3 months ago in “NVIDIA, ITS RECYCLED “#AI REVOLUTION” AND THE DARK SIDE OF IT KEPT AWAY FROM THE PUBLIC”, we already saw how the “#AI Revolution” was a PR campaign #NVIDIA tried to push already several times in the past without success. #OpenAI, a company founded on the 11th of December 2015 by Sam Altman, Greg Brockman, Elon Musk, Jessica Livingston, Peter Thiel, Microsoft, AWS, Infosys, and YC Research, had as a main goal to develop #AI as a non-profit endeavor for the benefit of humanity. Yes “non-profit”, what an aberration!

There is a name from the list above I would like you to focus on: #Microsoft

What’s wrong with them? “OpenAI has received just a fraction of Microsoft’s $10 billion investment”

So what exactly did Microsoft do? Putting aside the very misleading PR campaign, which is supposed to be illegal behavior but who cares nowadays, Microsoft invested ~1bn$ in #OpenAI while the rest were “credits” to use Azure servers… meant to be built upon NVIDIA GPUs since that was how #OpenAI technology was being developed since the 2012 breakthrough: “ImageNet Classification with Deep Convolutional Neural Networks”

Fun fact, this #Microsoft master plan isn’t even a mystery since the company itself made a press release in 2019 about it: “OpenAI forms exclusive computing partnership with Microsoft to build new Azure AI supercomputing technologies”

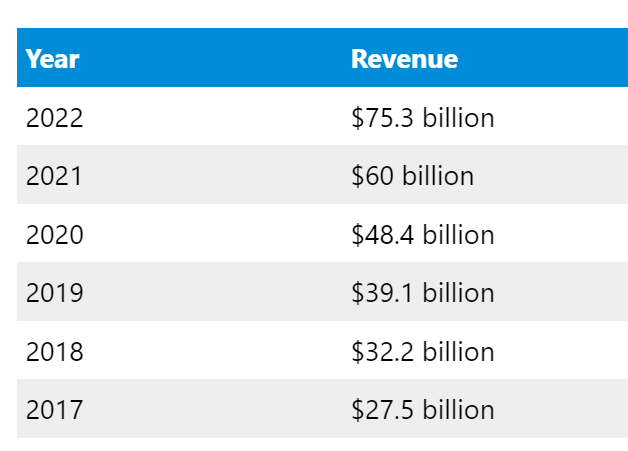

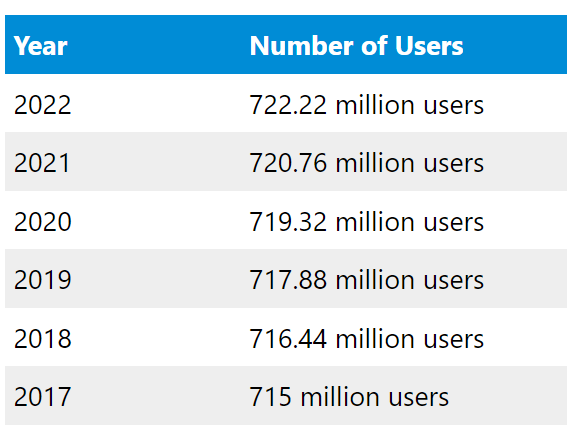

Putting things into another perspective, #OpenAI was simply the Trojan horse to inflate Microsoft Azure revenues. Wait, what? Please have a look at the 2 tables below from the article “Microsoft Azure Revenue and Growth Statistics (2024)”

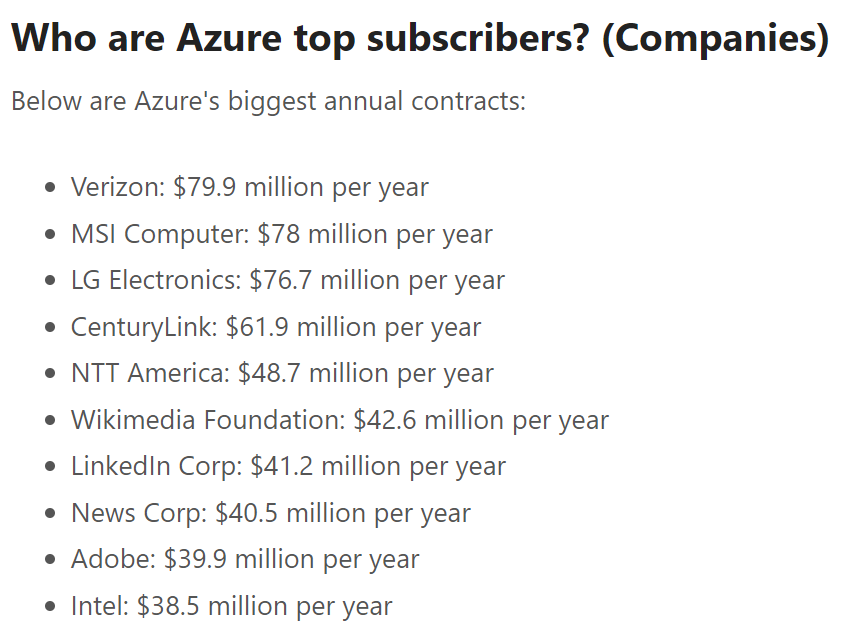

Do you notice anything strange? Yes, I bet you do, the number of users only grew by ONE percent between 2017 and 2022 while Azure revenues grew by 273%. Did companies really spend three times more for cloud services in the same period of time? Let’s have a look at that starting from the list of the biggest annual contracts with Azure.

