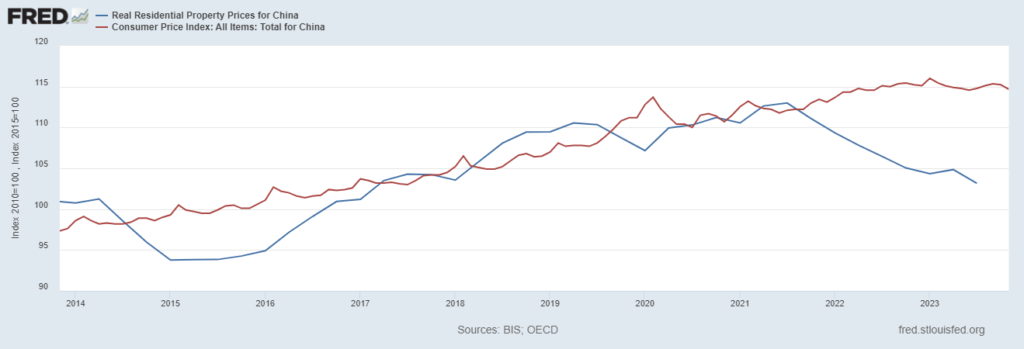

When did the smart ones start to cash out, repay their debts, and then live comfortably off their stable jobs and newly secured wealth that still generates additional rental income for those who own at least one well-located rental property? In mid-2018. Why? At that time real estate price increases started to lag behind China’s inflation rate and that was the signal to cash out (a process helped by the sudden inflow of foreign money into China that “saw the future” in the non-stop growing real estate sector and China state-sponsored Belt and Road infrastructure expansion).

The Screwed Ones – 穷人

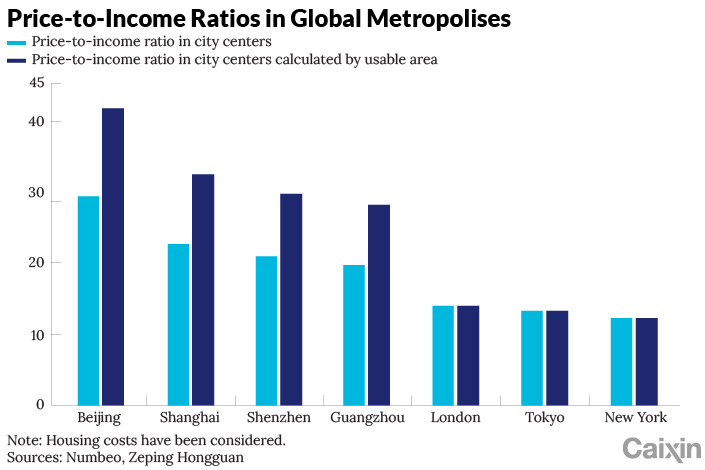

In this category, we find people who will likely be slaves of their debt for their whole lives. Would you ever buy an apartment with little to no upfront payment needed, 20+ years mortgage at 4% interest when the price of the apartment is 30 to 40 times your annual gross income? Many people before COVID-19, especially considering the Chinese stock market more like a casino where you are assured of losing money after the events of 2015, answered yes to the question.

Not only their answer was “yes”, but since they were so scared of home prices becoming more and more unaffordable they even rushed to pay in full for apartments that more often than not the real estate developer had not even started to build yet. Remember what I mentioned above, culturally speaking not owning an apartment often translates to not being able to marry and start a family in China. Combine these 2 factors with real estate developers’ unbelievable greed in seeing such an overwhelming demand from hundreds of millions of people (plus foreign investors) and you have the perfect setup for a disastrous real estate bubble. These developers even started using the money from the apartments they sold on paper to purchase more land to sell more apartments on paper rather than developing those they were bound to deliver.

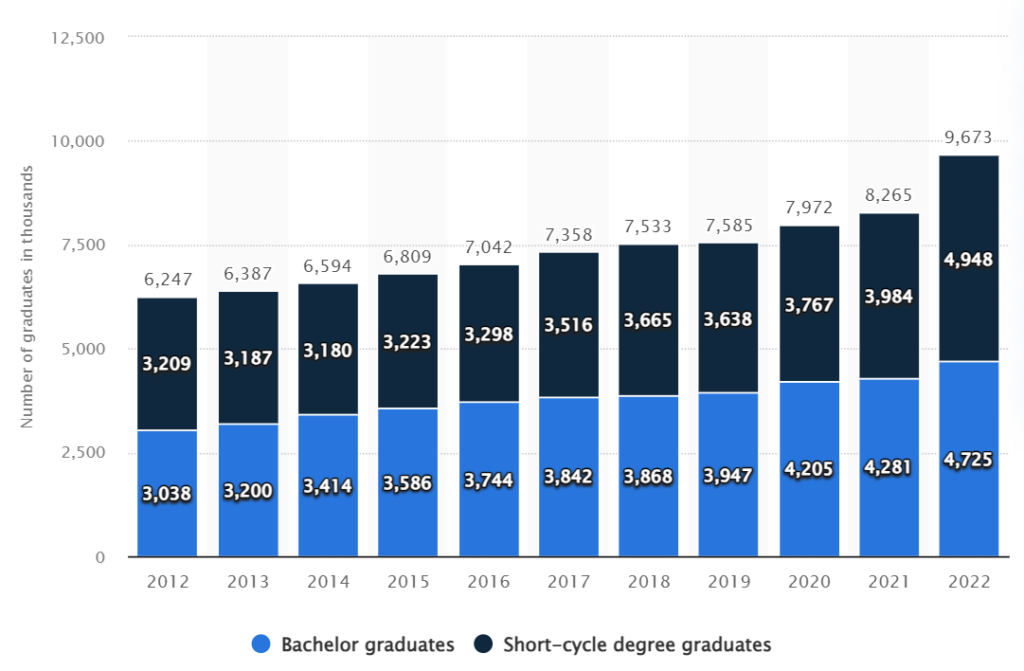

As if what I described above wasn’t enough already, China’s economic growth started to slow down already before 2020 and the events that followed derailed any expansion plan corporations already had. As a consequence, white-collar jobs across every sector started to be cut at the same time when the highest number of Chinese graduates ever entered the job market. From Chinese universities alone ~10M people graduate every year, on top of this, you now have the wave of the “turtles” who after living the American or UK college dream are now coming back home since they cannot afford to live in those countries for too long without job income (and their families in China cannot afford to subsidize them anymore).

Why are these categories of people literally debt slaves now? Pretty simple, the homes they purchased are now worth significantly less and there is hardly the chance they will see prices recovering to the peak in their lifetime realistically. Don’t be misled by the official numbers, if you go to the mainland now and bid 40-50% below the last transaction price in many major cities the sellers will be more than happy to sell.

What happens when an incredibly leveraged asset loses so much value? Well, you are screwed, because your debts remain to be paid at the level set in the original agreement. What happens when your apartment, already fully paid, is not even delivered? Not only do you have to pay your monthly mortgage, but also you will have to pay rent to live in a different apartment, losing any chance to put aside any savings.

Conclusion

I hope this article today helps everyone still living the (debt-fueled) dream in the US and Europe to open their eyes to the dangers they are facing and make sure they cash out their gains in time to be debt-free (or at least to make their debt sustainable in the long term) before it’s too late.