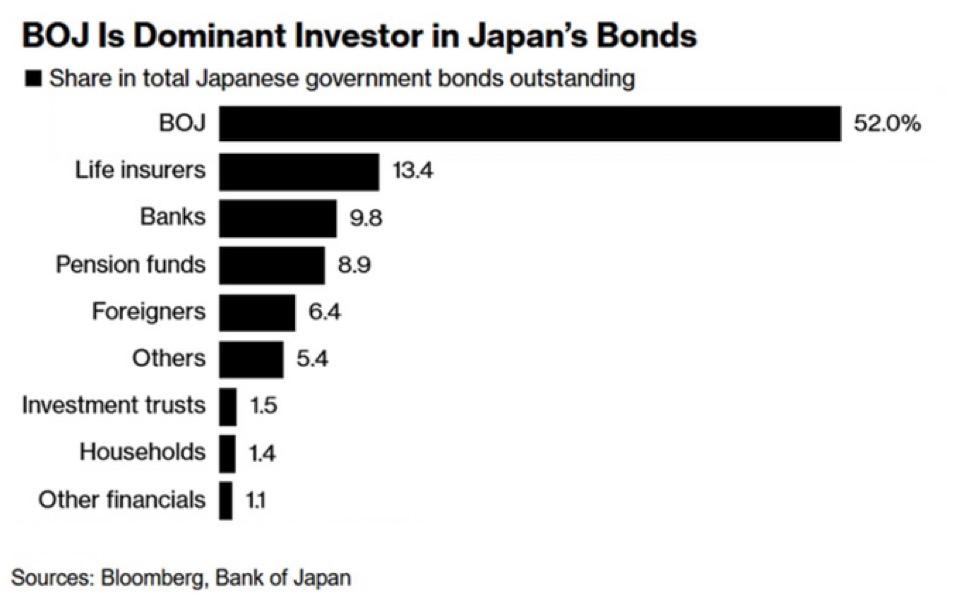

Imagine a whole financial system (banks, insurances, and pension funds) that for decades never second-guessed the solvency and liquidity of its own country’s government bonds because no matter what, its central bank was always ready to show a bid in case there were no takers in the market. What I just described is the Japanese financial system since the early 1990s when the Bank of Japan embarked on perhaps the most absurd monetary policy ever attempted in the history of modern finance: QE infinity. Because of that, as per the latest statistics, the Bank of Japan today owns more than 50% of the total amount of Japanese Government Bonds out there. What about the rest? 13.4% is owned by Life insurers, 9.8% by banks, and 8.9% by pension funds. Japanese households only own 1.4% of JGBs, and hard to blame them considering they barely paid any interest for many years. Only the remaining 16.5% of JGBs are in the hands of foreign investors, a sign that there is little appetite for JGBs outside Japan’s borders.

Because of the reckless and stubborn policies of the Bank of Japan, not only has the central bank greatly distorted the market of JGBs, but it has effectively printed itself into a corner. What does this mean? Because of decades of price discovery suppression, the JGBs market never priced where it should have, and in line with the astonishing amount of debt the Japanese government piled up till today – above 250% Debt/GDP, the highest in the world, even higher than countries considered “failed” from a monetary perspective like Venezuela. Last year, a few months before Japan’s “Black Monday” in August, I wrote two articles to warn about the dark clouds gathering around Japan’s financial system:

- WHY A HISTORICAL JPY CURRENCY CRISIS IS AT THE DOORSTEP OF JAPAN

- A PEEK INTO THE FUTURE: USD/JPY ROAD TO 300

Fast forward to today, the “doom loop” I warned about at that time and specifically explained in the article “EXPLAINING AND SIMPLIFYING THE JPY (COUNTERINTUITIVE) DOOM LOOP” is now starting to gain momentum and significantly undermine Japan’s domestic financial system. Here is what I specifically warned about last year:

“What do you expect will be the effect of starting to lift interest rates? The cost of debt will increase. How will this be paid? Issuing even more debt. Who will be the buyer of this newly issued debt? The BOJ fairy. How will she pay for it? Printing JPY out of thin air… This by itself is already the perfect spiral to trigger a currency crisis”

I bet you might be asking yourself why the JPY did not devaluate much more till now and trade beyond 160. The answer is simple: BOJ’s monetary intervention using its still large amount of foreign reserves, especially in USD. Let me remind you what happened last year: every time traders, especially hedge funds, geared up to force a devaluation of the JPY, the BOJ stepped in, selling reserves and repurchasing JPY in the market to strengthen the currency. The BOJ did this with such strength that it eventually started to “squeeze” JPY short positions, triggering a forced deleveraging of JPY carry trade leverage that caused the chaos in markets everyone is now familiar with. Paradoxically, because the BOJ not only owns the majority of JGBs but also the majority of stocks listed in Japan (via ETFs), once the stock markets started to tank, the BOJ had to resume money printing to salvage that part of its portfolio. Needless to say, this whole situation is more and more unsustainable and is effectively forcing the BOJ to keep the JPY exchange rate against the USD between 140 and 160.

