All the talk about #crypto as of late has been mostly around #Bitcoin and the #Bitcoin ETF that, like it or not, has been the most successful ETF launch ever. A while ago, I explained what the #Bitcoin ETF meant for the whole #crypto industry (“WHY A BITCOIN ETF WILL REMOVE THE BARRIER BETWEEN CENTRAL BANKS’ MONEY PRINTING AND CRYPTO”). The price of #Bitcoin at that time? 42,000$. What was everyone saying about the #BitcoinETF event? It was widely expected to be a “sell the news” one, even within the crypto community.

In order to understand what I am going to talk about next, it is very important to bear in mind the above along with these 2 concepts:

- The impact of central banks’ money printing and government deficit spending in injecting liquidity into the broad market, from #stocks to #crypto to #commodities

- The importance of investors’ “herd behavior” in channeling that liquidity into asset classes where they do expect to maximize their short-term return the most

Let me be clear, you can use fundamental analysis in #crypto (“VALUE INVESTING ON CRYPTO BLOCKCHAIN PROJECTS”) and that’s what I am personally doing. However, this at the moment is not only equivalent to looking for a needle in a haystack but also useless for profiting from very short-term dynamics mostly dictated by flows and psychology.

Alright, let’s cut to the chase now and have a look at what’s coming next for crypto altcoins.

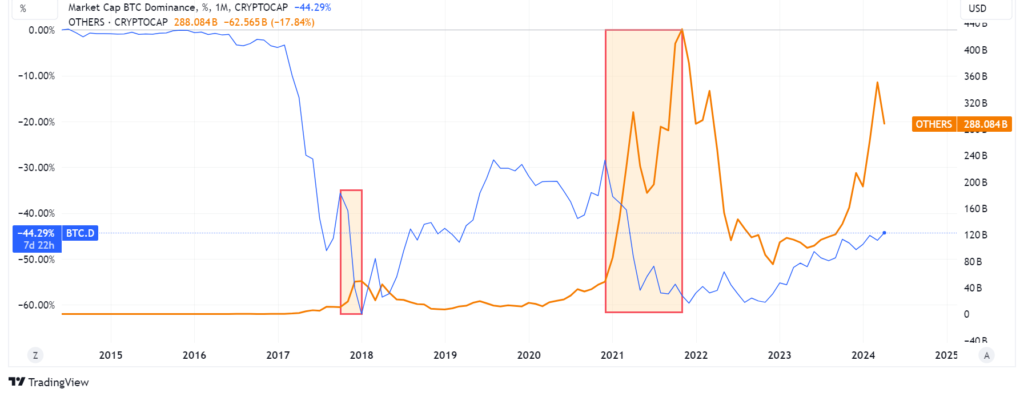

First of all, let’s have a look at how #Bitcoin “Dominance” is a great indicator to monitor to understand when the altcoins season is about to begin. As the chart below shows, a decrease in #Bitcoin dominance is natural and unavoidable, but at the same time, it doesn’t mean anything with regard to the Bitcoin price itself. As seen multiple times already, because of endless fiat money printing, #Bitcoin and #Altcoins can both enjoy a remarkable bull run together.

I am sure everyone noticed one thing, #Bitcoin dominance tends to grind higher during “crypto winters”. That’s right, the crypto bull run of this cycle didn’t even start yet. As a matter of fact, that implies a further drop in #Bitcoin dominance followed by a period of sideways consolidation, something we haven’t seen yet.

Now, let’s take a look at how #altcoins behave during a true crypto bull run. As you can see in the second chart below, a sharp drop in #Bitcoin dominance coincides with a massive spike in total #altcoins market capitalization (the index tracks all crypto market cap excluding the top 10 ones) EVERY SINGLE TIME. Why? This is actually an investor’s psychological reaction paired with the law of diminishing returns. After someone enjoys 100%, 200%, or more in gains, it is instinctive for the most to take some money off the table. However, humans are greedy by nature and no one would be truly eager to just sit on cash or T-bills at 0% to 5% returns. Due to “recency bias”, investors that enjoy big gains on investment do expect to enjoy the same replicating the strategy that just worked out very well for them. In our case, you will start seeing investors, especially “crypto native” ones repositioning part of their assets from #Bitcoin to #altcoins that do offer the chance of replicating 100%+ returns in the short term having been left behind till then.

