UBS just delivered another earnings expectations beat, what a surprise right? If it wasn’t for the Swiss regulator, who is aware of the bank’s real condition and doesn’t back off from asking UBS bank management to significantly increase their capital to prepare for potential significant losses (“Switzerland’s Finance Sheriff Takes on UBS and Banking Elite“), the market as a whole would have no concerns whatsoever about the bank’s health, considering the headline numbers it continues to deliver. These numbers are, once again, incredibly misleading.

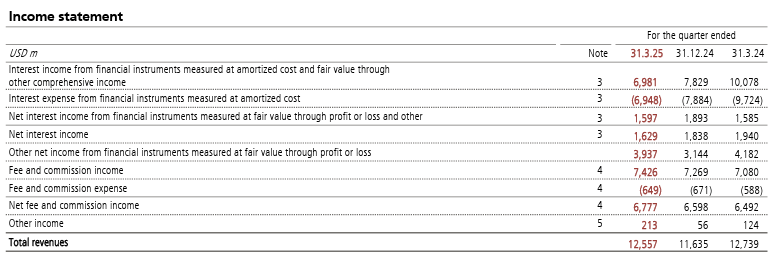

As I flagged in my last analysis on UBS (“WHY THE SITUATION OF UBS IS VERY DANGEROUS“), the bank made virtually zero money from being a “bank” – meaning collecting money from the public and then lending it out. In this last quarter, UBS made ~6.9bn USD in interest revenues from lending activities while incurring ~6.9bn USD in financing costs to fund the activity, delivering once again zero returns from the banking business. Who saved the day? UBS’s trading division, which brought in ~1.6bn USD of revenues, roughly flat compared to Q1-24 but down 16% compared to Q4-24.

Another interesting thing we spotted in my last analysis was how the Swiss National Bank continues to actively support UBS by easing interest rates and loosening financial conditions. Once again this quarter, this was of great help to UBS, which could record ~4bn USD of “Other net income” gains from assets measured at fair value through profit or loss. Interestingly, this is an Income Statement item the bank keeps providing no further detail about, despite it accounting for ~33% of its total revenues.

Last quarter, I highlighted a significant cash bleed from UBS. Did the situation improve three months later? At first glance, it seems the situation slightly improved in the past three months, with cash and equivalents increasing ~8bn USD to ~231.4bn USD. However, this looks more like the result of bold window dressing than a real improvement in the bank’s health. This quarter, the bank reported 744.9bn USD of deposits, roughly ~1bn USD lower than the previous quarter, but 58.4bn USD of short-term borrowing, up 4.5bn USD QoQ. Furthermore, the net amount of money UBS borrowed from other banks increased from 4.4bn USD to 6.7bn USD in the current quarter. Clearly, UBS had to finance itself from more expensive and short-term funding sources to beef up its cash position and give the impression it stopped bleeding cash; however, the bank’s effort is betrayed by another decrease in deposits.

Now, let’s measure again the size of the hole in UBS’s books, shall we? As of Q1-25, UBS reported a 1.234 Trillion USD total risk exposure to banking and traded products, 20bn USD higher than the previous quarter, with the bulk of the increase due to new loans to customers. Incredibly, the total amount of allowance for expected credit losses UBS set aside to face a potential economic downturn and increase in defaults remained virtually negligible at 2.63bn USD or 0.21% of its total risk exposure on this front. Considering the ~7bn interests earned this quarter, we can extrapolate a ~2.27% interest income on all UBS Banking and traded products. Keeping a 5-year duration assumption for consistency with the last analysis, at current rates, the mark-to-market value of these assets held by the bank implies a ~98bn USD unrealized loss against ~87bn USD of equity in UBS’s balance sheet – yes, a slight improvement compared to three months ago. However, let’s not forget this estimate only takes into consideration mark-to-market losses due to movement in rates (which this quarter has been beneficial to the bank), not credit spreads; hence, it can fairly be considered an underestimation. As you can read from UBS’s own outlook, due to tariffs, uncertainties and risks are expected to increase. As a consequence, credit spreads are bound to increase, reflecting the rise in risk in the overall economic environment and the likely increase of corporate defaults. What do you think will be the impact on UBS’s books in such a situation?

It is fair to conclude that the bank is totally unprepared to deal with a worsening economic environment, having only set aside a ridiculously low allowance for expected credit losses and already carrying a substantial amount of unrealized losses in its hold-to-maturity books. At the same time, its core operations are already unprofitable, and the bank relies every quarter on trading profits and fair value adjustments to deliver a positive net income. Swiss regulators’ concerns are more than justified, but the risk that things quickly deteriorate here is high, and that concern can swiftly turn to desperation because, as of now, Switzerland cannot afford to bail out UBS.

JustDario on X | JustDario on Instagram | JustDario on YouTube