On 14 October 2008, the BOJ entered the bailout arena in full force with its “Introduction of Measures regarding Money Market Operations to Ensure Stability in Financial Markets.” Among the four “temporary” initiatives announced, the last one was the most crucial one… and remains the most crucial one today.

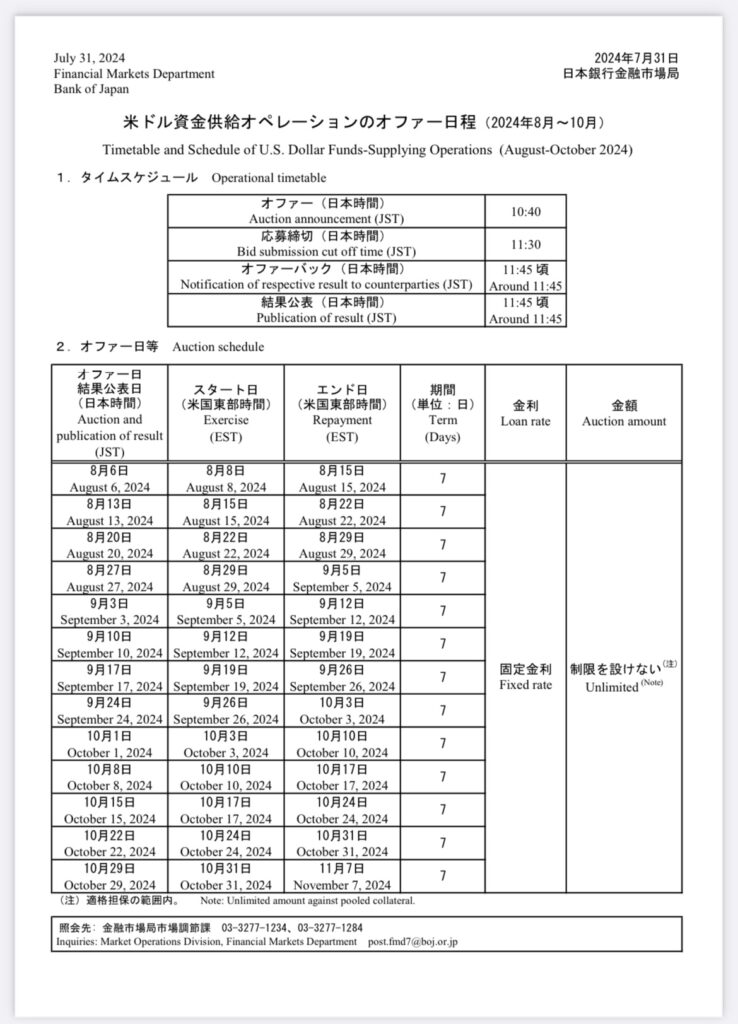

“Expansion of U.S. dollar funds-supplying operations against pooled collateral

The Bank will, based on Further Measures to Improve Liquidity in Short-Term U.S. Dollar Funding Markets announced on October 13, introduce U.S. dollar funds-supplying operations whereby funds are provided at a fixed rate set for each operation for an unlimited amount against pooled collateral.”

Why did the BOJ need to lend USD in the market against collateral at that time? Norinchukin and another bunch of technically insolvent Japanese institutions were on the verge of collapsing due to their mounting liquidity issues in foreign currency (Echoes of 2009 Crisis Thrust Japanese Bank Norinchukin Back Into Spotlight).

Is it different this time? Paraphrasing a very common slang in Asia, this time things are “same same but different.” It means the situation is similar, but not identical. What’s the difference? Its size (much larger) and ramifications (much, much wider) as previously discussed in “NOT ONLY IS NORINCHUKIN ABOUT TO LIVE THROUGH THE 2008 NIGHTMARE AGAIN, BUT MANY JAPANESE BANKS ARE IN THE SAME SITUATION,” an article written long before last Monday’s events.

Things are so ridiculously worse this time that, because the banks carry too many radioactive assets, the BOJ lends them JGB first, and then the banks pledge the very same JGB back to the BOJ so they can borrow USD. Wait, what? How can this be even possible? I know it’s shocking, but if you don’t believe me, you are free to check directly on the BOJ website in “Outline of Transactions for the Securities Lending to Provide Japanese Government Securities as Collateral for the U.S. Dollar Funds-Supplying Operations.”

How often does this happen? EVERY SINGLE WEEK, and it’s so critical that the BOJ even releases a fixed schedule in advance so banks don’t freak out.

How big are these operations? Unfortunately, the BOJ doesn’t disclose the amounts, but we can gauge them from its balance sheet figures. The latest one, released on 2 August and related to 31 July, disclosed an amount equivalent to 28,989,000,000,000 JPY or 197 billion USD. Yes, my dear readers, an already shockingly high number, and that was BEFORE last Monday’s events.

Let’s take a look at these amounts over time, shall we?

- 31 July: 28,989,000,000,000 JPY

- 20 July: 28,988,800,000,000 JPY

- 10 July: 25,192,500,000,000 JPY

- 30 June: 25,192,500,000,000 JPY

- 20 June: 25,192,600,000,000 JPY

- 10 June: 25,107,900,000,000 JPY

- 31 May: 25,107,900,000,000 JPY

- 20 May: 25,088,000,000,000 JPY

- 10 May: 25,043,000,000,000 JPY

- 30 April: 25,094,000,000,000 JPY

- 20 April: 25,094,000,000,000 JPY

- 10 April: 25,192,500,000,000 JPY

This is all the BOJ discloses, and just to give you a comparison figure, at the peak of the 2008 GFC the total amount of extraordinary support measures put in place by the BOJ peaked at 12 Trillion JPY.

I bet your thoughts are swirling already

Furthermore, as you can see from the balances of Japan’s monetary reserves here, the BOJ held 158.679bn$ of “deposits,” hence “cash,” which is effectively all the available USD (assuming they are all USD) the BOJ can lend to banks against pooled collateral.

Hold on a second, how is it possible that the BOJ reports an amount of cash in its monetary reserves while the very same is being lent out to banks (the higher amount likely related to special loans granted in JPY)? Accounting magic. What I think is happening here is that the cash declared only stays briefly with the BIS just in time to take a snapshot, and one second later, it is injected back into the system to keep it afloat. Not surprisingly, the BOJ releases its figures only every 10 days and NEVER at the same time as the reporting of the foreign reserves.

We don’t yet know the updated figures, but no one should be shocked to see the total number of “special operations” increasing even more. However, it is very clear to any observer that the BOJ is almost running out of room to keep the whole system standing, which is why we all hear that “tic toc, tic toc” sound in the background. When are we going to know when they ultimately run out of available USD to lend? When the swap lines with the FED will be reactivated, so keep an eye on that. When will the breaking point be reached? When the BOJ is forced to sell US Treasuries and bills not to intervene in the FX but to lend them to its domestic financial system. But we all know Janet Yellen won’t allow that to happen, and it’s obvious what the consequence of that will be.

Tic toc… tic toc…