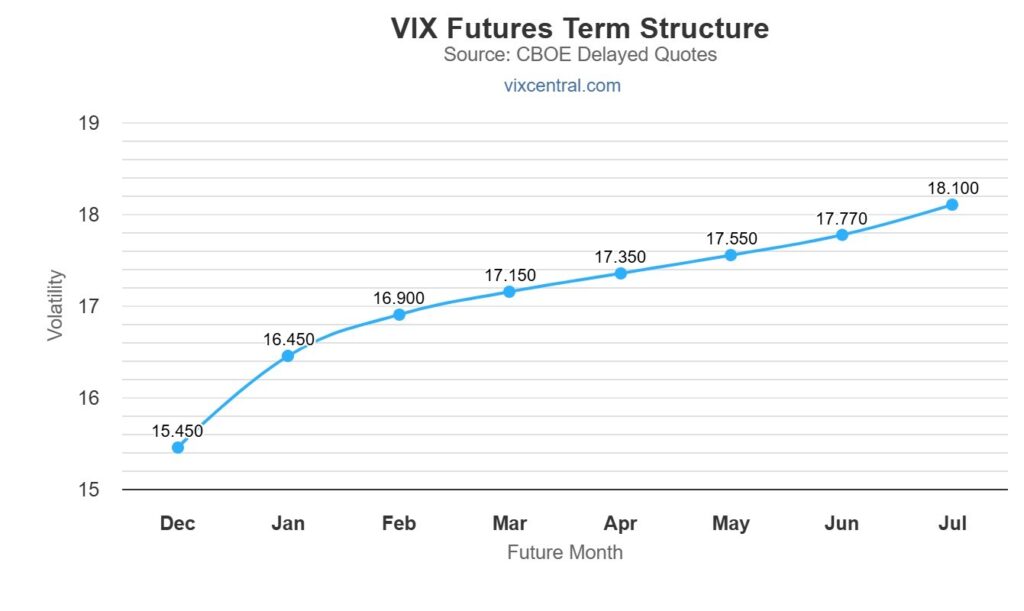

This is supposed to be a “quiet” week ahead of US Thanksgiving that ushers in the last month of the year when no money manager is willing to spoil their performance and put their year-end bonus in danger by trying to make changes in asset allocation. The VIX term structure totally agrees with this.

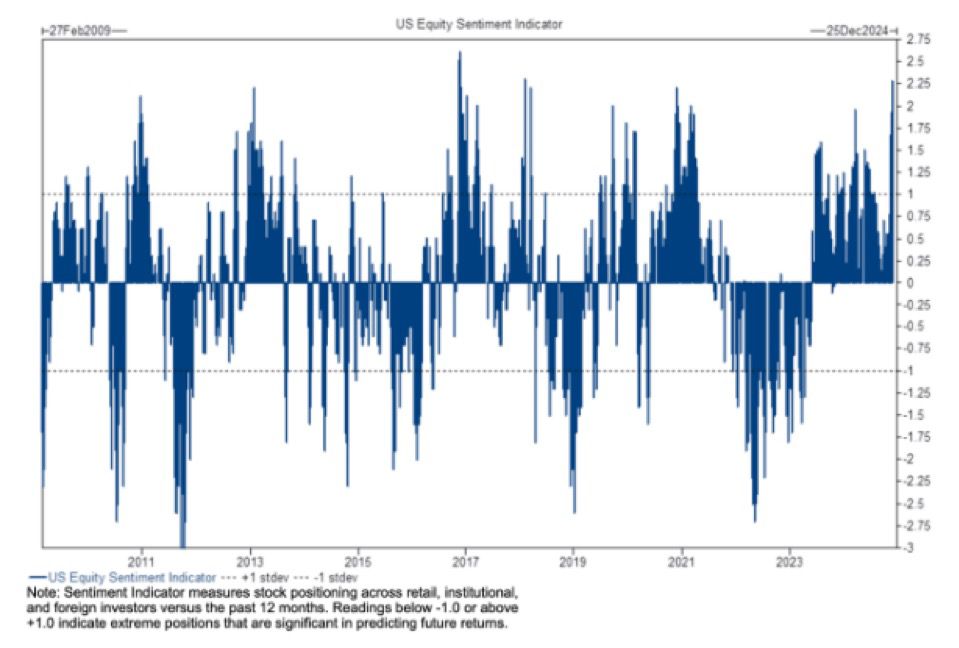

For those who were around many years ago to remember, the situation is quite similar to the moments before 2018’s Volmageddon triggered. Let’s take a look at some indicators to get a better idea, starting with the Goldman Sachs sentiment indicator that right now, consistent with a “quiet” VIX, is through the roof, signaling a very high level of complacency among investors.

