Many people have read Benjamin Graham’s “Intelligent Investor” masterpiece, although lately, some might have used the book to light up a barbecue or a bonfire. Personally, I read the book at least once a year since 2007, and often when I am in doubt, I go take a look at a specific chapter or paragraph.

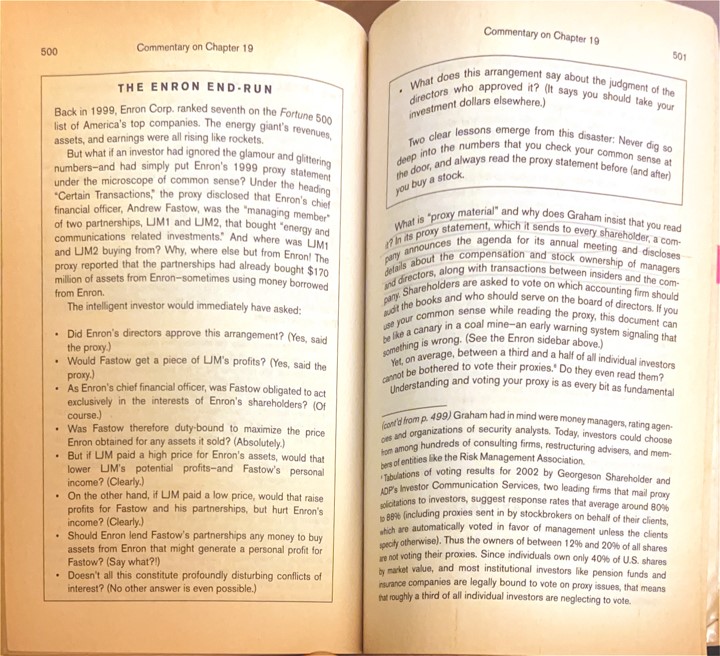

However, the edition I bought includes an appendix added by Jason Zweig, written in 2003 in the aftermath of the DotCom bubble, when people were regretting having used their own copies of the book to light up barbecues or bonfires in the great years of internet irrational exuberance. As you can see in the picture below, with the benefit of hindsight, people realized that if they had paid attention to Enron’s financial disclosures, the shenanigans the company was doing were right there.

I know I am a broken record about this, but if you buy a company share (or more) without having read at least its most recent financial statements (carefully) at least once and made yourself familiar with the business, then you aren’t an “investor” but a trader, a gambler, or perhaps just a sheep. If you have never spent time researching a company and its business, the only person you can blame if things go wrong is yourself.

Hold on a second, then how can it be possible to invest in crypto projects if there are no public financial statements available? First of all, you need to understand two things: the first one is what a “project” is, and the second is what an “instrument” is.

With regard to the first category, I already wrote about it a long time ago in “VALUE INVESTING ON CRYPTO BLOCKCHAIN PROJECTS” and these were the principles I outlined and that I personally use to screen the market and find needles in the crypto barn:

- REVENUE SUSTAINABILITY AND SCALABILITY

- HEALTHY TOKENOMICS

- TRANSPARENCY

- COMPLIANCE

- DEFINED PRODUCT/SERVICE VISION AND CONSTANT INNOVATION

Suppose a project doesn’t share enough documentation and information on all the above and I cannot cross-check the information shared with different sources. In that case, I will simply move forward without compromises.

With regard to the second category, things become more complicated. First of all, what is an “instrument”? Similar to derivatives in traditional finance, there are tokens that possess the very same type of characteristics, hence we can borrow the same valuation methods to understand whether there is any value beyond the dollar price the token trades for. What are these characteristics?

- Underlying Asset or Benchmark

- Price Sensitivity to the Underlying Asset or Benchmark

- No Ownership of the Underlying Asset or Benchmark

- Hedging or Speculation purpose

- Maturity Date or Expiration

- Liquidity and Marketability

- Exposure to Nonlinear Payoffs

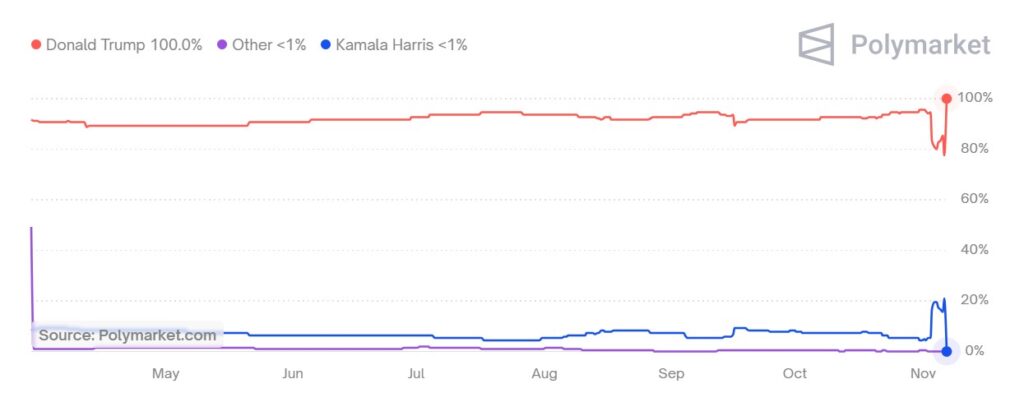

Since it became so popular during the latest US Elections, let’s use Polymarket “trading contracts” as an example:

