Earlier this year in “WHY A BITCOIN ETF WILL REMOVE THE BARRIER BETWEEN CENTRAL BANKS’ MONEY PRINTING AND CRYPTO” we saw a great leap forward being taken toward the fungibility of the crypto and Fiat ecosystems. Was the SEC on board with it? Of course, it wasn’t, and not because of regulatory reasons, but clearly because of political ones.

After “losing face”, as it is very common to say in Asia in these kinds of situations, Gary Gensler and his SEC minions doubled down on their crusade against crypto. They might have lost the Bitcoin spot ETF battle, but they had no intention of losing the war against crypto. Was this a fair stance? I am afraid not, why? Isn’t every single argument that the SEC put forward as a reason to antagonize the adoption of crypto a customary element of nowadays’ global financial system? Paradoxically, wasn’t the SEC and fellow regulators’ lack of oversight what fostered the current global financial system environment we addressed before in “THE SEC IS NOW THE GATEKEEPER OF AN ASYLUM WITH A NUCLEAR REACTOR AT ITS CENTER”?

The SEC claimed that the current infrastructure and mechanisms in place for Ethereum did not allow them to guarantee a high enough level of investor protection and oversight against potential market manipulation.

Please explain to me one thing, on one side the SEC is comfortable in approving triple leveraged hyper-structured retail ETFs that no one knows what the hell they really are, but a spot Ethereum ETF would not have allowed them to sleep at night because of all the dangers they exposed retail investors to? What a joke.

The truth is that the SEC is not an impartial regulator anymore, but a pawn on a larger political chessboard, and clearly they were acting to defend interests that had nothing to do with all the ridiculous excuses they raised during the years. This is why what happened last week is a much bigger deal than anyone is still figuring out.

The approval of the Ethereum ETF is indeed a massive political shift in the US, likely both Democrats and Republicans figured out cryptocurrencies and the blockchain technology, like the internet about 20 years ago, is a revolution they cannot stop so it’s better to get along with it in an effort to gain some degree of control and make sure it doesn’t disrupt critical pillars of the current dysfunctional economic system, in particular, “fiat money”.

Now, tell me, what happens to any sector or industry that in a fortnight gains such a massive amount of political support? Yes, money will start flowing in… big time.

What happens when a lot of fiat money is being printed out of thin air in the global system at the same time as what I described above is happening? Prices MEASURED IN FIAT MONEY will inevitably rise.

Like it or not, Ethereum is still to this day the bedrock of the entire cryptocurrency ecosystem. As of today, a significant majority of crypto projects, protocols, and Layer 2 (like Polygon, Arbitrum, and Optimism) solutions are built on Ethereum or are Ethereum Virtual Machine (EVM) compatible. Ethereum remains the dominant platform for decentralized applications (dApps), hosting over 4,000 dApps and more than 53 million smart contracts (Full guide to the Ethereum ecosystem here).

So, unlike Bitcoin which like #gold is in a league of its own, Ethereum is in reality an infrastructure play. I already highlighted before how the conditions of an incredible altcoins season were already in place (“THE NEXT CRYPTO ALTCOINS SEASON WILL BE A SPECTACULAR DISPLAY OF FOMO”), but this development is equivalent to injecting Red Bull into the veins of a whole asset class that is strictly intertwined with Ethereum.

What about Solana, Ripple, and all other non-Ethereum projects? I have no doubts anymore, you will all enjoy the moment of a spot ETF being approved for each one of them in the future. It’s very hard to stop a train of this magnitude once it has left the station.

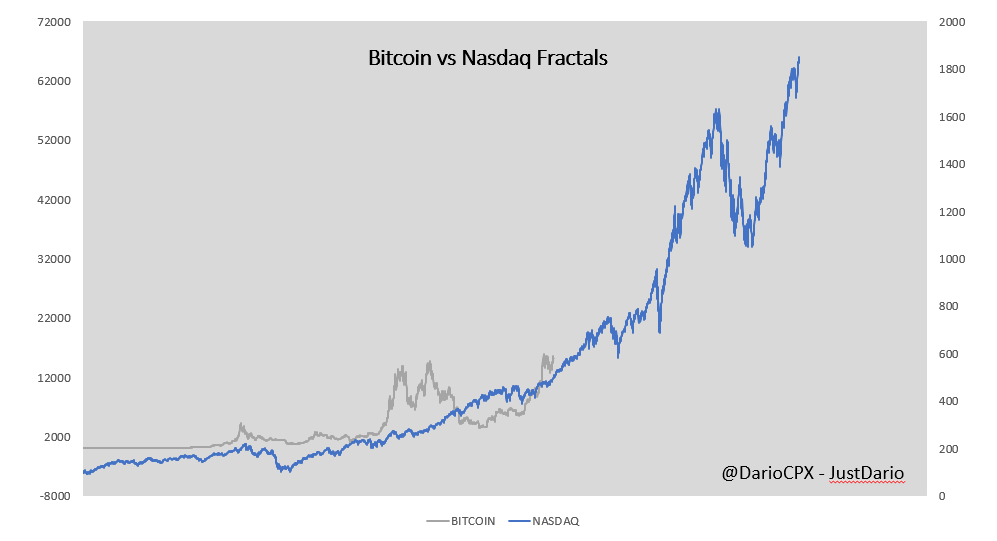

To conclude, what is going to be the end game of all I described? If you believe like me that crypto and blockchain will become part of our daily lives like the internet did 20 years ago, then this chart is the best proxy of what to expect.