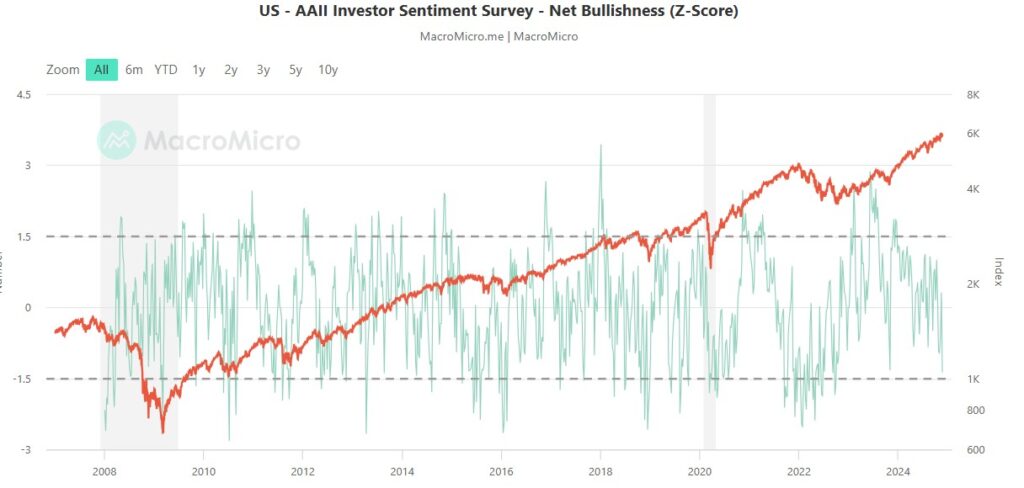

Something that clashes a bit with this sense of calm portrayed by the two indicators above is the AAII investors’ sentiment survey that, contrary to what many might expect, is currently at the bottom of the range, indicating that asset managers are not as bullish as believed. Furthermore, as you can see from the chart below, prior to Volmageddon in 2018, this indicator was instead at the top of the range, indicating true bullishness.

How do we interpret this discrepancy? As far as I can see, investors have to be bullish in such a bullish market since, as we saw before (“WE HAVE NO ALTERNATIVE BUT TO RIDE STOCKS UNTIL THEY RUN“), however, they are rationally aware of this market bubble in stocks is living on borrowed time. Consequently, this sense of calm on the surface is effectively misleading.

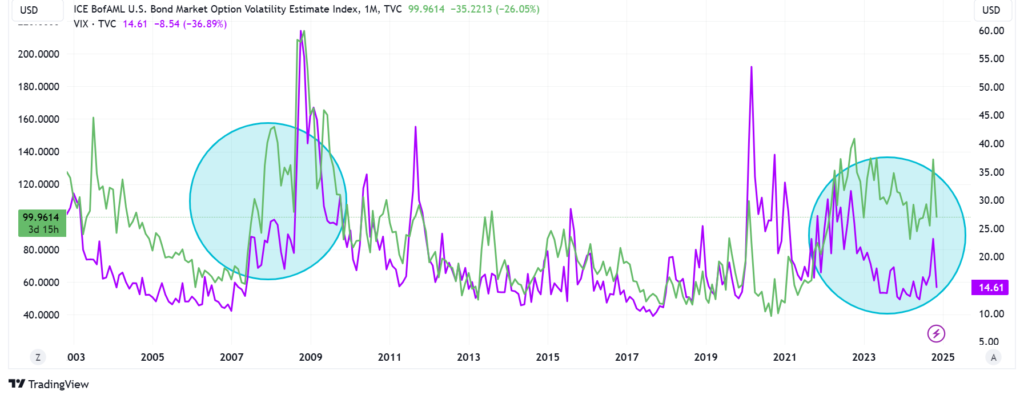

Not surprisingly, the MOVE index (US Treasuries volatility) and the VIX remain detached from each other in yet another sign that there is disagreement among investors about being in a true “bull market”. When did we experience this sort of persistent dislocation in the past? Right before the GFC.

