This year’s GTC 2025 confirmed what many observers already realized back in January after Jensen Huang’s presentation at CES 2025: the AI Narrative cultivated by Nvidia since 2021 doesn’t trigger the same excitement that it used to anymore. This narrative, based on the prospect of the nearly infinite potential of AI and how this required the buildup of an incredible amount of tech infrastructure, wasn’t even novel but a recycled one after the first attempt to make it mainstream failed in 2016, as I wrote about more than one year ago in the article “NVIDIA, ITS RECYCLED ‘AI REVOLUTION’ AND THE DARK SIDE OF IT KEPT AWAY FROM THE PUBLIC“.

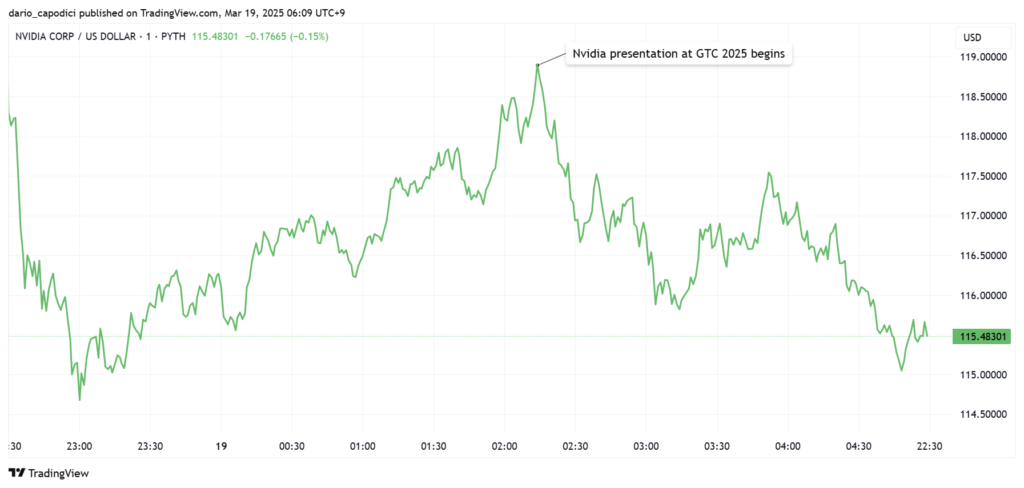

While previously investors could not wait to hear Nvidia’s CEO showcasing the latest novelties from the company and kept bidding the stock higher and higher during the pitch, today, in stark contrast with the recent past, Nvidia stock peaked intraday when Jensen started to speak, and the selling was constant until the end of the trading session.

For more than 2 hours, Nvidia’s CEO did not spare any effort to double down on all the elements he had already presented in January that did not fly even then, even before DeepSeek took all hyperscalers totally by surprise by developing a leading AI model that beat all the best-performing ones until then and was delivered for a fraction of the money spent by the likes of OpenAI, Google, or Meta. Here are what I believe are the most remarkable Jensen’s quotes, not in a positive way, from this year’s Nvidia presentation at GTC:

- “When you use ChatGPT today you have to wait longer and longer because many people are using it”

- “I expect data center build out to reach 1 trillion USD worldwide”

- “Every company in the future will have a physical factory for the product and another factory to generate AI”

- “We are super proud of CoreWeave going public”

- “General Motors selected Nvidia to build its fleet of autonomous vehicles”

- “This is the most extreme GPUs scale up ever built, the reason why we wanted to do this is to solve an extreme problem called inference”

- “The smarter the AI the less money you can make with Volume, we are trying to bend this curve”

- “Blackwell is 40 times more powerful than Hopper”

- “If you buy Hopper is a revenue incinerator”

- “The more GPU you buy the more money you make”

Starting from the first quote, it is already obvious how Jensen, who is famous for it, was blatantly lying, considering that it is now public knowledge how OpenAI is experiencing a significant number of subscription cancellations because clients are switching to equivalent (if not better) and way cheaper alternatives provided by the likes of DeepSeek and xAI.

The second lie was even more significant, considering how DeepSeek, Alibaba, Baidu, and even Google demonstrated to the whole world how cutting-edge AI models can be developed with a limited number of GPUs (“Gemma 3: Google’s new open model based on Gemini 2.0“). The goal here is obvious: continue to convince investors that there will be a need for hundreds of thousands more GPUs provided by Nvidia to develop AI applications. The third quote followed along the lines of the second one, overlooking the straightforward thought that comes to mind when hearing those words: wouldn’t that represent a marked increase in operating costs for all those companies deciding to build parallel “AI factories” along with the ones they need to produce their goods?

Considering the developments of recent days since CoreWeave filed its S-1 ahead of its plan to IPO, stating to be proud of CoreWeave is quite a misplaced cheap advertisement for a company Nvidia is heavily invested in, but it is such an obvious fraud (“WILL COREWEAVE MARK THE END OF INITIAL FRAUD OFFERINGS?“).

The fifth quote was by itself a big wink to the Trump administration; however, it did not trigger the market reaction such an announcement would have done before, with GM barely moving and ending up the trading day down 0.67%. This on its own should be such a warning bell for all Nvidia clients and partners that previously saw their shares jumping by very large amounts as soon as their names started to be associated with Nvidia.

The sixth quote is once again a poor attempt to steer investors’ attention away from the fact that DeepSeek showed the whole world how there is no need whatsoever for any “extreme” AI infrastructure to develop cutting-edge AI models and platforms.

The remaining quotes after the first six are such a desperate attempt to convince the market that Blackwell is doing great and is such a revolutionary GPU that greatly overshadows all the hundreds of thousands produced and sold by Nvidia so far. It would be very interesting to know what crossed Nvidia clients’ minds once Jensen, who was presenting without the help of a teleprompter, stated that “Hopper is a revenue incinerator”. If Hopper is such a poor product, what’s then the real value of those hundreds of thousands of GPUs all hyperscalers spent tens of billions of USD to purchase and are now sitting on their balance sheets at a cost clearly far greater than their real value? Fairly speaking, if Jensen is truthful here, all those hyperscalers should immediately write off the value of their investments for a significant amount, resulting not only in big losses in their financial statements but also in an assured upset of their investor base that will certainly be far from happy for the incredible amount of CAPEX gone up in flames.

At this point, I hope we all agree that the AI Narrative which greatly benefited Nvidia until 2025, a fake narrative carefully crafted to manipulate investors’ future expectations about the potential of the company and all its clients and partners, is now officially over. What just happened was likely a Minsky Moment for many investors who clearly are not falling anymore for all the rosy words coming from Nvidia’s direction and who have already been gradually scaling back their exposure towards the name. There is still a large crowd of believers still supporting Nvidia, but even this one is starting to question its convictions the longer Nvidia’s share price underperforms the broader market. Once even these remaining believers come to the realization that Nvidia’s future will not be as hyperbolic as the company convinced them it would be, a significant amount of selling will start to hit Nvidia shares that are doomed to crash back to earth to a market capitalization similar to that of its direct competitors like AMD that, differently from Nvidia, did not push expectations to the extreme and neither cooked their books using a highly sophisticated revenue round-tripping scheme and questionable accounting practices in recent years.

JustDario on X | JustDario on Instagram | JustDario on YouTube