Right now, the futures market is pricing only a 2.7% probability of seeing the FED delivering a 25bp rate cut in the upcoming meeting. Considering the overall economic situation, my personal view is that the FED should be tightening financial conditions further, not the opposite. However, while US inflation remains officially underreported and employment overreported due to BLS double-counting (counting as single jobs those performed by millions of people who work 2 or 3 jobs to make ends meet), the FED has plenty of room to pretend it is fulfilling its mandate. If it wasn’t for what happened in Taiwan, but most importantly in Hong Kong since last Friday, I wouldn’t be here writing an article warning you not to take it for granted that the next FOMC will be another uneventful one. Let me explain why.

The Bank of Taiwan and the Hong Kong Monetary Authority (the de-facto “central bank” of Hong Kong) both run a monetary peg system against the USD. Unlike the HKMA, which sets a specific 7.75 and 7.85 trading range for the HKD against the USD, the Bank of Taiwan does not have an official FX rate peg. However, it’s an open secret that its goal is to maintain the TWD competitive against the USD for the benefit of its semiconductor exporters, which contribute to the majority of Taiwan’s GDP and allow the country to accumulate foreign reserves thanks to the commercial surpluses they deliver.

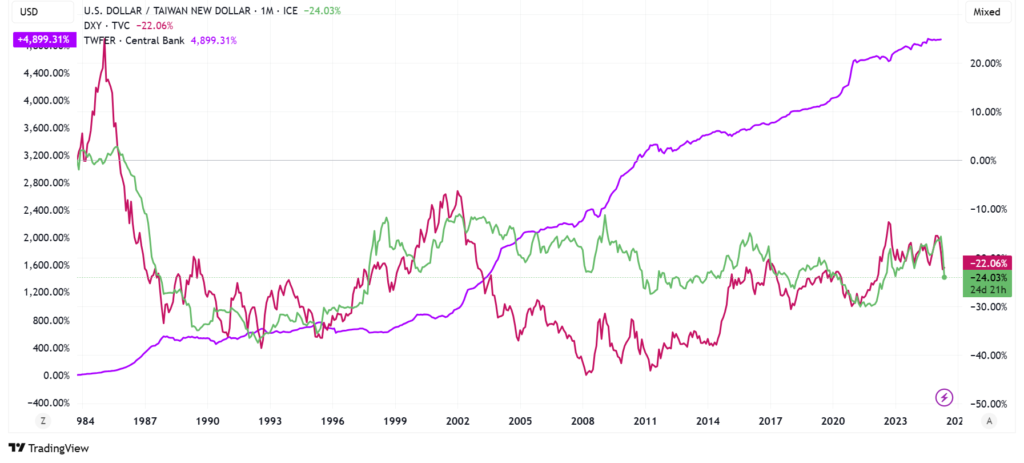

In other words, if the USD inflows that come into Taiwan through its companies’ activities are not reinvested abroad directly or through financial intermediaries like banks, insurance companies, or pension funds, the BOT needs to print TWD and use it to purchase USD currency. This is then reinvested in T-Bills or Treasuries, contributing to an increase in foreign reserves. The fact that Taiwan’s foreign reserves have consistently increased for many decades, despite global economic cycles as shown in this chart, indicates that the TWD is being kept systematically weaker compared to the USD.

