Last Friday, #ARM closed the day at $87.19, down by 16.90% in one session. The stock overall lost 31.10% last week or $40bn in market cap.

Why is this a big deal? Because #Softbank holds ~90% of #ARM and has been manipulating this stock on the upside since an IPO specifically designed for that purpose (“ARM IPO – A PUMP & DUMP MASTERPIECE”). This allowed them to cover up the holes created by many reckless investments, like the one in #WeWork while guaranteeing the vast amount of debt they carry, $215bn in the last report, was still sustainable. As a matter of fact, #Softbank bet everything on #ARM.

Last week, #Softbank lost $36bn on #ARM alone and they are set to lose much much more since at $87.19 the stock still trades at a completely asinine 1162 Price-Earnings ratio. As of the last report, Softbank disclosed an $8.5bn Margin Loan that was already fully secured by #ARM shares. However, during the latest management call, #Softbank disclosed #ARM shares would have been more broadly used as collateral for margin loans, triggering alarm bells across Wall Street to the point even the WSJ published the article “SoftBank’s $118 Billion Arm Problem” to warn about it. In particular, the WSJ highlighted: “In this month’s results call, the Japanese firm hinted that it would use Arm shares as collateral for margin loans. However, if public opinion turns against AI and the stock price drops, #SoftBank would be exposed”.

Wait, what did the WSJ say?! Yes, they said, “if public opinion turns against AI and the stock price drops, #SoftBank would be exposed”. Well… wasn’t this exactly what happened last week after the bad earnings miss from ASML sent a jolt through the spines of many semiconductor stocks maniac bulls? [Shares of critical chip firm ASML drop 5% as sales miss expectations with 22% fall]

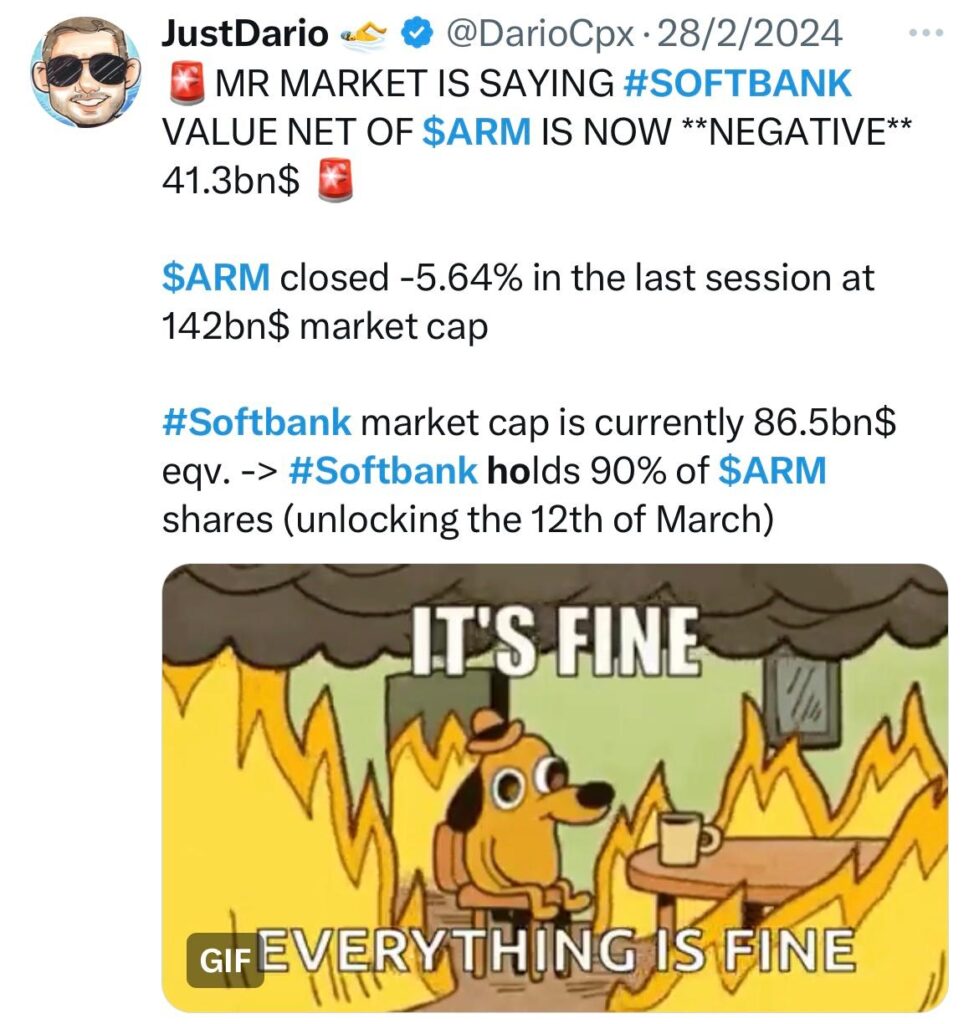

Funny enough, in the same article, the WSJ also picked up on a matter I warned about an endless amount of times: #ARM shares held by #Softbank were worth more than the total #Softbank market capitalization!

