During 2023, we have discussed so often how (ridiculously insolvent) banks have made extensive use of “Hold To Maturity” accounting to the point that it is now more appropriate to rename it “Hide Till Maturity” (TwitterX). Dump any asset with a market value implying a steep loss in the HTM books, and the loss is “gone”. However, this trick has two significant weaknesses:

- If you are forced to sell the underwater assets in HTM books before maturity, then the loss turns from “paper” into “real”.

- If the asset matures, hence ceases to be eligible for HTM accounting, and the principal isn’t repaid in full, then the paper loss becomes a real one again.

In 2023, the FED took care of the first weakness with the #BTFP (non-bailout ??) that effectively allowed banks in liquidity crisis to borrow against the nominal value of their US Treasuries rather than the market one, dodging a forced selling that would have likely triggered a domino of regional bank bankruptcies. As I explained in a post almost 3 months ago (TwitterX), big banks too are benefiting from the #BTFP, which is why the only scenario in which this program isn’t extended this coming March is the one where the #FED led by Jerome Burns goes totally out of its mind.

The second weakness, greatly ignored by #FOMO#stocks investors, not only is about to become a major issue but is also a problem that the #FED and other Central Banks cannot tackle, avoiding the “bailout” shame. Good luck putting together another official financial system bailout in a big election year, not only in the #US but also in other G7 countries like #Japan and the #UK.

BEWARE – #FED CUTTING RATES DOESN’T FIX A BORROWER’S INSOLVENCY PROBLEM BECAUSE ITS PROBLEM IS NOT THE COST OF FUTURE DEBT BUT THE DEBT ALREADY ACCUMULATED

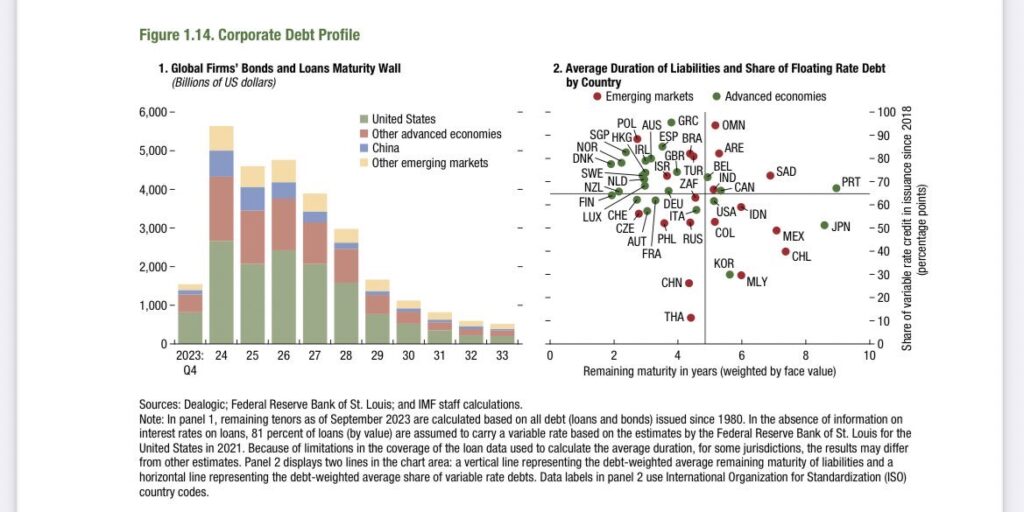

In 2024, you will have the US Treasury Department competing in the open market to raise Trillions of $USD (TwitterX), at the same time when 5+ Trillion $USD [Picture 1] of private corporate debt (bond + loans) matures, and, as if this wasn’t already enough, a lot of this private debt is going to be impossible to refinance because no one wants to be that last bag holder of a zombie company without the guarantee of a publicly sponsored TARP-like bailout fund. Simplifying all in a sentence: the “hide till maturity” trick is about to hit the (debt) maturity wall, literally speaking.

