Bank of America (#BAC) published its last quarterly financial earnings on July 16, and from the 17th to the 19th, Warren Buffett sold ~34m shares of BAC, cashing out ~1.5bn USD (Buffett’s Berkshire Sells Bank of America Stock Worth $1.5 Billion). Yes, Uncle Warren still holds almost 1 billion BAC shares, and assuming he keeps trimming his stake at this pace, it will take him about 20 trading weeks to complete the sale. However, considering he bought BAC shares at an average price of ~25.9$, I would not be shocked at all to see him accelerating the sale and closing this position as soon as possible before the buffer he has evaporates. Why so? Despite the efforts to hide all its troubles, if BAC conditions are deteriorating already so much from what can be observed from the outside, I cannot even imagine what the picture looks like from an insider perspective like Warren’s.

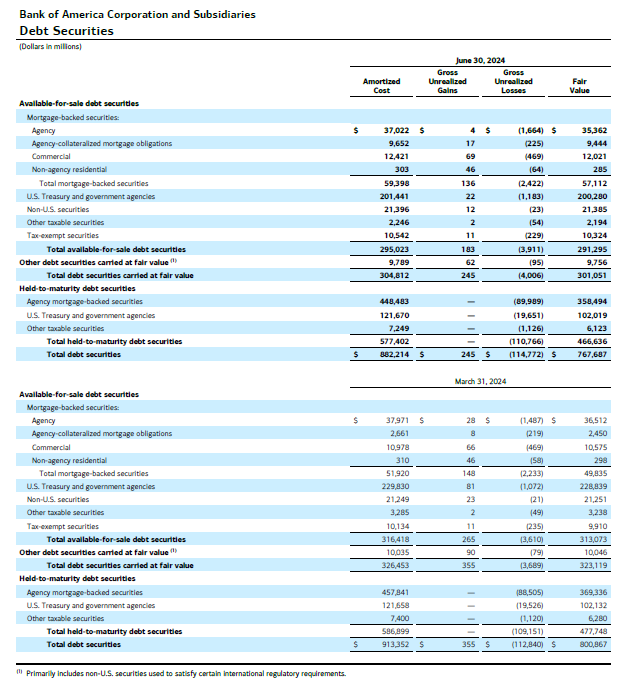

🚩 DEBT SECURITY “PAPER LOSSES” INCREASED TO ~114.8bn$ EVEN IF BAC TRIMMED ITS ASSETS

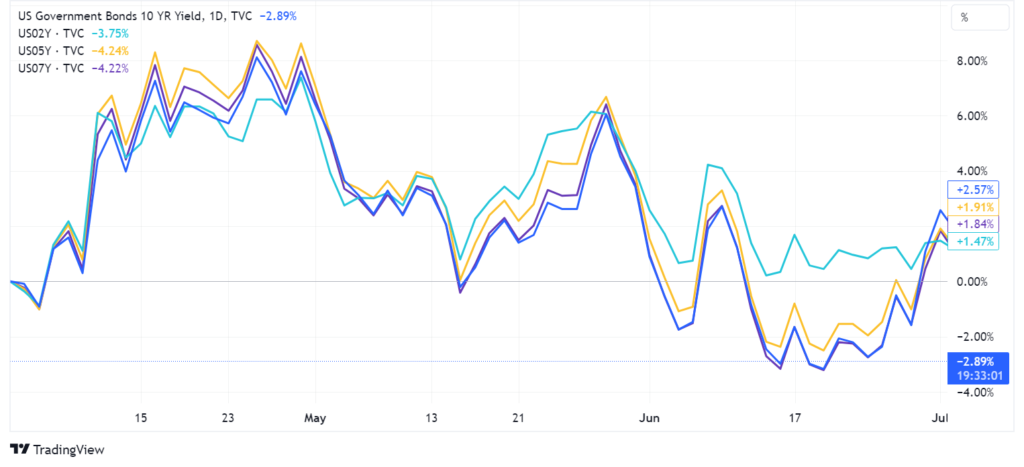

During the second quarter, US rates just moved slightly higher across the board as you can see from the chart below, so it should not come as a surprise that BAC “paper losses” on its Debt Securities book increased from 112.8bn$ to 114.7bn$, right?

Let’s look at the numbers a bit closer:

- BAC Agency MBS holdings DECREASED from 457.8bn$ to 448.5bn$ in the last quarter, however, the “paper losses” in the book INCREASED from ~88.5bn$ to ~90bn$. This means that losses on principal increased from 19.33% to 20%.

- BAC US Treasury holdings remained stable at ~121.6bn$, carrying ~19.6bn$ of MTM losses, equivalent to ~16% losses on the principal.

- If you compare the 2 points above, it is pretty intuitive how the value of BAC Agency MBS holdings is deteriorating beyond what the move in rates would have implied. Please bear this in mind.