It will be interesting to see how Softbank shares listed in Tokyo react when trading resumes for the week in Tokyo. For some reason hard to explain, Softbank ADR listed in the US completely ignored ARM’s free fall on Friday closing only 4.66% lower at $23.93. That makes the market cap of Softbank priced by the ADR at $72.50bn, equivalent to the one priced by Softbank share price in Tokyo. Currently, according to Mr. Market, Softbank value remains NEGATIVE for ~$8bn NET of #ARM shares. This is not only a sign that the market believes Softbank won’t be able to liquidate its assets for what they are currently (nominally) worth, but that there is concern that Softbank liabilities are higher than its assets overall. Basically, Softbank is already virtually bankrupt.

Now, suppose the implosion of a rather small and unknown to the public hedge fund like Archegos managed to bust Credit Suisse and deliver severe losses to Nomura. What do you expect is going to happen if a 15 times bigger player goes under? Yes, it will be ugly for some big banks out there. Let’s try to figure out which one.

A good proxy to understand which bank lent a lot of money to a company and/or provides a good chunk of its book for derivative business is to look at which bank is “rewarded” with fat fees business by the company itself. Ok, then who were the lead underwriters of ARM’s IPO? Barclays, Goldman Sachs, JP Morgan and Mizuho. What about PayTm IPO underwriters? Besides some Indian banks, we find Citigroup, Goldman Sachs, JP Morgan, and Morgan Stanley. What about Didi IPO underwriters? Morgan Stanley, Goldman Sachs and JP Morgan. Going further back in time, who was supposed to lead the WeWork IPO back in 2019 before it got pulled? JP Morgan, Goldman Sachs and Morgan Stanley. Overall, if you dig deep into the Softbank business the names of Goldman Sachs, JP Morgan, and Morgan Stanley are in one way or another always there.

Among these, one seems particularly cozy with Softbank: Goldman Sachs.

Softbank’s very own Vision Fund was led till 2020 by Michael Ronen, former joint COO of Goldman Sachs investment bank’s TMT group. Katsunori Sago was another Softbank employee very fond of rewarding a lot of business to Goldman Sachs (Banker Who Brought Goldman Clout to SoftBank Starts Venture Bets). WeWork was another ground where Softbank and Goldman Sachs’ coziness was very evident. The latter was part in every single transaction of the WeWork saga till it helped to orchestrate WeWork’s bailout in 2019 also providing a $1.75bn credit line (it syndicated later on) as support within the $9.5bn rescue bailout led by Softbank (“WeWork arranges $1.75 billion credit line with Goldman Sachs”). Awkwardly, Goldman Sachs got all its money back days before WeWork declared bankruptcy (“SoftBank paid $1.5bn to WeWork lenders including Goldman Sachs days before bankruptcy“). Isn’t it usually the case that guarantees are triggered and paid only after a formal bankruptcy is declared? Ehmm….

It’s not possible to say which bank carries the most dangerous exposure against Softbank considering everyone has an interest to keep his mouth shut on it, in particular now. However, considering what happened on Friday, if things escalate it won’t take long for names to surface, and personally, I won’t be surprised to see them coming out from those I listed above.

Here are all the previous major articles on the Softbank (potentially coming to an end) saga:

- IN A SCRAMBLE TO SURVIVE, SOFTBANK IS KILLING ALIBABA!

- WHILE YOU WILL BE WAITING FOR THE US-ELESS CPI, IT LOOKS LIKE “SOMEONE” IS AT RISK TO BLOW UP (AGAIN)

- WHY IS #JAPAN SO SCARED ABOUT $JPY CROSSING 152 AGAINST THE $USD?

- WARNING: SOMETHING BROKE!

- Is ARM The Canary In The $NVDA Coal Mine?

- SOFTBANK UNHEDGED JPY FX EXPOSURE