Hold on a second, then why did #altcoins market cap go up even if we just said the crypto bull run of this cycle didn’t start yet? Central banks’ money printing and governments’ deficit spending my friend…

At this point, let’s compare #Bitcoin and #Altcoins market cap looking at #Altcoins dominance to have the full picture of all we discussed so far.

I believe now there is no more doubt left on the kind of opportunity that lies ahead of us.

It’s now time to bring in the investors’ psychology component into the picture. Nowadays more than ever, investors want to get rich quickly, particularly retail ones that see #inflation eroding their wealth significantly every day. This has led to an explosion of retail trading not just in #stocks like all previous bubble times but in very short-dated stock options too with #0DTE gambling reaching almost 50% of the total flows in a single day. Do you think that because semiconductor stocks like #Nvidia or #SMCI are now losing their appeal, investors will stop looking for other ways to notch life-changing gains in a very short time? Of course not, gambling after all is an addiction.

Many of those still sitting on fat gains from the latest stock market (insane) mania are already looking around for other opportunities to reposition their bets. Do you think they will move into #Bitcoin when its price already enjoyed an incredible bull run since October last year till reaching new all-time highs a few weeks ago? Of course not. However, this won’t mean #Bitcoin will stop heading higher and the reason is the #Bitcoin ETF turned it into an asset class now easily accessible by institutional investors that will gradually reallocate a portion of their portfolios through time. Think about this, with total assets under management expected to hit 145T$ worldwide by 2025 (PWC Report), if 1% of those will be allocated to #Bitcoin that alone will imply 1.45T$ of new money inflow into #Bitcoin. Trust me, this is going to happen, and still, that will imply a total market capitalization for #Bitcoin still at a fraction of other “staple” portfolio allocation asset classes like #gold (today at ~16T$ market cap).

As I said at the very beginning of this article, this crypto bull cycle will be very different compared to other ones because the #Bitcoin ETF effectively allows for a smooth flow of fiat money in the crypto ecosystem, something that was never available before.

With all this flood of money entering crypto, potentially made higher by investors drifting away from Mag 7 #stocks and mania semiconductor ones, the dry powder available to ignite the next #altcoins season is simply mind-blowing.

Because most of the #Altcoins trade at a very low market capitalization, their payoff potential doesn’t look very different from the ones made available by stock options. This is yet another aspect that wasn’t present at all in previous crypto bull cycles and it won’t take long for retail investors to figure out that trading #altcoins is pretty much equivalent to trading stock options. Naturally, you will start seeing new narratives surfacing, all needed to justify the upcoming mania in this space, in particular focusing of super low cap #altcoins currently trading at ~100M$ market capitalization or below. However, I expect something different this time, people won’t be fond of #meme coins because that “degens” type of investing wouldn’t fit the mindset of many people who think about themselves as “investors” (while in reality they are just gamblers).

#Defi projects, protocols, and decentralized exchanges are those tokens I expect people to #FOMO into because their use cases, even if sometimes far-fetched, do still allow for a strong narrative to be built and grow. Like in the DotCom bubble, more than 90% of these projects will be worthless in a few years, but I don’t expect anyone to care about it since nowadays no one likes to do a lot of homework anymore and cherry-pick investments that will require years to mature and start generating real value. Furthermore, once everything crashes down, it will be easier to pick up diamonds from the rubble… if you have cash available to do so at that time.

Cool content,Sir.

Would you mind to elaporate about how to identify valuable alts compared to the gigantic pile of shit out there.

I find that almost impossible to do.

Are there markers or something like that?

Thanks.

Hi sir, I addressed this already in this article few months ago: VALUE INVESTING ON CRYPTO BLOCKCHAIN PROJECTS (https://justdario.com/2023/12/value-investing-on-crypto-blockchain-projects-part-1-2/). If still doesn’t help enough please let me know and I will be happy to follow up. Cheers