Goldman Sachs just released its Q1-24 results and, of course, they beat expectations. Nothing less could be expected from the “best in its league” right? Well, if you pay attention to details, #GS financials are less and less shiny (and increasingly worth paying attention to).

Once again, #GS cherry-picked the numbers it wanted to showcase to the markets and wrapped them nicely in a total of 12 pages, yes… 12 pages (GS Q1-24). So even if we will need to wait for its 10-Q to be (quietly) released when everyone is distracted, #GS still didn’t manage to keep all that smells bad out of today’s release.

First of all, let’s start with #GS cash position that keeps, alarmingly, shrinking vs total assets:

Q1-24: 209bn$ cash vs 1,698bn$ (12.3%)

Q4-23: 242bn$ vs 1,642bn$ (14.7%)

Q3-23: 240bn$ vs 1,577bn$ (15.2%)

Q2-23: 271bn$ vs 1,571bn$ (17.2%)

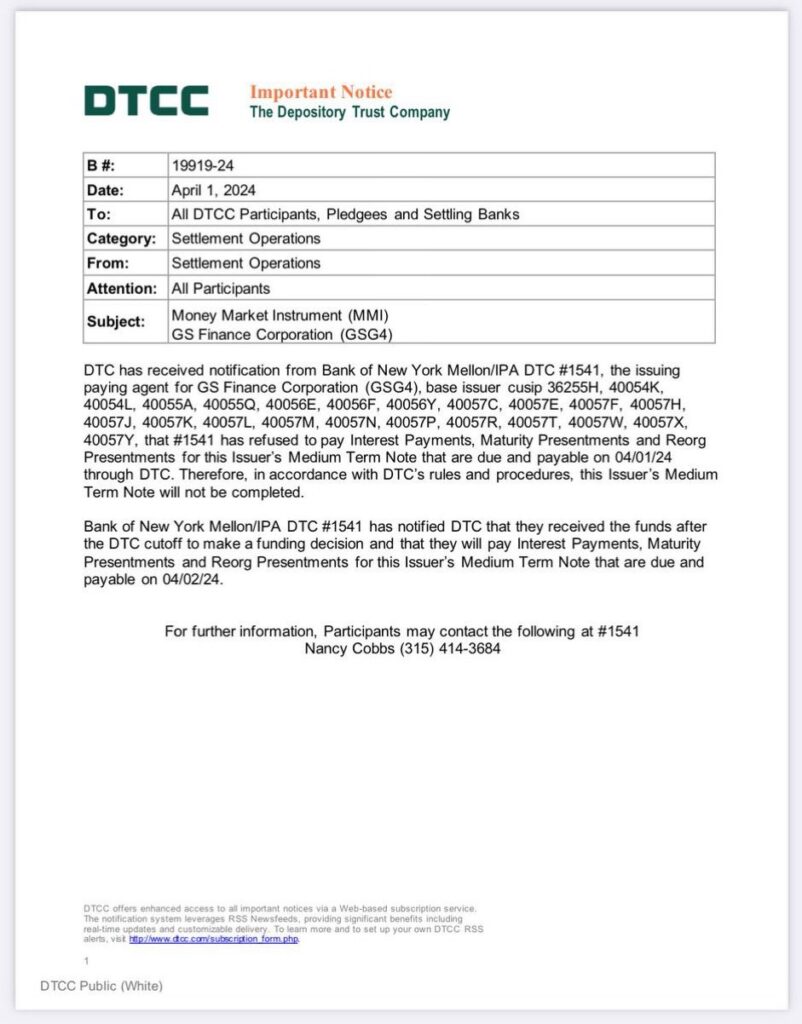

If we also consider that #GS failed to repay principal and/or interests on a significant number of debt notes on the 1st of April and needed 24 hours more to deliver the necessary cash to its paying agent BNY Mellon as the below DTCC notice highlighted, it is pretty clear there are increasing liquidity problems at #GS

As if this wasn’t worrying already, #GS is financing its balance sheet growth more and more with deposits instead of more stable longer-term borrowings

Q1-24: 441bn$ deposits vs 234bn$ LT Borrows

Q4-23: 428bn$ vs 242bn$

Q3-23: 402bn$ vs 224bn$

Q2-23: 398bn$ vs 230bn$

Hold on a second, how come #GS is still constantly growing its balance sheet while every other major bank is trying to shrink it and cut its risk exposure? Odd isn’t it? What if I tell you the growth mostly comes from an increase in the amount of highly volatile “trading assets”?