The pressure on the BOJ is mounting though because inflation in Japan is starting to significantly bite into its domestic economy, and the consequence is increasing pressure on yields to rise. The BOJ dealt with this in the past by implementing a very strict yield curve control, but the room for maneuver it has to resume the same today is almost zero. Why? Because inflation is eroding the principal value of JGBs; consequently, the larger the negative real rates are, the more damaging it is for JGB holders to keep those assets in their portfolios. What can the BOJ do? Buy all the JGBs market? Think about it – in that extreme case, the JPY as a currency won’t make sense anymore since all domestic investors will then be holding foreign assets and start transacting between each other in foreign currency, as happens, for example, in Venezuela where the local currency is only used for day-to-day expenses. At that point, the value of the JPY will be set in the international market simply as the value of Japan’s reserves against the total amount of JPY circulating supply outstanding, as I warned in my articles one year ago and when I showed how objectively the JPY should be trading at 300 or above against the USD.

With the BOJ QE effectiveness evaporating every day and its attempt to normalize Japan’s monetary system has failed even before it began, clearly, the BOJ has not much left to do than try to kick the can down the road as much as possible, hoping that the government finally steps up and puts in place the draconian and painful financial measures needed to put the Japanese economy back on a sustainable path. I won’t hold my breath for the Japanese government to intentionally do that, similar to the Greek government only taking action once Europe and the international financial community forced it to do so more than a decade ago. Japan’s prime minister’s words last week describing Japan’s situation as worse than the one Greece found itself in back in those days should have triggered massive alarm bells all around the world, but Japan is much, much bigger than Greece and no one is prepared to take this whole mess seriously still. Maybe they will after local financial institutions start collapsing one after another and Japan finds itself unable to bail them out on its own.

Norinchukin Bank is the one in the worst shape and already technically insolvent if mark-to-market is done properly on the value of its assets as I described many times till the last article “NORINCHUKIN BANK IMPLOSION OFFICIALLY BEGINS“. This bank just reported almost 13bn USD of losses for the last fiscal year, and without the capital raise closed at the very last minute at the end of March, it would not have been able to maintain the minimum capital requirements to operate even considering the inflated value of the assets in its books. Norinchukin isn’t listed, which is why it does not make big headlines as it should, being the second largest bank in the country behind Japan PostBank (“Yucho”). Now, how come Norinchukin’s health is in such bad shape when the three largest and listed commercial banks in Japan reported record profits? The situation here is not very different from that of, for example, Bank of America, which is carrying a hundred billion USD of losses in its belly as I described in “BANK OF AMERICA’S Q1-25 EARNINGS: MORE SMOKE AND MIRRORS TO HIDE ITS INSOLVENCY“. How long will investors turn their eyes away and pretend everything is fine?

I am not sure they will be able to ignore the growing financial crisis in Japan much longer, and not because SoftBank’s situation is fast deteriorating as shown by its latest financial results (“SOFTBANK GOES ALL IN ON AI WITH THE LITTLE MONEY IT HAS LEFT“), but because of huge losses starting to pop up from the direction of usually low-profile Japanese insurance companies. Last week Japan’s top insurance company Nippon Life reported its unrealized paper bond losses tripled to an astonishing 25bn USD at the end of March (Japan’s Top Life Insurer Says Unrealized Bond Losses Tripled), yesterday Meiji Yasuda Life, another large Japanese insurance company, reported its unrealized losses by the end of March increased EIGHT TIMES in a year to 9.7bn USD (Meiji Yasuda’s bond paper losses jump eightfold as rates climb).

While everyone was watching in disbelief as JGBs 30-year and 40-year yields broke all-time highs every day, I was the only one, as far as I know, to warn about how that was disastrous for Japanese insurances, and now everyone is so surprised to hear them reporting massive holes in their books.

There is no easy way out of this disaster anymore for Japan because no matter what, JGB yields will continue to climb due to monetary inflation, and even if a stocks crash can trigger a “flight to safety” into JGBs, that will be just temporary relief because, as I explained above, negative real interest rates in Japan are larger and larger, making it difficult for anyone to hold JGBs for a very long time without significantly damaging their business. Clearly, “hold to maturity” is not an option anymore for Japan’s banks and insurances; only a default and restructuring of Japanese government debt “Greece style” can save the country from an assured financial implosion in the future if it remains on this course. This is an option I do not think anyone will be willing to consider in the near future because it would be catastrophic for the global financial system that benefited greatly through the years from the endless amount of liquidity printed by the BOJ and channeled into other financial assets via the JPY carry trade. However, there will be a time when tough choices will be required, and while nothing can happen for decades, a lot can happen in weeks, hence my suggestion to take all the necessary precautions because things can turn nasty all of a sudden when nobody expects.

JustDario on X | JustDario on Instagram | JustDario on YouTube