I checked all the names above and their cloud computing expenses are so minimal that they are not shown separately in their financial statements, however, all these companies either spent a similar amount of money in operating expenses through the years or in many cases, this cost decreased. So we cannot answer the question above, however, it is pretty strange to increase revenues by that much while maintaining the same number of clients, isn’t it?

However, what we can definitely say with certainty is, that there is no chance #OpenAI will ever be capable of spending ~9bn$ of Azure credit in any realistic future when the biggest Azure client pays Microsoft less than ~100m$ a year. Even assuming #OpenAI spends DOUBLE every year than a humongous company like Verizon, it will still take FORTY-FIVE YEARS to go through all those #Microsoft Azure credits! I mean, when Intel spends less than 40m$ a year how realistic is any of the above? I will leave this question open for today.

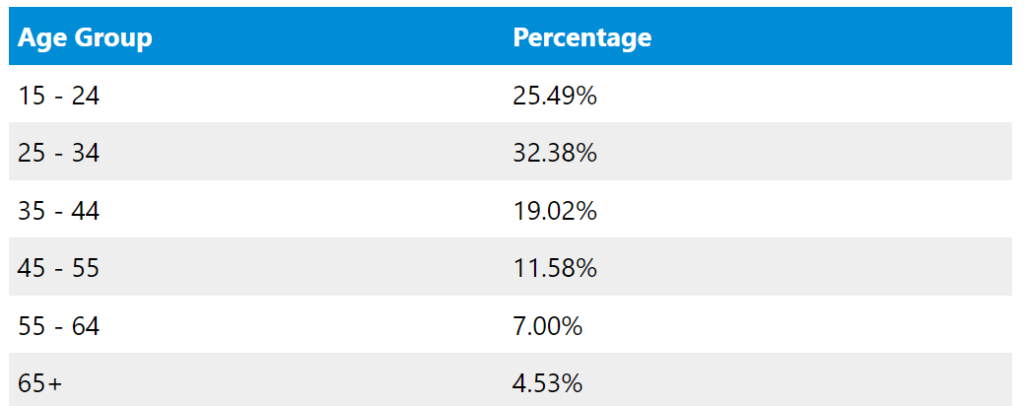

There is another very strange thing I noticed about Azure, as you can see from the table below, according to the statistics 25.5% of the users are in the 15-24 years old age group. Hold on a second, aren’t those people in school or university? Yes. Would those people, or the institutions where they study pay for Azure by any stretch of the imagination? If anything, very little. If you add people 65 years old or older then 30% of total Azure users are not in the workforce.

So, there is very little chance that 30% of Azure “customers” pay any meaningful bill to #Microsoft, this means that the average return per user of Azure (ARPU) in 2022 was… 148.5$. And let’s be clear this puts the likes of Verizon and a 15-year-old kid at the same level……..

Is it only me or do those numbers not make sense at all?

So this is, in my opinion, what’s going on. #Microsoft is so obviously inflating its Azure revenues, by how much is hard to say but by the look of it seems quite a lot. Because of this, the company needs to keep building servers across the globe even if, with a high chance, there is minimal use for most of them. This wasn’t enough though, Azure needed “real” customers with a virtually big price tag, and here is when #OpenAI comes in handy to justify its business line growth. The problem here is, as it is very obvious in the case of #OpenAI 9bn$ of “credits”, those revenues are not real ones but a simple accounting trick!

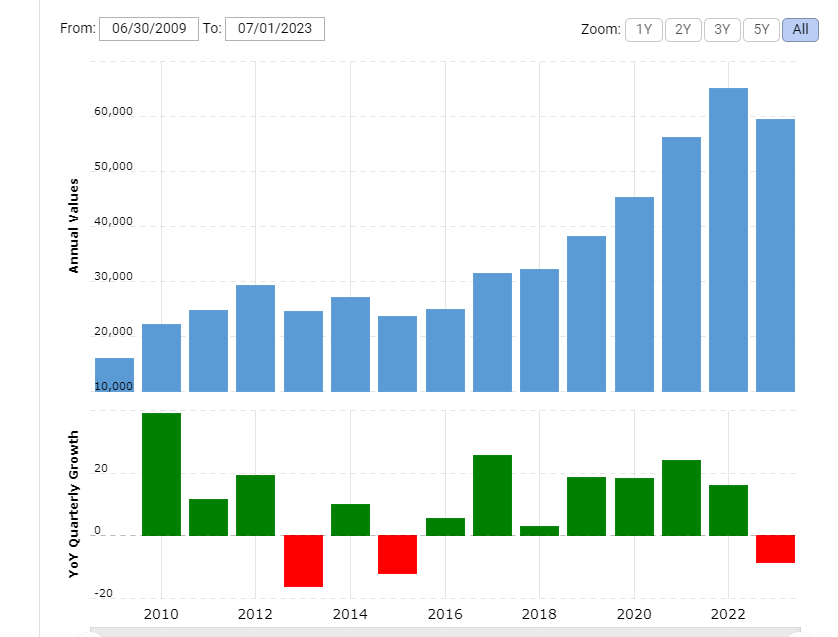

What happens when the growth in revenues comes from growth in “virtual” revenues and not from “real” ones paid in cash? The company’s Free Cash Flow growth becomes negative even if revenues keep growing. What happened to Microsoft’s latest annual FCF growth? Here you go..

What are the chances that Nvidia figured this out and tagged along with a scheme that #Microsoft spearheaded and has been imitated in different shapes or forms by other US Tech Mega Cap companies? What are the chances that after saturating its top customers (META, AMZN, MSFT, and GOOG) the company kept creating fake buyers like Coreweave and inflating its revenues stretching the limits of customer financing in some cases beyond what’s legal? I will leave these questions too open.