How many “AI” companies are currently listed? No, you should not include those “AI washing” their operations and earnings calls in the count. I refer to companies where AI is their core business, like advertising through internet search for Google, for example. Let me help you out, the number is in the single digits (worldwide).

Similar to the internet in the early 2000s, we haven’t seen AI applications become commercially viable products yet. Translated, the current stage of AI applications available to the public does not make money and not surprisingly, access to those is given away pretty much for free. Furthermore, what is the switching cost between OpenAI’s ChatGPT and META’s Llama? Close to zero.

In economics, what I just described is called an environment of perfect competition. In this environment, a company by definition cannot sell its product or services for a profit.

Believe me, and here I am speaking from the perspective of a person building an AI product himself, similar to the DotCom era when you saw real internet companies emerging in the aftermath of the bubble implosion, those that are building commercially viable AI products that solve real-world problems and can charge a fee for that netting a profit are still currently in the shadows and too small to make headlines. Or maybe I shall say too small to pay the MSM to write a sponsored article on them. Anyhow. If you are interested in knowing more in detail about what I am talking about, here is the article I published a while back: “WHY WE ARE BUILDING SYNNAX, AND WHY CREDIT INTELLIGENCE IS THE FUTURE”

Alright, now that I hope we all agree there is no “AI Bubble” if we use both words properly, let’s move on to the real problem here: semiconductor stocks.

5 months ago in the article “NVIDIA, ITS RECYCLED “#AI REVOLUTION” AND THE DARK SIDE OF IT KEPT AWAY FROM THE PUBLIC” I already attempted to bring to everyone’s attention how the companies systematically tried many times to jump on what was the “hype” of the moment to sell more GPUs beyond their very limited, and already saturated, gaming market.

As you can see from the article, the company attempted to hype the “AI Revolution” already in 2015 without success mostly because the crypto miners mania polarized all speculators’ attention at that time. So Nvidia was quick to pivot and jump onto that bandwagon, hyping the potential demand from it above and beyond what was reasonable. For this, the company ended up being fined by the SEC (”SEC Charges NVIDIA Corporation with Inadequate Disclosures about Impact of Cryptomining”

Between 2015 and 2017, #Nvidia wasn’t the only mega-cap company seeing its revenues plateauing, Microsoft had the same issue as well. #Microsoft and Nvidia were almost a match made in heaven, one company was desperate to sell more GPUs while the second was desperate to lift its Azure cloud and catch up with Google and Amazon, ultimately reigniting its revenue growth. Not surprisingly, in 2018 you started reading articles like this one: “Microsoft’s Intelligent Cloud group posts a 17 percent jump in revenue on 93 percent growth for Azure”

The two companies had a problem though, the market was too small for them to grow fast enough and please the nowadays very short-term oriented investors. This is why they came up with a sophisticated revenue “round-tripping” scheme I did my best so far to describe in all its beautiful ingenuity:

- 23 August 2023 – Is ARM The Canary In The NVIDIA Coal Mine?

- 22 November 2023 – NVIDIA (PONZI) “LIES” UNDER NVIDIA NOSE

- 1 December 2023 – NVIDIA “Elite Partners”

- 13 February 2024 – IS NVIDIA CURRENTLY EMPLOYING THE SAME ACCOUNTING TRICK TO INFLATE ITS MARGINS IT WAS PREVIOUSLY CAUGHT USING DURING THE DOT-COM BUBBLE?

- 22 February 2024 – NVIDIA – THE (FRAUD) SMOKING GUN?

- 22 May 2024 – WHAT IF NVIDIA SIMPLY TAGGED ALONG WITH A MICROSOFT AZURE SCAM PLAYBOOK?

- 23 May 2024 – NO, NVIDIA IS ONLY ONE PIECE OF A BIGGER (FRAUDULENT) PUZZLE

- 24 May 2024 – HOW TO FABRICATE REVENUES FOR DUMMIES (A GUIDE)

