China’s 10-year government bond yields have just hit a historic low at 1.64%. Despite this downward trend continuing for a while, there is still a great deal of misunderstanding about what’s happening here in the Western part of the world (with many mainstream media and social media “gurus” not missing a chance to issue incorrect warnings about what this means for the Chinese economy). Overall, the incredible confusion around China is something I tried to address many times in 2024, especially regarding government stimulus measures for the economy and their true goals:

- A BIG BANK IS ON LIFE SUPPORT, CHINA KNOWS IT AND IS PREPARING TO WITHSTAND THE SHOCK – IS THIS BULLISH?

- THE TWO KEY PRINCIPLES UPON WHICH CHINA IS REBOOTING ITS ECONOMY (AND THAT THE WEST DOESN’T UNDERSTAND)

- CHINA HAS BEEN THE FIRST ONE TO ABANDON THE QE ABERRATION, WHO IS GOING TO BE NEXT?

- CHINA’S ECONOMIC RESTRUCTURING RECIPE: CAPITALISTIC COMMUNISM

The biggest misunderstanding of all was around the impact of government stimulus on stocks: AT THIS RATE CHINESE STOCKS WILL HIT ALL TIME HIGHS IN 3 WEEKS – WHAT’S REALLY HAPPENING THERE?

Today, my focus will be on government bonds, hoping to help everyone understand what’s really happening, which is quite different from the narratives running wild on popular European and US mainstream media and social media.

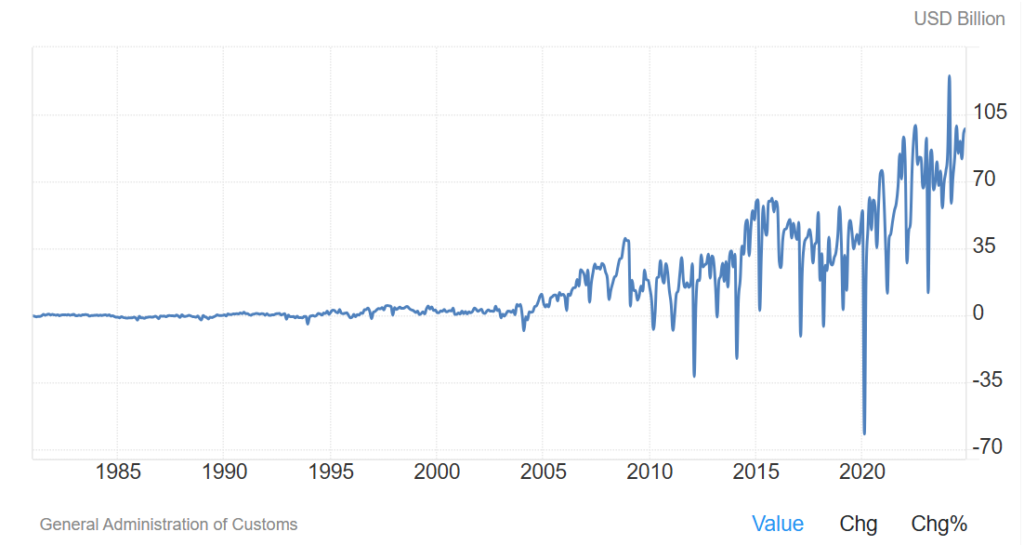

First of all, as you can see from the chart below, China’s trade surplus has been increasing significantly after COVID-19, with 2024 ending at an all-time high record. How is this possible when the popular narrative embraced outside Asia is that “China’s economy is collapsing”? Obviously, the complete opposite is happening.

This trade balance surplus is mainly driven by industrial production based in China and then exported abroad by local and foreign firms with operations in the country. This results from high inflation in Europe and the US (the true extent of which is being hidden by local statistical public agencies so far), particularly exacerbated by salary increases to keep up with living costs. This is incentivizing companies to shift more production to China, where salaries and energy costs have remained stable. To protect their margins, this trend won’t end anytime soon, especially when consumer credit is soaring in the United States thanks to incredibly loose monetary conditions.

What happens when a country accumulates such a trade surplus? The country experiences a significant inflow of foreign currency into its banking system.

