From a fundamental perspective, no matter from which angle you look at it, NVIDIA should be nowhere near its current price for a number of reasons, most of which are shady, to say the least, we discussed so far:

- July 4th – MELLANOX, THE CORNERSTONE OF NVIDIA-MICROSOFT REVENUES ROUND-TRIPPING SCHEME

- May 31st – THE DARK CORNERS OF NVIDIA 10-Q REVEAL THE EXTENT OF THE NVIDIA FRAUD

- May 23rd – NO, NVIDIA IS ONLY ONE PIECE OF A BIGGER (FRAUDULENT) PUZZLE

- May 22nd – WHAT IF NVIDIA SIMPLY TAGGED ALONG WITH A MICROSOFT AZURE SCAM PLAYBOOK?

- February 22nd – NVIDIA – THE (FRAUD) SMOKING GUN?

- February 20th – NVIDIA, ITS RECYCLED “#AI REVOLUTION” AND THE DARK SIDE OF IT KEPT AWAY FROM THE PUBLIC

- February 13th – IS $NVDA CURRENTLY EMPLOYING THE SAME ACCOUNTING TRICK TO INFLATE ITS MARGINS IT WAS PREVIOUSLY CAUGHT USING DURING THE DOT-COM BUBBLE?

- November 22nd – $NVDA (PONZI) “LIES” UNDER $NVDA NOSE

However, here we are with a 3 trillion-plus market cap stock trading at 75.56 Price/Earnings, 64.74 Price/Book, and 40 Price/Sales ratio. What do these ratios mean? If the current (ridiculous) expectations traders have for this name materialize as they are, whoever buys into this stock right now will need to hold it for more than 75 years to recover the capital invested and start earning a profit. Would you ever invest in something that will require more than an average person’s lifetime to see the profits? I am sure 100% of people will answer “no”, but somehow they fight basic human logic when it comes to very specific hyped names during periods of irrational exuberance. Without considering any external factor such as a new round of forced JPY carry trades unwinding, the options market is currently pricing a +/-10% move for the earnings day of a 3 trillion market cap stock. Putting this into another perspective, considering the nominal US GDP currently stands at ~28.7 trillion USD, a single stock can move up or down by a magnitude greater than 1% of the biggest economy in the world’s GDP. Isn’t this completely silly? Of course, it is, but yet we live in a period of time when people believe unicorns exist or donkeys can fly, so no matter how irrational something is, it can come true simply as a result of enough people buying into it.

There is one thing that is quite different this time from all previous ones: NVIDIA CEO Jensen Huang sold an incredible amount of shares ahead of earnings, more than 550m+ USD worth of them in little more than one month. Not surprisingly, the die-hard bulls quickly dismissed that since they only represent a tiny fraction of the total shares held by Jensen Huang, failing to understand a very simple dynamic of financial markets that doesn’t allow him to sell too many of those without starting to trigger alarm bells. If we look at NVIDIA insiders’ activity throughout its history, we can notice some interesting things:

- Besides a brief period in the aftermath of the DotCom bubble burst, NVIDIA insiders NEVER bought shares in the company

- The current amount of insider selling is, literally, off the charts

- The previous time such an unusual amount of insiders selling NVIDIA stocks occurred was right before the burst of the GFC

Honest question: if the future is so bright for NVIDIA and according to their promises the sky is the limit for this incredible stock, why is everyone cashing out so much of it, forgoing the opportunity of making an incredible amount of wealth in the future?

Now, unfortunately for NVIDIA, despite all the efforts from the FED to make sure nothing can spoil the bull run going into US November elections, the stock does not live in a vacuum where everything is hunky-dory. In particular, the JPY Carry trade is the current wild card that, as we saw at the beginning of this month, can easily spoil any plan to keep the status quo.

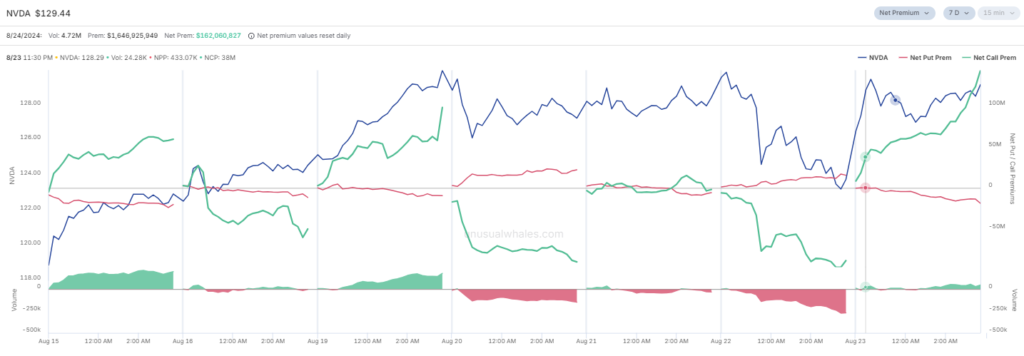

As we discussed in “A TRAVELER GUIDE TO NAVIGATE THE BANK OF JAPAN MESS” and as it was obvious during the first wave of JPY carry trades forced unwinding, NVIDIA among other mega-cap US stocks was a very big beneficiary of it and hence was greatly impacted by the forced deleveraging. Yes, the stock experienced an incredible recovery in just a few weeks from under 100$ to almost 130$, but how much of that was a factor of a reignited gamma squeezing options activity? As we can easily see from the chart below, the number of call options premium volumes traded in the run from 100$ to 130$ was on average 4 to 5 times larger than put options. An undeniable statement on the fact that the stock was simply squeezed up once again into its earnings (and in a greater magnitude than other mega-cap stocks).