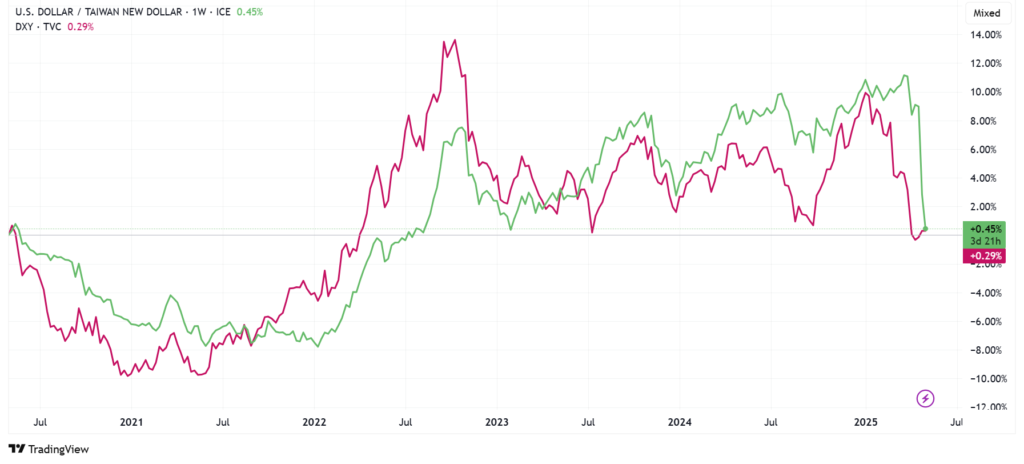

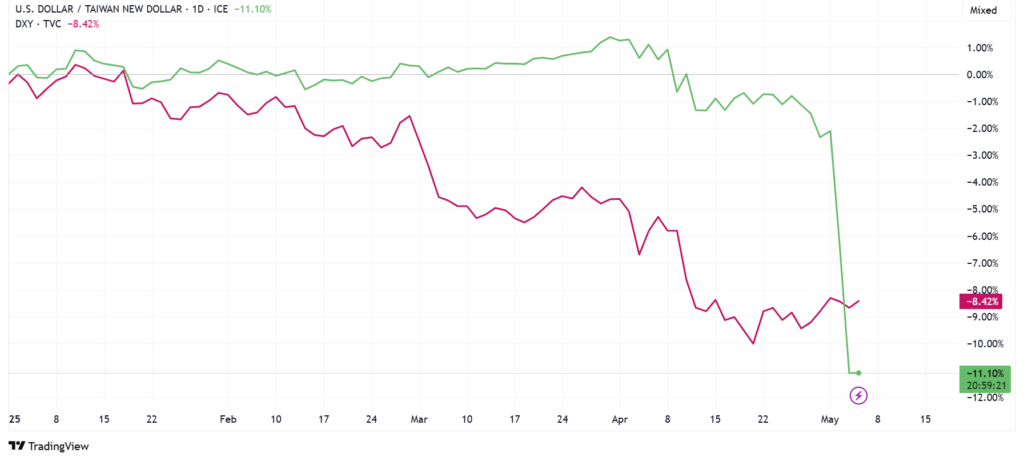

Do you think that suddenly the BOT would U-turn and completely change its policy by strengthening the TWD relative to the USD and begin dealing with an erosion of its foreign reserves, especially if local corporations start to claim their USD assets and take them abroad to build manufacturing plants in the US? Of course not, as that would quickly destroy the island’s most valuable economic ecosystem. This sudden move might be in preparation for a FOMC rate cut that could potentially push the DXY further down from current levels in the short term. This BOT move, while strengthening the currency, will allow the TWD to remain relatively weaker than the USD but not too weak to risk the label of “currency manipulator” from the US Treasury Department. This manipulation was becoming increasingly difficult to deny publicly, considering the TWD’s behavior so far in 2025, especially since the US tariffs turmoil began.

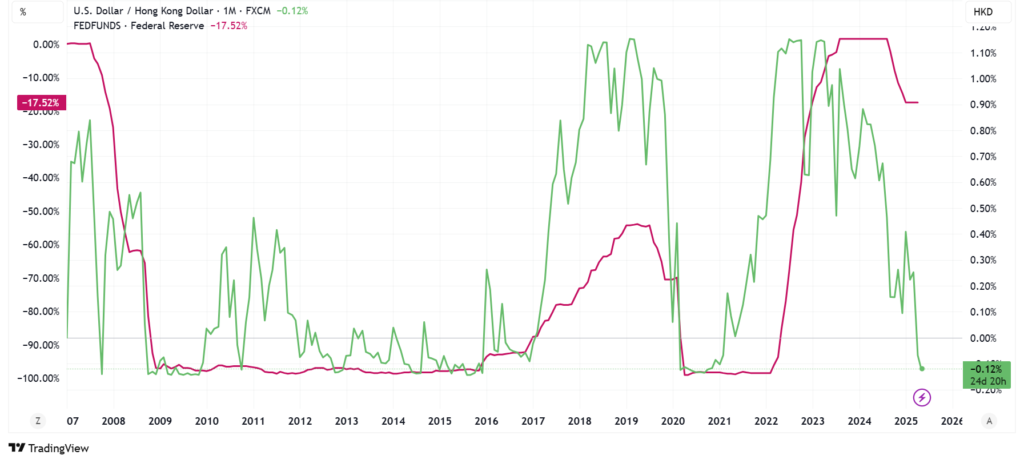

While social and mainstream media were mesmerized by the currency events in Taiwan, another important development was occurring simultaneously: the HKMA had to intervene in the open market to defend the 7.75 band of its peg by selling HKD (printed out of thin air) to purchase USD and weaken the currency back within the statutory range. What’s special about this, considering it isn’t the first time the HKMA has had to defend the peg? The HKMA was forced to buy the highest amount of USD ever in a single day to defend the peg (Hong Kong Buys US Dollars to Maintain FX Peg in First Since 2020). When was the last time the HKMA had to intervene so strongly in the market to defend the HKD peg and prevent currency appreciation beyond it? In 2020, around the same time when the FED was forced to cut rates and resume QE shortly after to bail out the entire global financial system. Prior to that? At the end of 2007, when the mortgage crisis was about to spiral out of control in the US and the FED was already in the process of cutting rates quickly to support the whole system. As you can see from the chart, the HKD peg is a reliable indicator to gauge the trend of FED Fund rates and FED money printing activity (aka “Quantitative Easing”), since every time the FED loosens or is about to loosen monetary conditions aggressively, the HKMA has to step in and defend the 7.75 strong range of the peg. The mirror side is the FED’s aggressive tightening that pushes the peg to the weaker 7.85 bound, requiring the HKMA to step in by selling USD reserves in the open market to repurchase HKD.

Now, if the BOT move had happened in isolation, an easy explanation could have been the outcome of tariff negotiations behind closed doors with the US government, which would reasonably be expected to request a stop to the unfair and excessive weakening of the TWD. However, considering the events involving the HKMA, that explanation wouldn’t justify the significant moves in the HKD at the same time. What if we combine HKD, TWD, and FED FUND rates in the same chart? Here you go:

At this point, the probability of the FED cutting rates by 25 bp in the next 24 hours feels greater than 2.7%, justifying the title I chose for this article, doesn’t it? Now, will Jerome Burns have the courage to pull the trigger? Surely the move would be supported by the US government and could be easily justified as a “preemptive cut,” considering the dreadful real-time commercial data that keeps hitting the tape and will surely cause significant financial stress in the US system sooner than many want to believe. Furthermore, the US government is starting collection on more than 5 million delinquent student loans at the same time the tariffs turmoil hits the economy, raising the risk of financial distress in the system even further, since the vast majority of these people not only have no means to repay their student debt but have also accumulated consumer debt to make ends meet during the past few years of high inflation. To conclude, I believe it is proper to keep an open mind about such a move being taken by the FED. Perhaps the FED officials themselves gave a heads-up to their fellow central bankers and CEO friends in the banking system, which would explain why we saw such unusual front-running moves in TWD and HKD simultaneously.

JustDario on X | JustDario on Instagram | JustDario on YouTube