The second important aspect to understand is Chinese people’s spending behavior, which is diametrically opposite to that in the United States, where consumer credit keeps breaking new all-time highs. Even though Chinese salaries haven’t grown like in other countries, consumer prices have remained stable or even decreased after COVID-19. The Chinese population, famous for its stubbornly high saving ratio, has been accumulating savings in local currency. This creates a problem for banks, which are accumulating an increasingly high amount of deposits in local currency with virtually no willing borrowers, even in the corporate space. Those with good credit aren’t willing to borrow in China, while zombie companies don’t enjoy access to credit as they do elsewhere when banks are confident the government will bail out lenders if things go wrong. Indeed, the Evergrande and Country Garden defaults have sent a clear message to lenders, who have learned their lesson.

Suppose we combine the first and second points. In that case, you can quickly understand why the CNY is depreciating against the USD: the amount of local currency accumulated in the system, not as a result of central bank QE that ended long ago, is outpacing the inflow of foreign currency.

At this point, it should be easier to understand why Chinese government bond yields keep declining: banks and insurance companies cannot afford to sit on large amounts of cash because this would significantly impact their profitability, and they have few alternatives but to “park” all this cash in risk-free government bonds, pushing yields lower and lower.

Why isn’t this trend triggering a “carry trade” similar to the famous one around the JPY? Simply because China’s financial system is closed and the outflow of CNY to foreign countries is tightly regulated, financial institutions, both local and foreign, cannot move liquidity outside China and invest in foreign assets. Is this bad for the Chinese economy? No, it isn’t, since allowing a carry trade would divert resources outside the country, adding pressure to the CNY, which would eventually become a problem as it did for Japan.

Make no mistake, China is trying to encourage increased local consumer spending and investments; however, it wants to do so without reinflating financial bubbles in stocks or real estate, as there is no desire to repeat the mistakes of 2014-15 and 2017-2018 respectively (China to ramp up fiscal support for consumption next year). Here lies another great misunderstanding of China’s policy measures in the West, where “stimulus” is always associated with helicopter money being thrown into the system. In China, the government has identified specific sectors it wants to support, like EV manufacturing and Industrial Technology. These sectors, however, are enjoying significant cash surpluses, and with the threat of sanctions, companies are reluctant to borrow more than they need to expand their operations, preferring to grow organically within markets where they see no threats to their business.

Chinese retail investors only had a brief love affair with stocks, which are culturally considered high-risk and speculative investments, even though in the West, everyone expected them to embrace stocks due to their attractive valuations compared to other markets. Ironically, foreign institutions that bet heavily on this, based on the false premise that fair valuations would align with the inflated ones in Europe or the US, have been consistently disappointed. What are Chinese retail investors buying instead? Safe insurance products (that ultimately end up buying government bonds), bank time deposits, and “safe” investments like gold and silver, have always been culturally favored.

Is the government happy with what’s happening? No, they aren’t, since they don’t want to fall into the same trap as foreign governments. Banks and insurance companies accumulating too much in government bonds creates a significant risk to the system since an increase in borrowing demand will push yields higher, potentially resulting in steep mark-to-market losses for banks and insurances. These institutions would then be forced to “hold to maturity” the assets to avoid losses and, paradoxically, would not be in a position to lend when demand in the system finally returns. To avoid too much demand for central government bonds, China is now pushing to securitize local government debt, which has been strictly restricted from financing itself through bond issuances before. China is effectively working to aggregate this debt into bond securities guaranteed by the government, which will allow banks and insurance companies to deploy cash at higher rates while making this debt liquid. This will unlock significant resources for local governments to pay their direct creditors (especially real estate and infrastructure companies), ultimately freeing up liquidity these creditors can use to complete projects currently on hold. This is not QE since there won’t be an increase in debt in the overall system monetized by the central bank as happened elsewhere, but there will still be a great benefit to the economy because resources will be unlocked and put to productive use.

The effects of all I’ve described will be visible in the medium to long term, ultimately benefiting GDP growth and even stocks, which will grow organically through profit growth rather than valuation expansion. This is also why the Government has set up facilities that local listed companies can use to repurchase their shares, which is actually a great investment opportunity right now, before the general public bid returns once the whole dynamic becomes clearer and the risk associated with buying stocks for the long term decreases.

JustDario on X | JustDario on Instagram | JustDario on YouTube