Since last week, while the market was distracted by the geopolitical slapping contest between Israel and Iran, both large banks (#KBE) and regional banks (#KRE) lost 5%, outpacing the S&P500 by more than 2%. JP Morgan, surprisingly, is leading the tumble, down almost 8% since releasing its Q1-24 results. Bank of America and Citigroup are following behind, both down ~6.5% in the past 7 days, while the less “deposit heavy” Goldman Sachs and Morgan Stanley are holding up a bit better, down only ~3.5% in line with the major market indexes.

So what’s happening exactly? After Bank of America published its latest Q1-24 results something now is very clear: banks are now starting to fight for liquidity.

What does this mean exactly? So far, banks, especially the large ones, managed to pay 0% on their deposits and keep for themselves all the profits they could easily make just parking that cash either back at the #FED or in T-Bills, pocketing a chunky 5% spread for quite some time. However, now more and more depositors are figuring out the (legal) scam and bypassing banks, investing directly into money market funds or T-bills if they don’t get higher interest rates.

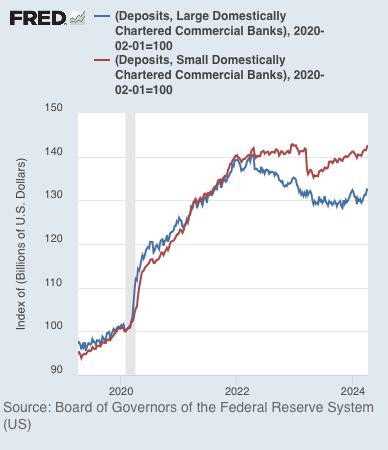

This trend is incredibly obvious if you compare the growth of deposits between Large and Small US Banks (personally I prefer to do this using not adjusted data), where the latter ones notoriously offered much higher interest rates.

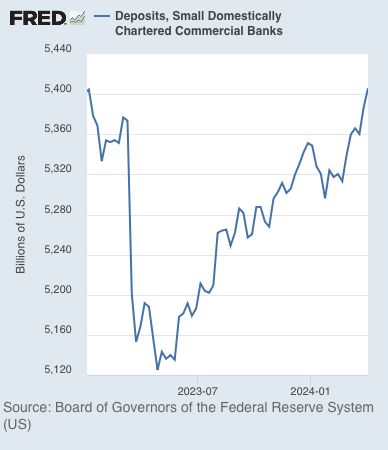

Incredibly, Regional banks almost managed to recover all the deposits they lost from last year’s crisis. Kudos to the #FED and Janet Yellen for such a successful mass brainwashing here while US Regional banks are surely not safer than one year ago, in particular after the plug of the #BTFP was pulled (WITHOUT THE FED BTFP, BANKS WILL NOW HAVE A HARDER TIME TO “HIDE TILL MATURITY” THEIR LOSSES)

Not only banks are now fighting with each other to hold onto their deposits, but they are also fighting to recover the overall cash they lost in the past 2 years.

Do you understand why all banks in December were pulling Jerome Burs’ jacket and begging him for 6 Fed Fund Rate cuts? Not only were banks dealing with their mounting credit losses in their real estate loan books, but they also started to grow uncomfortable about cash leaving their books for better alternatives. After failing to get what they wanted, banks (in particular large ones) started to capitulate in Q1-24 and raised their yield offers on deposits with a consequent ripple effect across their operations.

As if all of this wasn’t bad enough, long-term rates are up between 0.80% – 1.00% since the beginning of 2024 and back to levels where US banks are sitting on ~600bn$+ of unrealized losses in their securities books.

To conclude, banks are not only fighting to keep their losses hidden, but they are also starting to fight harder for liquidity with an increasing impact across their businesses and balance sheets. As I warned for the first time at the beginning of this year (2024 THE YEAR WHEN “HIDE TILL MATURITY” ENDS) up until yesterday (GOLDMAN SACHS’ CASH BLEED WON’T ALLOW THEM TO KEEP HIDING THEIR LOSSES FOREVER), banks won’t be able to hide their mounting losses and pretend those wouldn’t impact their capital stability forever. You better take some precautions because once this Pandora’s box is reopened after all that happened last year, it will be hard for the Jerome and Janet duo to brainwash everyone all over again and stop a banking crisis from unfolding in all its ugliness.