Since last Thursday, a strange tension could be sensed on trading floors in Hong Kong and China, then on Friday, the $CNY suddenly sold off against the $USD. While the event has been greatly overlooked so far by investors, it might have been a pretty loud warning about the next move #china is going to make soon.

During the weekend, I heard that the move was triggered in the offshore market where a significant amount of $CNY was suddenly sold and only mitigated by #China SOEs promptly stepping in to mitigate the impact. So I investigated further. What happened in the offshore market and didn’t make any MSM headlines, was that some lenders suddenly hiked their short-term offer rates by 50-60 basis points up to ~3% to raise $CNY funding that was quickly converted into $USD. Why the sudden need for $USD? This is not confirmed, let me be clear, but it looks like someone pulled out a large chunk of $USD deposits held offshore from various Chinese lenders. Why such urgency? After living in Hong Kong for more than 10 years, based on personal experience, I can link this behavior with the risk that the well-informed might be preparing for a big government move to happen anytime.

Frankly, I don’t think #China is planning anything military on #Taiwan, but the events might have something to do with Taiwan. What exactly? Semiconductors.

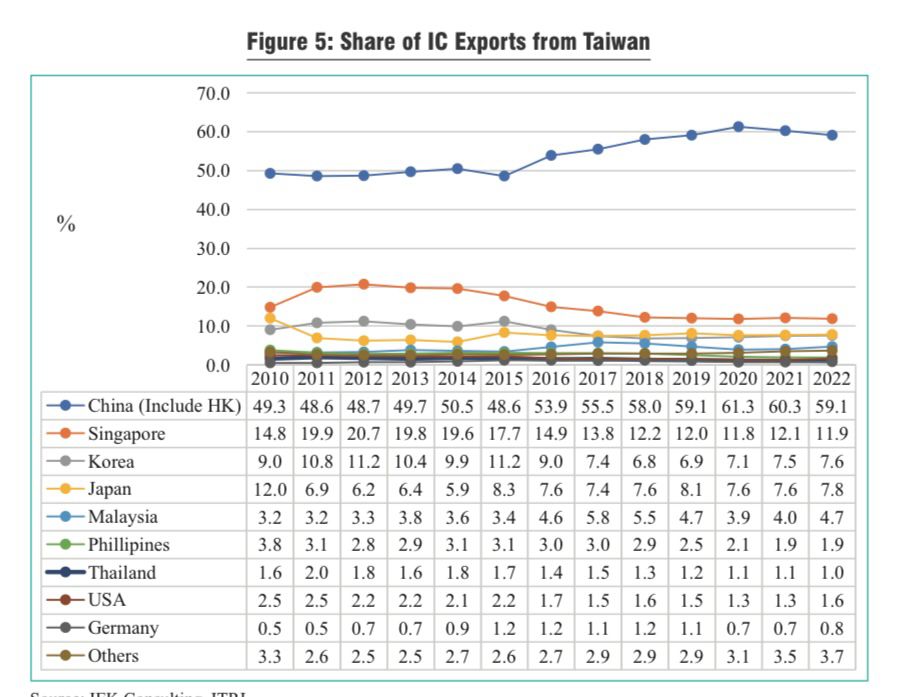

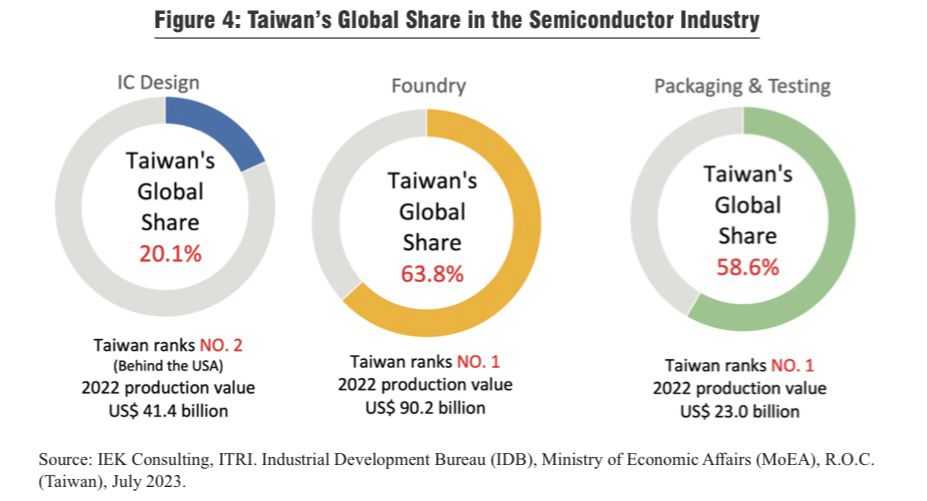

According to the “TAIWAN AND THE GLOBAL SEMICONDUCTOR SUPPLY CHAIN” report published last year by the Taiwan-ROC representative office in Singapore, it reported #China is the major country where Taiwan-made microchips are exported the most (and by far).