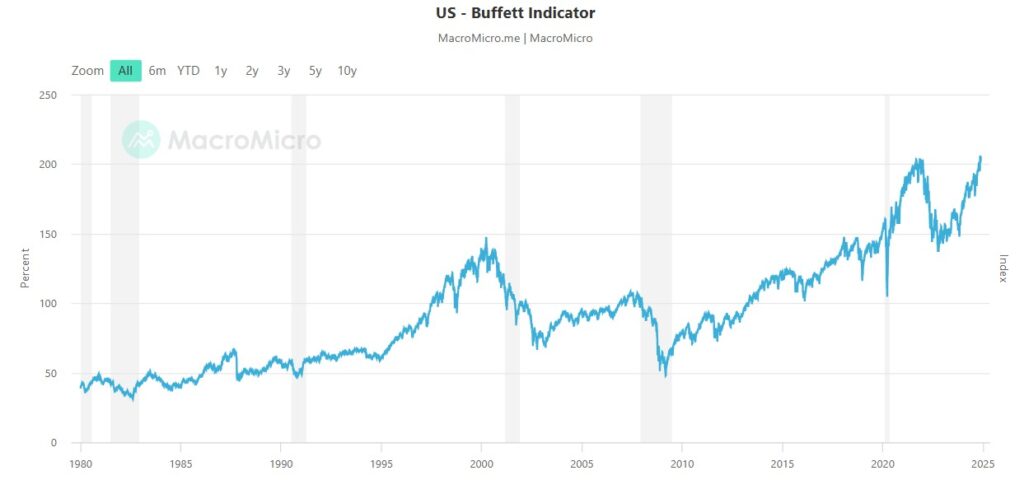

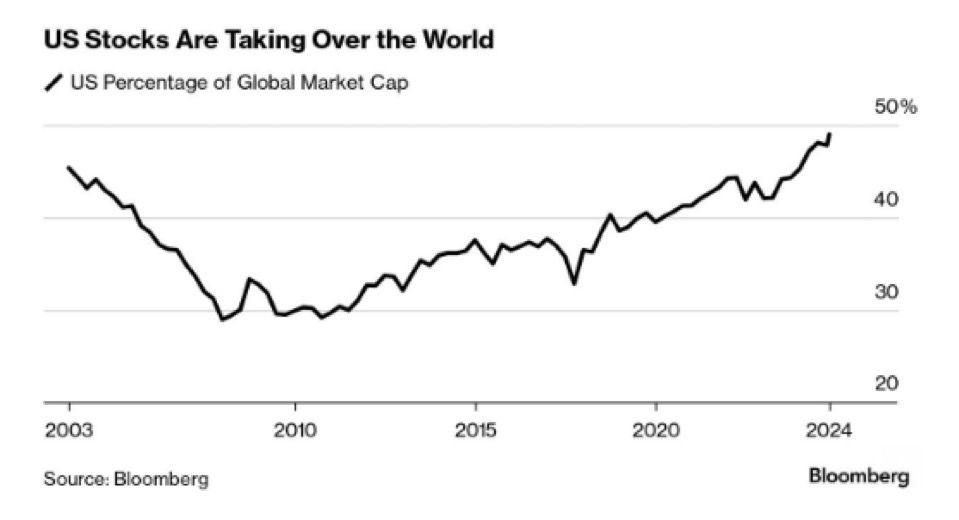

The Warren Buffett and US market capitalization against the rest of the world are other two indicators warning that valuations are now significantly stretched

Now it is fair to wonder, why is there so much complacency in the stock markets, especially in the US. Personally speaking, I believe there is only one answer to this question: investors, as they mistakenly did before in 1987, 2000, and 2008, have become overconfident in the capability of their trading algorithms to quickly downsize their risk exposure in case an unforeseen event happens. What happens if they are wrong again? There is widespread confidence that Central Banks and Governments will jump in to bail out the whole financial system once again. Unfortunately, there are two important elements currently not taken under proper consideration:

- There is not only one bubble but multiple at the same time, especially in Tech and Financial stocks

- While many companies are considered “too big to fail” it is also true that they have also become “too big to be rescued” considering most of the major central banks, starting from the FED, are effectively running on NEGATIVE capital and carrying bloated balance sheets while governments keep piling up debt due to their deeply negative deficit spending.

To be fair, at the moment it’s hard to point at a specific “black swan” (that by definition cannot be predicted), but there are plenty of “grey rhinos” out there to be VERY CAREFUL about and clearly, the investors community is not blind to them:

- The ripple effect on Tech stocks, starting from Nvidia, as a consequence of SMCI’s likely delisting (SUPER MICRO’S SECOND CHANCE OR NASDAQ’S NEXT SCANDAL?)

- Adani implosion involving major global financial brokerages in what can be a repeat of Archegos events, but this time on steroids (Japan’s SBI follows Nomura in disclosing Adani funds exposure; US charges against Gautam Adani put loyal Jefferies on the spot)

- Ongoing DOJ investigations on Tech monopolies (Microsoft, OpenAI and Nvidia investigated over monopoly laws)

- A Major financial institution like Norinchukin Bank’s insolvency becoming manifest due to unbearable liquidity problems (HOW LONG WILL THE MARKET IGNORE NORINCHUKIN BANK INSOLVENCY?)

- Another energy crisis in the Eurozone (Europe Is Already Facing Its Next Energy Crisis)

At this point, we can say that everyone is clearly on guard, but nobody wants to be the first to jump ship because when the ship sails at such speed it will be hard to jump back promptly without being left behind and underperforming competitors. Warren Buffett, who never cared about what the rest of Wall Street was doing, once again is piling up a record amount of cash in yet another major warning sign that something can spoil the bull market at any time.

To conclude, be careful to relax when everything feels “too quiet” because by experience I can tell that is when everyone is too relaxed bad things happen. I am afraid I cannot tell you today what’s going to happen, but what I said few weeks ago (BRACE FOR IMPACT: WHY MARKETS MAY FACE A VOLATILITY STORM AFTER THE 2024 US ELECTION) is clearly in play and today’s markets reaction to Donald Trump’s threat of new economic tariffs to Mexico and China as soon as he will be in power is a clear telling sign that a volatility event can now trigger at any moment (and it will be “good” for the new president for it to happen while the previous administration is still in charge).

JustDario on X | JustDario on Instagram | JustDario on YouTube