🚩 BAC NON-AGENCY GUARANTEED REAL ESTATE PORTFOLIO IS WORTH MUCH MORE THAN THE ONE SECURED BY THE US GOVERNMENT

I wish I was joking, but unfortunately, I am not. 7 months ago, when I wrote “BANK OF AMERICA WENT “CRAZY” IN Q4 (LITERALLY)” I highlighted how BAC saw no meaningful risk in the credit market, especially in the Real Estate one (both Residential and Commercial).

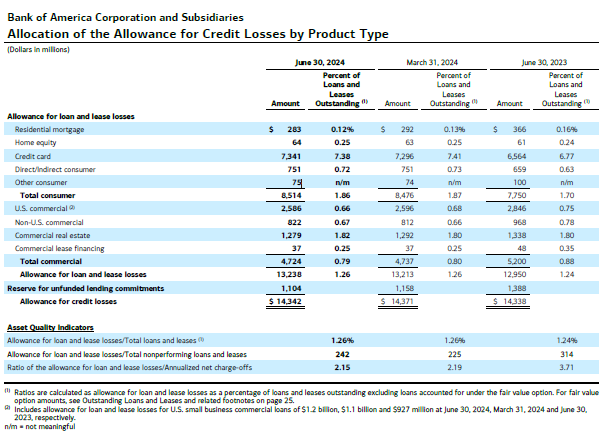

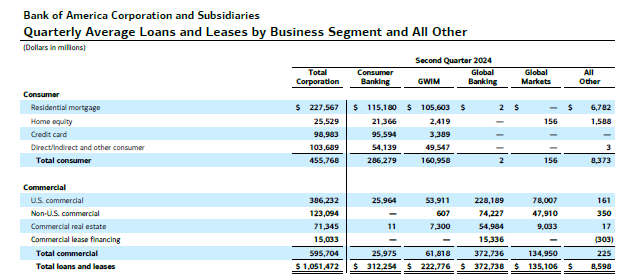

Please have a look at the tables below outlining BAC Allowance for Credit Losses by product type and the total amount of assets per category

So, while BAC is carrying a 20% Mark to Market “paper loss” on its Agency MBS holdings (that are government-guaranteed):

- BAC’s ACL for Residential Real Estate Mortgages is 0.12% against 227.5bn$ of assets

- BAC’s ACL for Commercial Real Estate Mortgages is 1.82% against 71.3bn$ of assets

What if we applied the same “Mark to Market” across all BAC Real Estate exposures, bearing in mind it will still be an underestimation since the government guarantee won’t apply to all?

- BAC Agency MBS: ~90bn$ of “Paper Losses”

- BAC Residential Real Estate Mortgages: ~45.5bn$ of “Paper Losses”

- BAC Commercial Real Estate Mortgages: ~14.3bn$ of “Paper Losses”

TOTAL: 149.76BN$

How much is BAC’s total tangible common shareholders’ equity? 194.5bn$ 🚨

I know, shocking, right? And there are two big things I have not even started to touch upon yet:

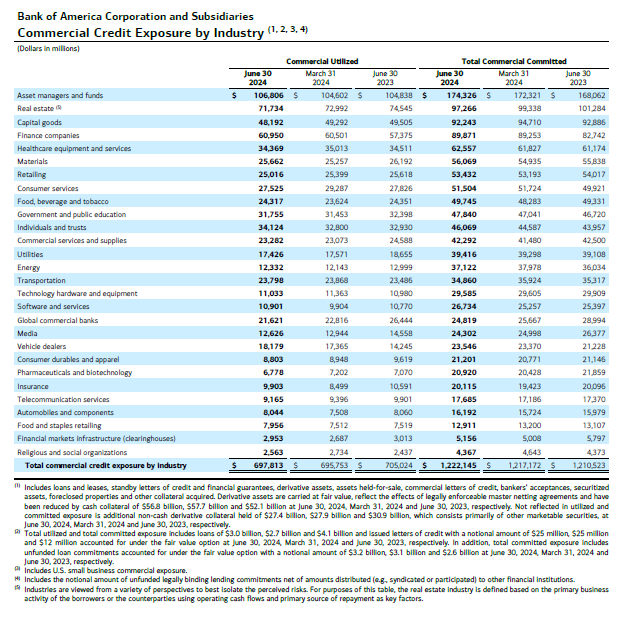

- Real Estate is not even BAC’s biggest commercial credit exposure, but Asset Managers, Hedge Funds, and Private Equities are

- BAC Consumer Lending losses are starting to pile up with Credit Cards ACL already equivalent to 7.38% of the total exposure the bank carries

- On top of the ~700bn$ of Assets BAC has already deployed, BAC is already committed to lending ~500bn$ more on top, and as we saw in March 2020, this can happen on short notice if things turn ugly in the market. How can BAC meet these commitments without selling deep underwater assets and turning “paper losses” into “real losses”? You tell me.

I believe at this point it is easy to understand why Warren Buffett started trimming his BAC stake. To be fair, it is arguable BAC is still solvent.