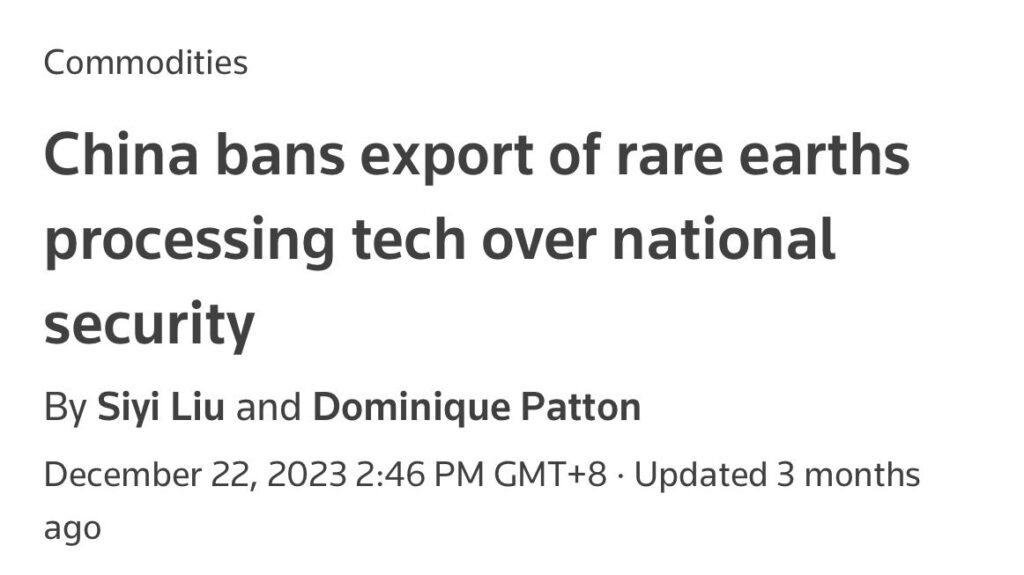

The question nobody has been really asking so far is why #china has been stockpiling so many chips from Taiwan. Perhaps the answer is, that Taiwan might not be in the condition to produce that many at some point in the future. How could that be possible? Well, rare earths necessary to produce chips in #Taiwan come almost entirely from… #China.

A few months ago, #China tightened the controls on exports of rare earths over “national security” concerns, remember?

What might be coming is a further tightening of these curbs, and China logically might have been seriously considering allowing rare earth exports only to manufacture chips for the #china market, sending a significant shockwave across the whole semiconductors industry. If this happens, the immediate impact will be a sharp drop in the productive capacity of Taiwan which will also impact China in the short term (hence the need to stockpile chips).

At this point, Taiwan will be in a very tough spot, either complying with the new restrictions and keeping 50% of their semiconductor exports in place or “playing tough” with China, threatening to put the entire semiconductors supply chain on a standstill. In this situation, I expect Taiwan to choose the first option because the second one will put the island’s economy on its knees very quickly.

What if Taiwan pretends to comply with it but then uses China’s rare earth to produce chips and then export them to other countries? This will give China the perfect excuse to enforce a commercial blockade because China has to keep production going in the medium term for its own national security interests too, till the local manufacturers can replace the outputs from Taiwan in terms of both quantity and quality.

Choking Taiwan’s semiconductor industry will significantly reduce the island’s geopolitical importance, weakening (although less significantly than anyone thinks) China’s competitors from an industrial perspective and making the island way less strategically important to be defended.

Of course, such a move, even if not military, won’t come without consequences and China’s competition will likely fight back with commercial and financial sanctions, in particular with the use of $USD to settle international payments, in particular, to pay Chinese suppliers (that for the vast majority still prefer payments in foreign currencies they keep in offshore account versus $CNY).

At this point, foreign companies will either comply with buying $CNY to settle payments with their Chinese suppliers or face major supply chain disruptions. Will they be allowed to do so though? I doubt otherwise the $CNY might become significantly stronger. What will likely happen is a settlement of imports via commodities China is in need of import. Companies in China will then sell these commodities back to the government onshore for $CNY payments.

Clearly, Chinese offshore lenders will have a hard time holding foreign currency, especially $USD, and processing payments in case of sanctions, which is why some (well-informed) depositors might have transferred out their $USD last Friday (triggering a sudden drop in the $CNY as described at the beginning of the article).

Needless to say, all that I described will hit #US where it hurts the most right now, its stock market because, from a semiconductors supply perspective, as you can see from above, only a small part is exported by Taiwan to the US, and they can quickly replace that, for example, increasing their imports from South Korea. As a matter of fact, despite the whole world has been brainwashed to think semiconductors are synonymous with GPUs, the truth is most of the semiconductors needed by the current industrial complex are the far less powerful ones, and those can be sourced ramping up the production outside Taiwan that in the grand scheme of things accounts for ~60% of the global market (out of which ~60% is exported to #China and only ~1% #US). This by itself will already decrease significantly in the future with the US and other Western countries subsidizing tech companies hard to bring onshore the strategically important part of semiconductors manufacturing.

However, as I hinted, a Chinese move on Taiwan’s semiconductor industry will hit the high-flying tech stocks that lifted US listed #stocks indexes beyond realistic levels, in particular $NVDA, since all of them are almost totally dependent on Taiwan for the production of their (“so much in demand”) semiconductors.

To conclude, #China doesn’t need to invade or blockade Taiwan to deliver significant financial damage to the US that has in its #stocks bubble a big Achilles heel. Is all I described about to happen? Perhaps we will know the answer in the not-so-distant future.