Yes, quantitative easing is what just happened under everyone’s nose. The #JPY interventions of this past week effectively injected about 100 billion #USD into the global financial system that previously was not circulating. Why? Because #Japan MOF selling reserves to fetch #USD that can then be sold in the market to buy #JPY are effectively putting those #USD in the market that now have to be put to use by the financial players who saw them landing in their books. A small part of these will be lent, although in the current environment with banks having significant capital constraints and bankruptcies picking up across the globe, don’t expect much flow in this direction.

What I expect is that most of this liquidity will end up supporting the whole derivatives complex I talked about before in “MR. MARKET HAS BEEN FULLY REPLACED BY MR. DERIVATIVES – OH MAMMA MIA!“. This new flood of liquidity will effectively allow banks and brokers to keep their positions in place and eventually open new ones with an implied leverage inherent in the derivatives space. Where is the heaviest derivatives flow at the moment? Not in credit where the CDS market is down to ridiculously low volumes, but in the equity market where there will be more room to support and incrementally grow the currently giant delta hedging built up in the space.

Does this mean #stocks will resume their run-up in hot markets like #US and #Europe? Maybe, and I say maybe because at the same time, there is a clear shift in sentiment where many institutional players are shifting more and more towards defensive portfolio allocations trying to trim their leveraged exposure. What is fair to expect here is a sideways price action for a while till the next macro event is going to hit and likely this will ultimately be a credit event. Why? Because interest rates, despite this new flood of QE, will keep rising.

On one front #Japan is indeed selling its reserves putting pressure on yields, while this new flood of dollars will contribute to reigniting inflation the more it trickles down in the system like we saw last year when the same happened in October and brought us where we are today (#inflation heating up again and #FED rate cuts almost being taken out of consideration because of #inflation pressures). As if this was not enough, as I described a few days ago in “WHY ILLEGAL IMMIGRATION IS VERY INFLATIONARY AND IF THE FED DOES NOT HIKE RATES NOW INFLATION WILL BE HOT RIGHT BEFORE THE US ELECTIONS IN NOVEMBER“, US Treasury QRA came higher than expected because of lower tax revenues than originally estimated. With the US having no alternatives to issuing more bonds while the deficit is going to widen even faster, the pressure on yields to go higher will also increase.

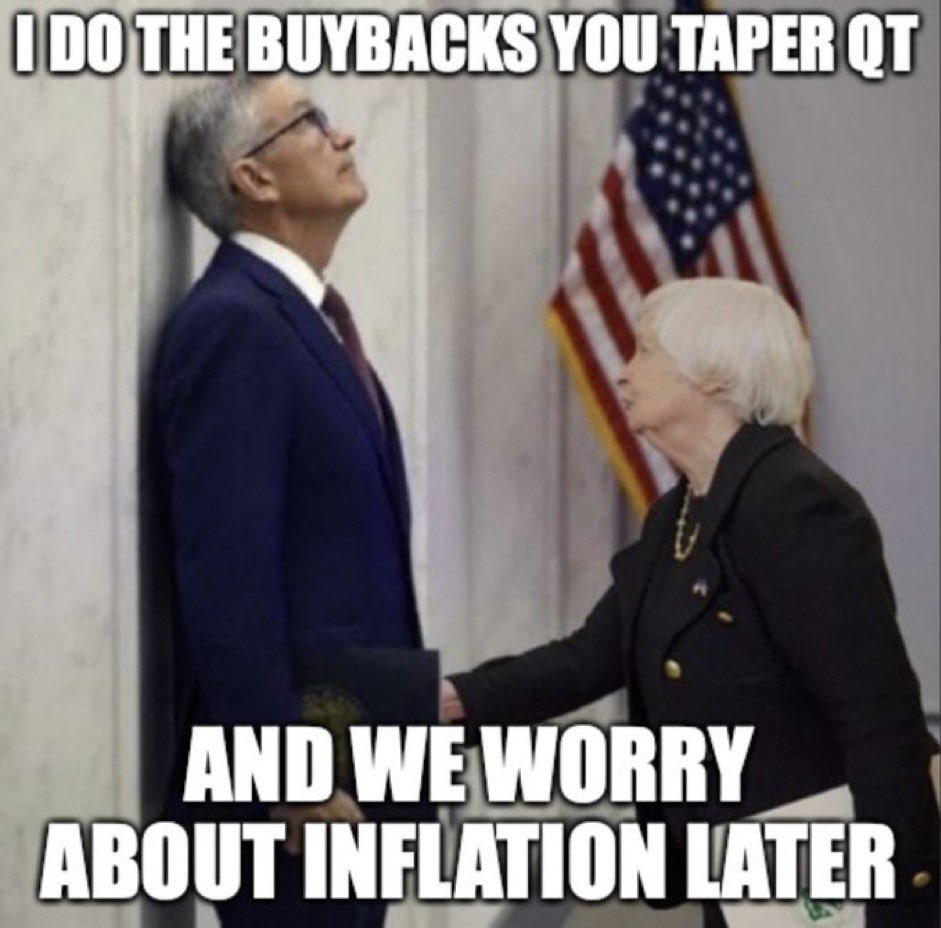

Jerome Burns in the latest #FOMC a few hours ago announced the #FED will begin to slow down on QT to 25bn$ a month, but intuitively this is going to result in little to almost no relief for the overall yields spectrum.

What is going to happen the more yields go up inevitably? Depreciating pressures on the #JPY will increase making any additional intervention more and more futile. Eventually, I do not even exclude a panic #BOJ move where they will be forced to hike rates, however as explained in “WHY A HISTORICAL $JPY CURRENCY CRISIS IS AT THE DOORSTEP OF #JAPAN” this move at best will provide a short term brief relief since eventually the #BOJ will be forced to print even more #JPY to monetize the larger amount of #JGB issuances because of increasing cost of debt.

Within this set up, the US Treasury buyback plans are totally useless. Effectively the US Treasury will have to issue more debt first, at higher rates, to then buy back debt issued at lower rates and currently trading below 100% (in some cases far below 100%). So while this is a zero-sum game per se and will even increase yield pressures on US Treasuries in the long run because of the increasing cost of debt, we might even see this buyback program effectively failing right from the beginning since it will be hard for banks and investors to digest the capital losses they will face in case they decide to sell US Treasuries, currently marked at 100% in their “Hold to Maturity” books, for a value far below the nominal one they paid at the very beginning.

Paradoxically these latest developments will contribute to exacerbating all the dynamics that Central Banks tried all they could to avoid from a macro perspective.

Increasing yields per se will also increase the chance of a credit event materializing due to all the zombie companies out there trying to refinance their debt this year and early next year. Yes, what a mess right?

In the meantime all I described unfolds, no one should be surprised if a portion of this last burst of QE delivered by the #BOJ will trickle into the #crypto space contributing to the last #FOMO of the cycle I described in “THE NEXT CRYPTO ALTCOINS SEASON WILL BE A SPECTACULAR DISPLAY OF FOMO“.

Personally speaking, I see this whole house of cards to be under significant pressure just right before US elections, similar to 2008, but differently from the #GFC Central Banks now carrying massively inflating balance sheets will have little to no room to print problems away from the system setting up the stage for a long overdue reckoning of years of reckless monetary and fiscal policies.