The past week has been incredibly interesting, to say the least. For the first time since the 2020 COVID crisis, we saw the FED Standing Repo Facility being tapped for a significant size by at least one bank (IF “EVERYTHING IS AWESOME” WHY THERE IS AT LEAST ONE LARGE BANK THAT COULDN’T FIND LIQUIDITY IN THE OPEN MARKET AND NEEDED IT FROM THE FED?) and then about 24 hours later, despite no MSM reporting the news and some prominent financial plumbing “furus” of the Twitterspace rushing to dismiss the importance of the event (after all they are “furus”), this happened: Bank of America customers report account outages, some seeing balances of $0.

As you know, I never have and will not start now to believe in coincidences or events labeled as “glitches” when mainstream journalism needs to write something about it without having any clue about the same. Personally speaking, and familiar with how the banking system works, this is my guess on what truly happened inside Bank of America (shared promptly here):

“Personally I don’t think it was an IT system issue otherwise the whole of it was supposed to show zero balances not only deposits. By the description of the events, it looks like something went wrong with the broadcasting of deposit balances specifically. This is weird since it’s supposed to be from an accounting ledger within the bank not attached to an external provider.

It’s a bit far-fetched what I am about to say, but if that ledger went to zero not for a system problem the only way that could happen is the bank having a peak of cash outflows so to stop that the plug was pulled from everyone so they couldn’t withdraw their deposits till they fetched the cash to fill the shortage”

A very similar event happened again in the UK a few days later last week: NatWest, RBS and Ulster Bank all down as Brits unable to access money with mobile banking. Two coincidences start to be a little bit too many, right? Well, here you have a third one that happened just one month ago in the UK: Multiple UK banks hit by app outage spikes. Enough? No, because the same happened even before at the end of June again in the UK: HSBC, Barclays, Lloyds, and Nationwide banking apps saw outages affecting millions. Do you still believe all these are coincidences? Apparently, the UK regulator was already aware on the 25th of April that something was wrong: UK High Street Banks Fail Tests on App and Online Security.

Now, if all those events above in the UK were a coincidence, then how do you explain this action by the Bank of England on the 23rd of July (one week prior to the BOJ rate hike that triggered the 5th of August market chaos)? BOE Reveals Design of Emergency Lending Facility for Non-Banks

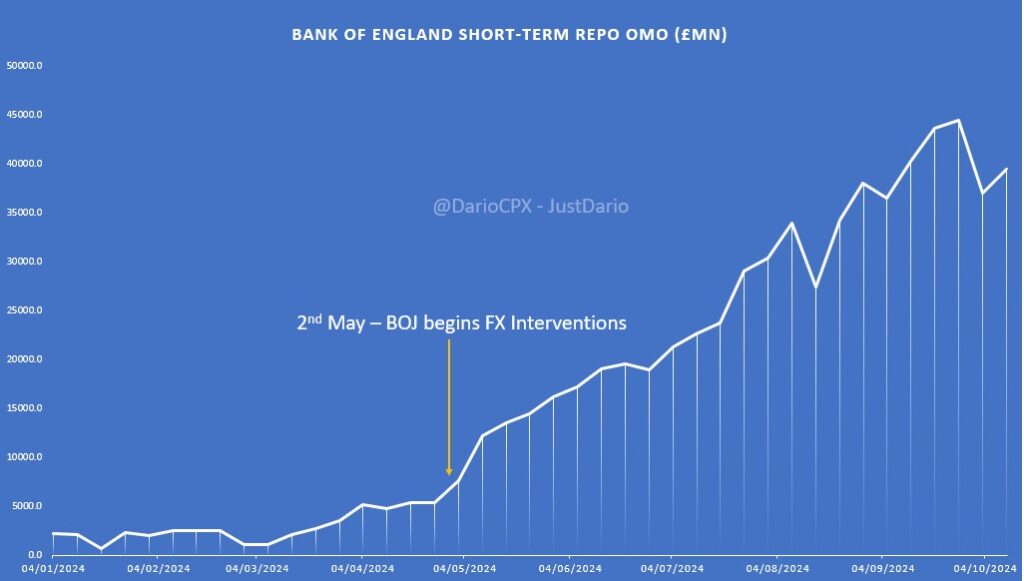

As a matter of fact, since the JPY Carry Trade forced unwinding started to bite, the BOE has been busy injecting liquidity into the system (THE JPY CARRY TRADE IMPLOSION CONTAGION IS ALREADY SPREADING INTO THE UK) with the BOE Short term repo OMO growing from zero to ~40m GBP in a few months till now. All these coincidences and somehow no one sees the link between them still, huh?

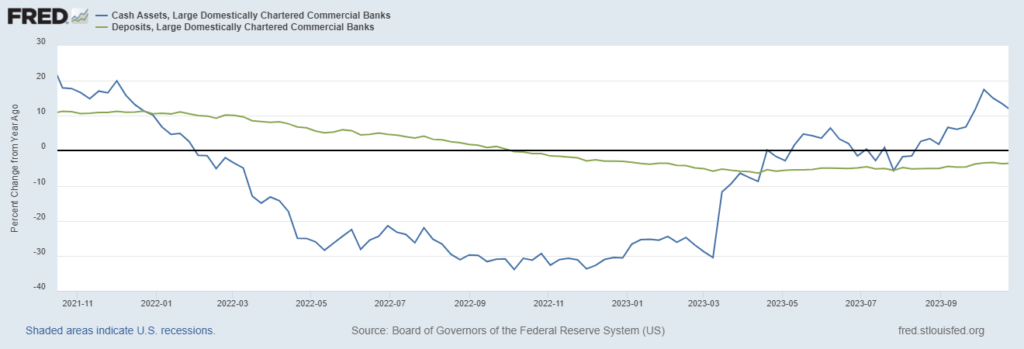

Alright, let me blow your mind now. Please have a look at the chart below from 2022 to 2023 (when the latest banking crisis surfaced in all its beauty). As you can easily notice, while large banks’ deposits only decreased slightly overall (likely the reason why it took a while for the MSM and furus to realize a crisis was brewing), cash held at large US commercial banks part of the Federal Reserve system was collapsing in a clear sign of a liquidity crisis.

