Before diving into what’s happening in the gold market, with a particular focus on the Bank of England, let me first share a broader view of the dynamics at play for better understanding.

The physical gold market is where people buy and sell real gold in the form of bars, coins, and other bullion products. It’s a global system that includes miners, refiners, banks, investors, brokers, and everyday buyers. Gold trading occurs both directly between buyers and sellers and on major exchanges, with key hubs in cities like London, New York, Zurich, Hong Kong, and Shanghai.

Gold begins its journey in mines. Once mined, refiners process the gold to remove impurities and shape it into bars or coins of different sizes and purity levels. The refined gold needs to be stored securely. Banks, exchanges, and private companies operate high-security vaults, mainly in financial centers such as London, New York, and Zurich.

Gold is bought and sold on major exchanges, including the London Bullion Market Association (LBMA), the COMEX in New York, and the Shanghai Gold Exchange (SGE). The LBMA is particularly influential because it sets global pricing benchmarks and standards for the industry. While some investors take physical possession of gold, much of the trading happens on paper, through financial contracts that represent physical gold without requiring actual delivery.

Central banks are key players in the gold market, especially through leasing. This means they temporarily lend gold to financial institutions like banks and brokers in exchange for a fee. The institutions that borrow gold can sell it on the market or use it to meet obligations on gold exchanges. This leasing system helps ensure there is enough gold available for trading, making the market more stable and liquid. However, leasing gold comes with several risks. One major risk is that the central bank lending the gold might not get it back if the borrower runs into financial trouble, which means they could end up with a cash payment instead of the actual gold. Another issue is that once the gold is leased, the central bank loses direct control over it, and it might be difficult to reclaim in times of crisis. If gold prices rise sharply, the borrower might struggle to buy it back, leading to potential losses. Additionally, since leasing increases the available supply of gold in the market, it can push prices down, reducing the overall value of the reserves. Finally, there’s also a reputational risk: if a central bank is seen as mismanaging its gold reserves, it could face public criticism or political pressure.

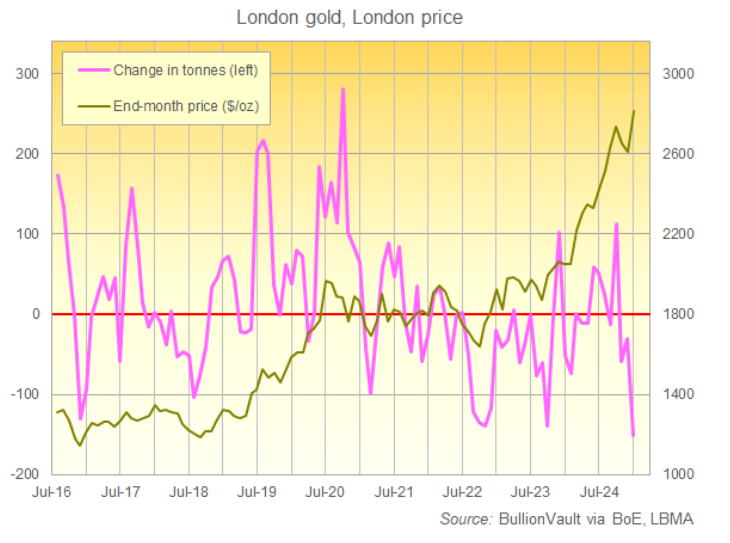

According to data from the world gold council, the countries that bought the largest amounts of physical gold in 2024 are: Poland (+89.54 tons), India (+72.60 tons), and China (+44.17 tons). On the other side, those who reported the largest decrease in physical gold reserves in 2024 are: Kazakhstan (-10.18 tons), Singapore (-10.08 tons), and Thailand (-9.64 tons). If changes for all other countries have been rather marginal, then why is the Bank Of England struggling with physical deliveries of gold that now take up to two months while the usual standard was 1-2 weeks?

According to the BOE own data, while the central bank officially declares to hold ~310 tons of gold reserves (unchanged since 2002), as of the end of January 2025, ~170 tons were held in custody in its vaults, meaning not all of it legally belongs to the BOE. Some of the vaults managed by the BOE are particularly tied to the LBMA, meaning that when dealers ask for physical delivery of their OTC contracts in London, gold bars make their way into it. However, when physical delivery is requested outside London, there is an outflow of gold bars. If this amount held in custody officially remained rather stable through the years, how would you explain dealers starting to sell bullion held at the BOE at a steep discount compared to other markets? Clearly, there is something wrong here.

MSM blamed fear of Trump’s tariffs behind the decision of many brokers to start asking for large deliveries of gold from London to the US, but this is wrong since no indication of such a potential policy has ever been given.

What’s more plausible is that the BOE does not hold in custody all the gold it declares, and with strong central banks buying into the market, especially from China and India, along with increasing demand for physical gold across the globe, brokers are now becoming wary of the potential counterparty risk against LBMA and the BOE that could have leased too much gold at lower prices and, due to the sharp increase of the value to ~2900$ per OZ, will now incur a significant loss in case their counterparts (that are short) won’t be able to return what they borrowed.

What I just described has huge implications from a monetary perspective since the BOE also keeps reserves belonging to other central banks in custody, like the Reserve Bank of Australia. If this gold, likely re-hypothecated in the system through OTC contracts into the financial system, cannot be repossessed, the BOE is effectively short the commodity, and if this pattern continues, there are only two ways it can make up for it:

- Printing more GBP to repurchase gold from the market

- Selling monetary reserves to repurchase gold from the market

Both alternatives will directly create a sharp devaluation of the GBP since it is unlikely the BOE will recover all the gold from the financial institutions that are in default on the lease agreements, with an inevitable domino effect in the global financial system.

Considering demand for physical gold isn’t slowing down due to all the dynamics I described in my last podcast on the topic, the situation could only worsen from here which can potentially lead to a default of the BOE itself if it won’t be able to meet physical delivery requests from the market any longer.

All in all, the gold price is set to continue to rise in the future until requests to audit the reserves physically held in vaults will be strongly requested, and that will expose how large quantities of gold assets in the financial systems are just “paper gold” without the real commodity behind it. Inevitably, all those assets, especially ETFs and central bank reserves, will collapse in value, and those who hold physical gold for real will be the ultimate winners.

JustDario on X | JustDario on Instagram | JustDario on YouTube