- 31 May 2024 – THE DARK CORNERS OF NVIDIA 10-Q REVEAL THE EXTENT OF THE NVIDIA FRAUD

- 4 July 2024 – MELLANOX, THE CORNERSTONE OF NVIDIA-MICROSOFT REVENUES ROUND-TRIPPING SCHEME

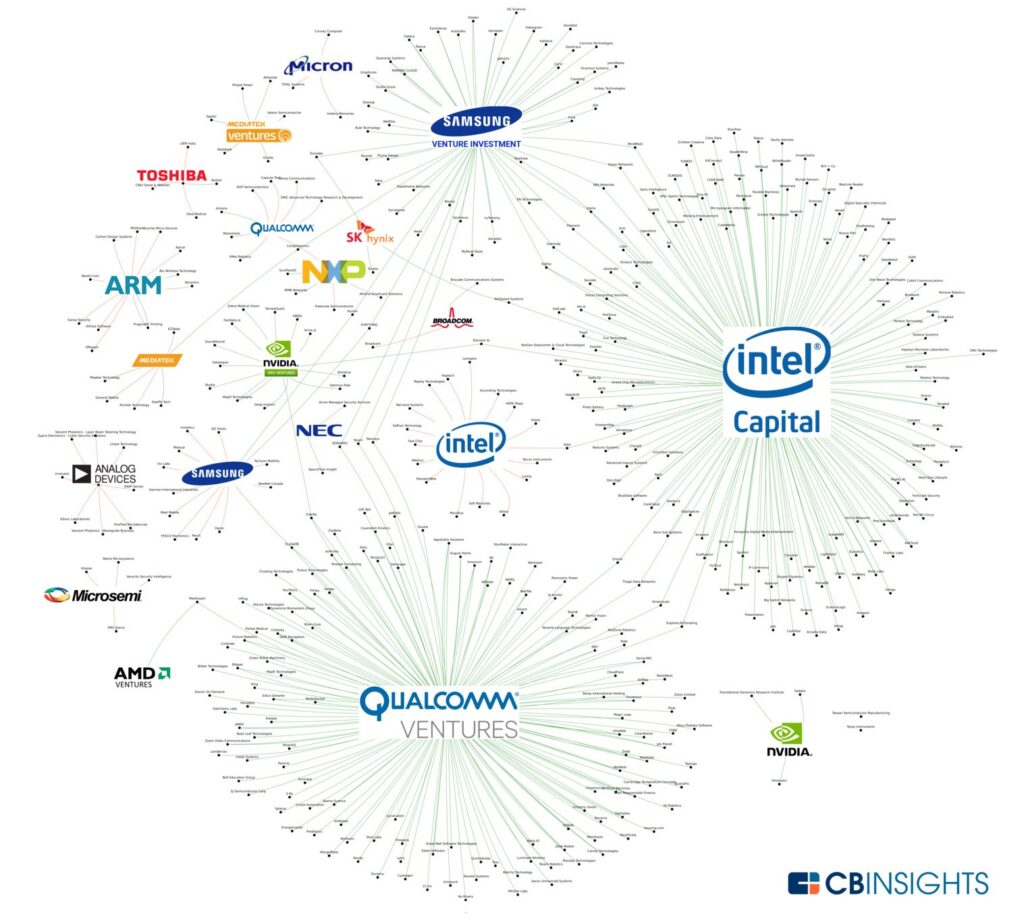

At this point, did you expect companies and investors that figured this out to just sit on the sidelines and let the Nvidia – Microsoft duo run wild with the (fabricated) AI hype, notching spectacular share gains in the stock market? Of course not. This literally triggered a race from struggling large semiconductor companies into the private market to invest in or acquire start-ups they could then “feed” their own services (and very often these acquisitions were mostly paid in “credits” rather than in cash in a fashion made popular by the OpenAI – Microsoft dealings)

All this combined created the multiple trillions worth semiconductors bubble, perhaps the biggest bubble in a sector ever, on top of which investors like Magnetar were more than happy to throw gasoline on (IS MAGNETAR CAPITAL BLOWING AIR INTO THE NVIDIA (PONZI) SCHEME SO THEY CAN BET ON ITS IMPLOSION?).

How is this going to end? Not surprisingly to me and I believe to all my dear readers, the market is starting to question whether all these billions in investments IN SEMICONDUCTORS would start yielding the promised profits: It started with Dell first (Shares of Dell fall 18% as AI servers are sold at ‘near-zero margins’) and slowly the doubt is spreading to the companies that so far benefit the most from the whole craze beyond the king Nvidia like Microsoft, Google, and AMD (Microsoft, Alphabet and AMD tout AI progress, but investors want tangible results). If history is any guide, similar to what happened in the early 2000s, the overspending on computer equipment made them so cheap in the aftermath of the bubble that small start-ups could benefit from it, creating commercially viable products. However, companies like Intel, Cisco, and the very same Nvidia ended up biting the bitter dust, and believe me, it is never “different” this time.