You can see the situation started to improve exactly at the moment the FED BTFP became operational, so no, the problems were not only within US regional banks contrary to what all the Central Bankers, Nobel prizes, and public officials were claiming. Credit Suisse’s emergency bailout was another proof of that, but still greatly ignored.

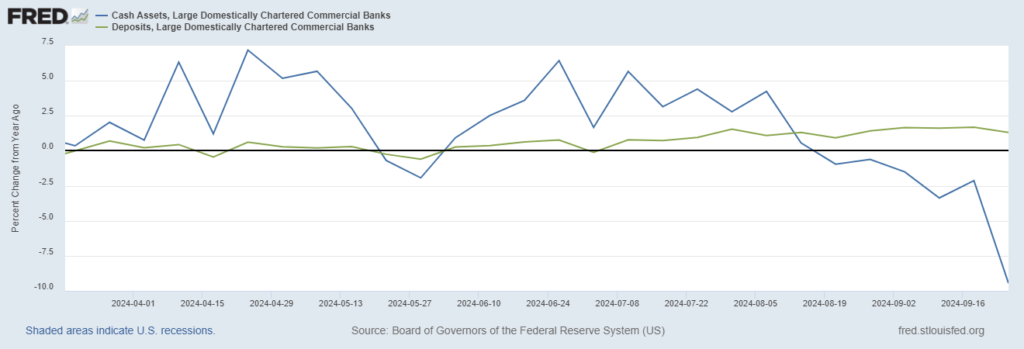

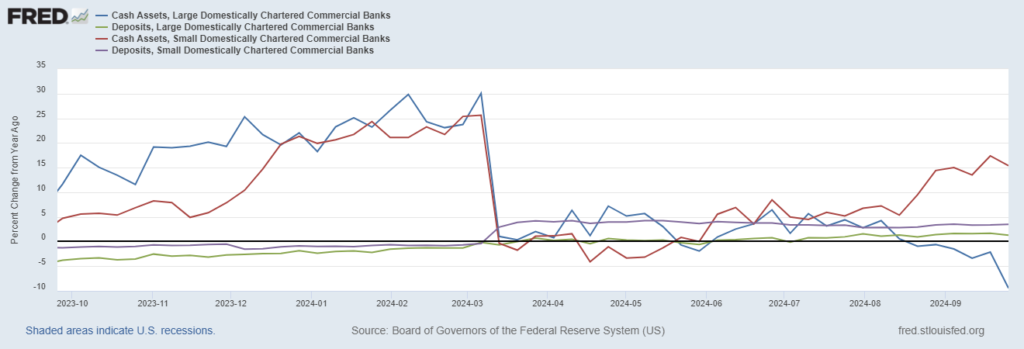

Now, please have a look at what’s happening today despite Jerome Burns just declaring the FED cut rates by 50bp despite everything being awesome in the economy and in the financial system

What’s even more interesting is that Cash is being moved from Large to Small banks in equal proportions even if there has not been a similar shift in deposits. What does this mean? Clearly, customers still trust large banks, but clearly, smaller bank treasurers aren’t trusting them in the same way and are shifting cash back into their books.

At this point, I hope we all agree there are liquidity issues within Large US Banks with Bank of America the number one suspect at the moment. Why? Here is what I warned about two months ago and since then Warren Buffett sold $8bn USD worth of BAC shares and is just 0.1% away from going below the 10% ownership threshold after which he will not be required to inform the market promptly of any further sale (so likely he is going to cut his stake at a faster pace): IS WARREN BUFFETT STARTING TO BE WORRIED ABOUT BANK OF AMERICA’S SOLVENCY?

That Bank of America financial statements did not make any sense was already clear 10 months ago (BANK OF AMERICA WENT “CRAZY” IN Q4 (LITERALLY)), but it has been greatly ignored.

Putting all together, it is undeniable that there are increasing liquidity issues in both the US and the UK, but no worries next Friday when banks start reporting there will be little chance that they will confirm this to the public. Especially Bank of America which is expected to report its Q3-2024 on the 15th of October. Furthermore, we are one month away from US elections so do not expect the SEC or the FED to take any action to tackle this problem because the political embarrassment for the incumbent US administration seeking re-election will significantly undermine their effort to make everything look awesome in both the economy and the financial system. Personally, I do not expect a 2008-style “Lehman moment” before elections either, but there is always a small probability that things go out of control all of a sudden if fears quickly spread among financial institutions. This is obviously an event China already took precautions for: A BIG BANK IS ON LIFE SUPPORT, CHINA KNOWS IT AND IS PREPARING TO WITHSTAND THE SHOCK – IS THIS BULLISH?