- Underlying Asset or Benchmark ⇒ Whether the candidate is going to win or not the election

- Price Sensitivity to the Underlying Asset or Benchmark ⇒ The more the votes are counted, the higher or lower the chances of the candidate winning the election

- No Ownership of the Underlying Asset or Benchmark ⇒ The candidate cannot be “owned”

- Hedging or Speculation purpose ⇒ Either speculating on the candidate’s victory or using the bet as an effective hedge against another asset in the portfolio (for example who bet on Kamala Harris to win as a hedge against its DJT shares)

- Maturity Date or Expiration ⇒ The 9th of November (this is the date till mail-in ballots will still be counted after which the results will be certified)

- Liquidity and Marketability ⇒ These contracts could be bought or sold before expiration

- Exposure to Nonlinear Payoffs ⇒ If you bet 1$ at 50:50 chances you would receive 2$ at maturity if the event occurs, but if you bet 1$ at 25:75 chances you would receive 4$ while if you bet 1$ at 75:25 chances you will just receive 1.25$ in case the event occurs.

With all these elements in place, you can easily understand how you can price an equilibrium price for the contract and take advantage of it. If, for example, you were living in Iowa, it didn’t take much research to figure there was a 90%+ chance of a win for Donald Trump, and this was being priced correctly in Polymarket odds almost all times. Consequently, when someone placed a strong bet lowering the odds priced by the betting volumes to ~75%, it was a no-brainer for any “intelligent investor” with access to superior information to pick up the bet and exploit what was effectively an arbitrage due to a market distortion.

Now, using the same principles, let’s go one step forward and apply it to crypto meme-coins. Of course, 99.9% of those out there do not tick all the boxes, hence I would personally stay away from them in principle, but a few do, like RUGGA, as I am about to show you.

- Underlying Asset or Benchmark ⇒ Whether or not the team will “rug pull” when the market cap of the token hits 1 billion USD

- Price Sensitivity to the Underlying Asset or Benchmark ⇒ The further away RUGGA is from the 1 billion USD threshold the lower the chances for the “rug pull” to happen. Vice versa the higher the chances of a “rug pull” occurring

- No Ownership of the Underlying Asset or Benchmark ⇒ You cannot control the team and its willingness to “rug pull” or not. However, if they go ahead and “steal” money from investors they will end up in jail hence there is a big disincentive NOT TO RUG PULL

- Hedging or Speculation purpose ⇒ Buying such a token is equivalent to take a bet on two outcomes: whether the market cap will reach 1 billion USD and whether the team will effectively “rug pull” it as they stated since the very beginning.

- Maturity Date or Expiration ⇒ This one is tricky since there is no explicit expiry date, however a “maturity window” will start to materialize in terms of probability the closer the market value is to 1 billion USD

- Liquidity and Marketability ⇒ RUGGA can be traded at any time

- Exposure to Nonlinear Payoffs ⇒ Similar to Polymarket contracts, RUGGA price simply represents the probability of the “rug pull” to occur. As a consequence, if the rug pull threshold is 1$ and the price is 0.004$ the chances of the event occurring are 0.004%. Consequently, the chances to make a profit from entering this trade are effectively 99.996% and they will decrease exponentially the closer the price moves towards 1$. Why exponentially? Because if the token reaches 500 million USD that will be a ton of money “up for steal” by the team and it will only require an increase in price of 100% to hit the 1 billion USD threshold. Effectively here you are placing a bet on the willingness of the team to end up in jail or not.

How many people are willing to end up in jail? Statistically very few, which is why, as per basic game theory, the team has an incentive NOT TO RUG and to shift the threshold forward if the first 1 billion USD is hit, effectively creating optionality that increases the implied value of the contract further.

All in all, you can now realize why I took this bet since mathematically speaking it makes sense, but I am also conscious of it being an asymmetric one (meaning that, similar to options or Polymarket contracts, you can either lose all your money or strike big gains), hence it will only be a very tiny one in my overall portfolio.

To conclude, my goal in this article was to provide you with instruments to broaden your view and better understand a growing asset class that, like it or not, is here to stay and the likes of BlackRock’s commitment to it is quite of a strong statement about it (IS THIS BLACKROCK’S MASTER PLAN FOR BITCOIN?). I do not disagree with the fact that, like in the DotCom era, many of these projects and instruments will end up worthless; however, as the DotCom taught us, there will also be winners in the long run, and if you are diligent to understand where the true value lies and manage the risks you take accordingly, there can be big opportunities that can be exploited.

JustDario on X | JustDario on Instagram | JustDario on YouTube