Suppose we zoom in and focus on the net premium traded in the past week when the stock experienced incredible and very unusual swings for a very large-cap name. In that case, it is even more evident how NVIDIA price action is mostly a factor of options trading on the name (19th to 20th of August and 22nd to 23rd of August).

There is no better example to visualize what I tried to explain in “FINANCIAL MARKETS REACHED A “SINGULARITY” NO ONE WANTS TO DEAL WITH” and that makes this market incredibly dangerous even if most people fail to recognize it.

Furthermore, as we can see comparing the JPY with the Nasdaq, the latest squeeze created an incredible disconnect between the two.

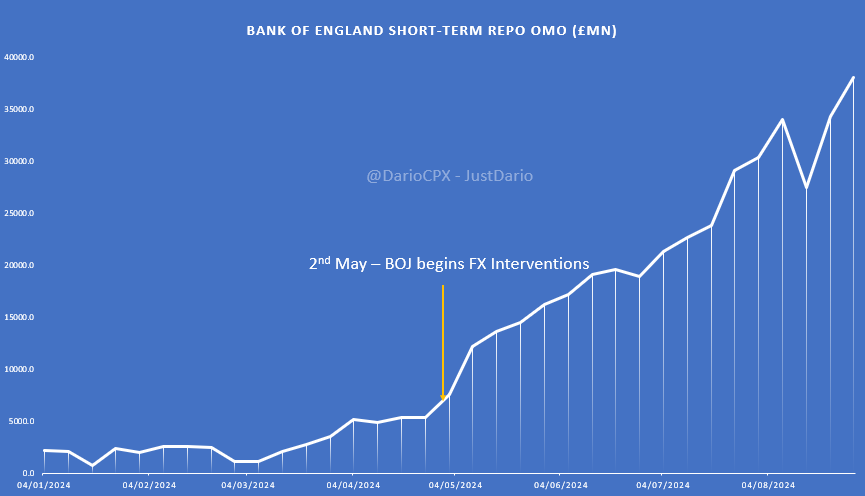

Where did traders likely find the leverage needed to rebuild their long positions? Look no further than the Bank of England (“THE JPY CARRY TRADE IMPLOSION CONTAGION IS ALREADY SPREADING INTO THE UK“)

What’s happening with the Bank of England is really telling of the desperate need for liquidity this market has to keep all the bubbles in US stocks, especially megacaps, standing. However, the BOE alone cannot continue alone to supply the vacuum created by the BOJ that is actively trying to manage its currency while avoiding another abrupt crash in its domestic stock market. How far are we from the breaking point? Hard to say, but the more you pull a rope, the higher the chances it breaks, ultimately causing the type of mess we saw for the first time between the 2nd and the 5th of August.

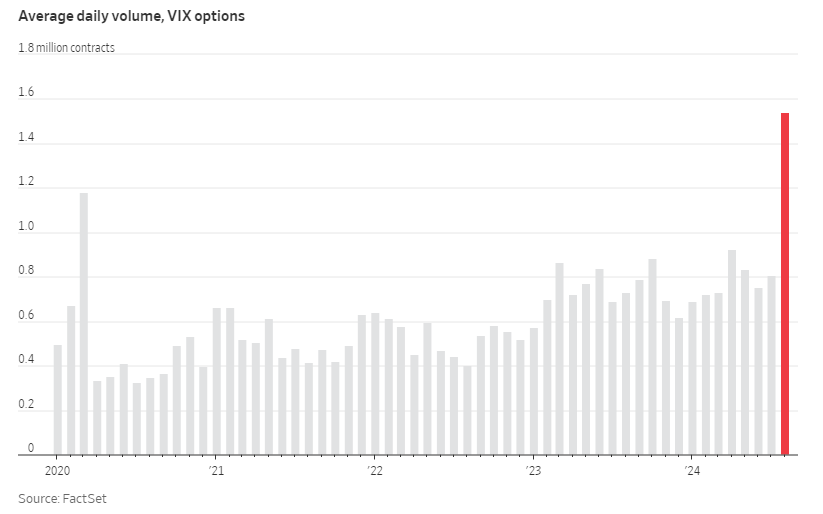

Clearly, the market as a whole is not so blind to the risks mounting this time, and as such, the options activity in the VIX and other volatility instruments has now reached levels we last experienced right before the infamous 2018 Volmageddon was triggered.

Putting it all together, what do you expect to happen if prior to earnings a forced deleveraging happens again, hitting stocks and options across the board? Obviously, stocks like NVIDIA that are so dependent on a relentless bull options flow to keep rising will suffer the most, and this time wise traders are putting some hedges in place to withstand that.

Why do you assume JPY M2 = the FX reserve Japan holds to calculate the true value of JPY?

Because that’s a straightforward relationship between the total amount of JPY in circulation within the financial system and the value of the reserves Japan can use to meet its monetary obligations