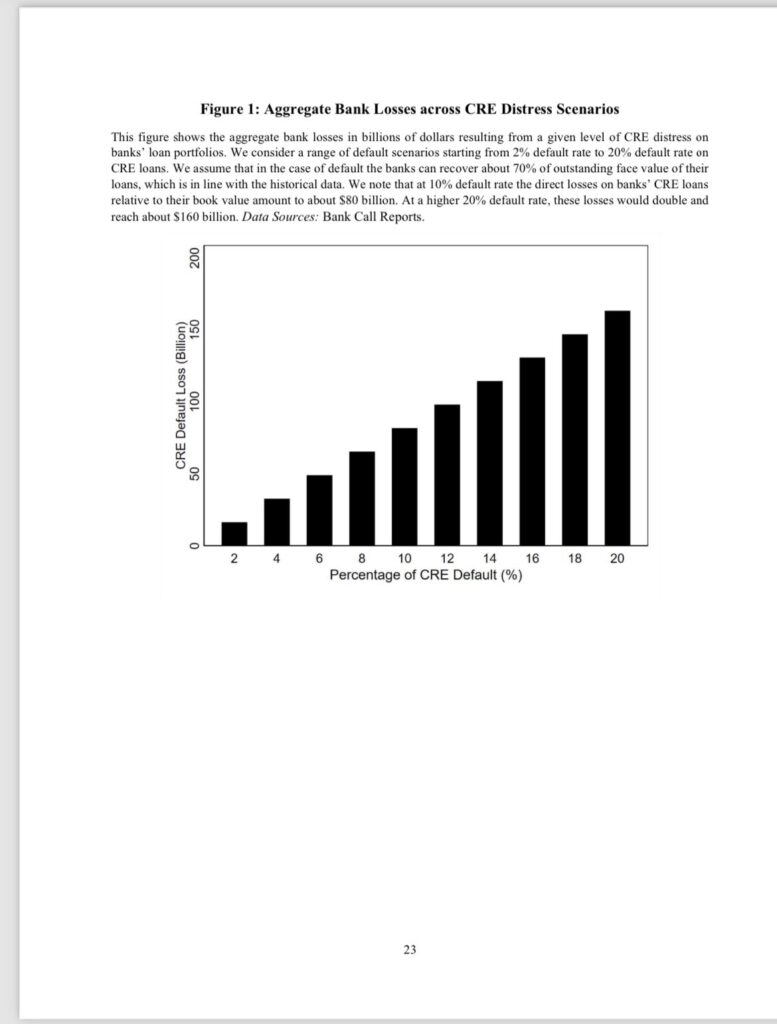

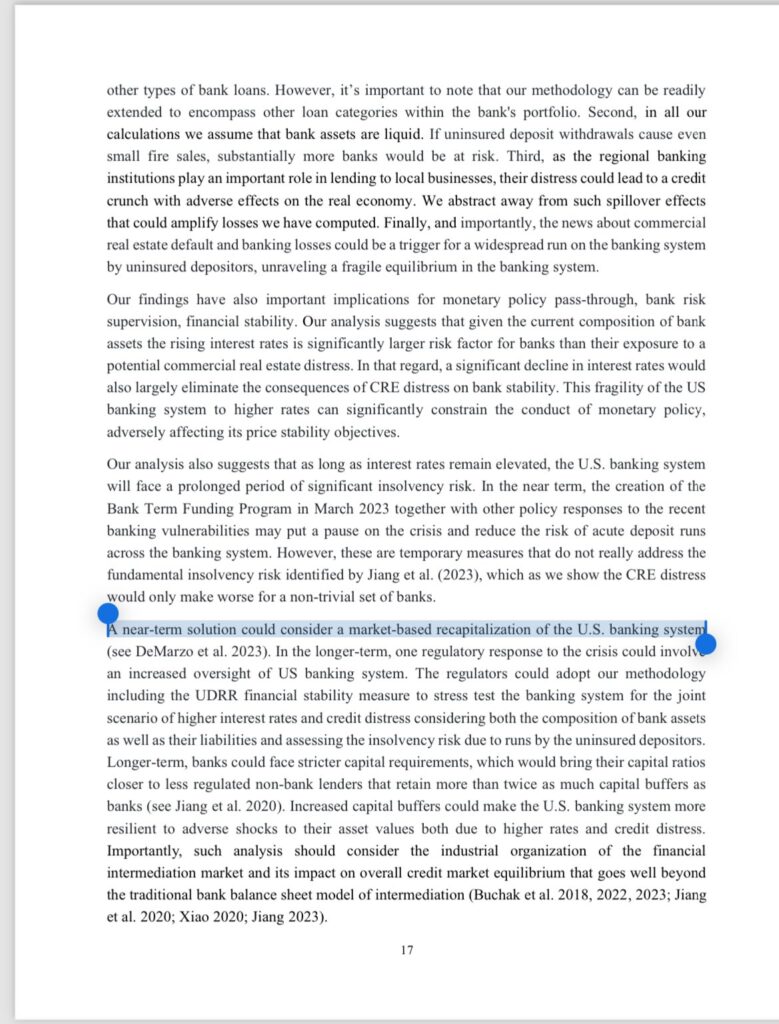

Which sector is the one likely to implode first? Commercial Real Estate. The National Bureau of Economic Research estimates just released in December [Picture 2] portray a situation beyond horrible and now hard to ignore for Banks like they did before (post in quote below). According to the NBER, 14.3% of CRE loans are in NEGATIVE EQUITY status. Many of the remaining ones are expected to face cash flow and refinancing issues due to the high Loan-To-Value in place (average 80%) and almost double debt costs in the current interest rate environment. At ~14% default rate, US banks already face more than 100bn$ of losses according to the NBER [Picture 3]. How to solve the issue then if #FED rate cuts are useless here? The NBER suggests: “A near-term solution could consider a market-based recapitalization of the U.S. banking system” [Picture 4]. Translated: BANKS NEED A BAILOUT

We know that CRE is only the tip of the iceberg of the financial system problems. Credit Cards debt, buy now pay later consumer loans, student debt, and on and on. The list is pretty long, and none of these issues can be fixed with either a rate cut or money printing because capital is all that matters to sustain credit losses and avoid insolvency materializing into bankruptcy. Perhaps 2024 will be another irrationally exuberant #bullish year for #stocks, but once the party ends, because for sure it will, the “debt hangover” this time around will be brutal.