Q1-24: 508bn$

Q4-23: 476bn$

Q3-23: 448bn$

Q2-23: 400bn$

I assume you already agree with me there is something very odd going on here

Let’s continue to dig a bit deeper and we quickly see how something is very wrong with #GS numbers, in particular with the value of their investments and loans.

Concerning its “investments”, their values kept constantly increasing despite the swings in rates and equities we observed in the past 12 months

Q1-24: 155bn$

Q4-23: 147bn$

Q3-23: 145bn$

Q2-23: 137bn$

Sounds like nails scratching on a chalkboard, doesn’t it?

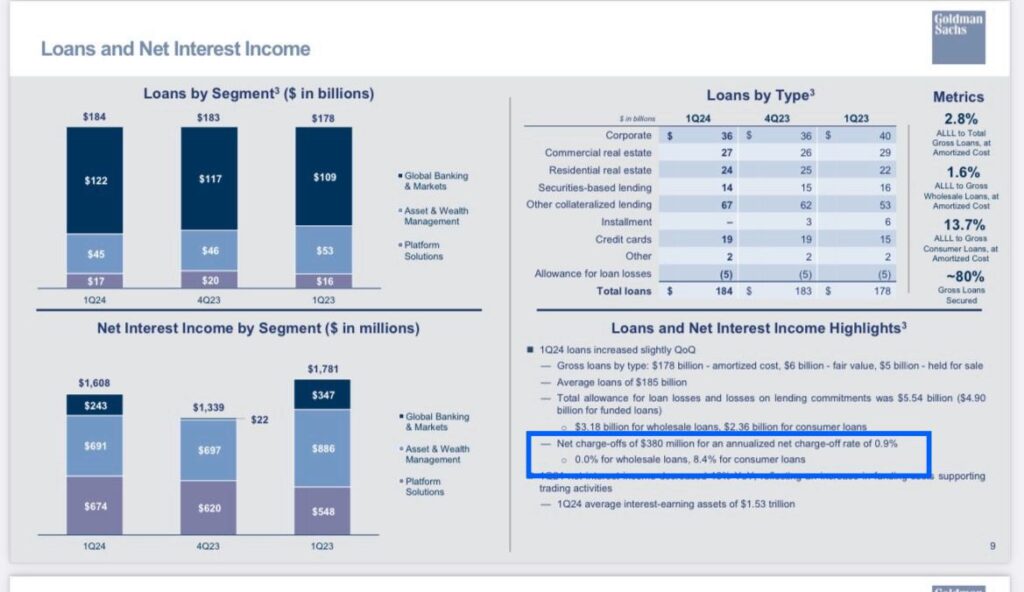

What about #GS net loans and quarterly credit loss provisions?

Q1-24: 184bn$ loans vs 318m$ CLP

Q4-23: 183bn$ vs 577m$

Q3-23: 178bn$ vs 7m$

Q2-23: 178bn$ vs 615m$

I believe by now it’s quite clear #GS numbers are too good… too good to be true. Indeed they are if also consider the net credit loss provisions of the current quarter only impacted the #GS consumer segment without any impact whatsoever on the wholesale one

It doesn’t take much effort now to connect all the dots and realize #GS is inflating the value of its assets to cover up its losses and keep “beating” analyst expectations, similar to what we saw them doing already in the previous quarter (GOLDMAN SACHS – A BIG EPS BEAT ENGINEERED TO HIDE LIQUIDITY STRUGGLES AND A QUESTIONABLE LOAN BOOK?). However, if their cash bleeding continues at this rate this trick won’t work forever and, in particular, considering the current fast deteriorating market environment, the chances #GS will be suddenly forced to come clean on its problems are rising with what is going to turn out as a big (if not shocking) surprise to the market.