I started the year writing about how in 2024 the practice used by banks of hiding their losses in Hold to Maturity books (hence “hide till maturity”) would have come to an end [Post Below] .

However, I was wrong there, because I wrote this: “As I explained in a post almost 3 months ago (TwitterX), big banks too are benefiting from the #BTFP, which is why the only scenario in which this program isn’t extended this coming March is the one where the #FED led by Jerome Burns goes totally out of its mind.”

Well.. As per the #FED press release that just came out at 7pm EST today (Picture 1), either our dear Jerome Burns finally realized what it means to be a Central Banker, or he lost his mind and unintentionally just rug pulled half of the US banking sector.

There is a potential third justification for the #FOMC action though: okay, we are in a US election year, and a bull market is good for the incumbent president, but looking at what’s happening with $NVDA, imagine if this idiocy pops before November from a much higher market cap, and Biden ends up being forced to bail out hedge funds, fraudsters, and gamblers singing “Kumbaya!” all together on this stock right now.

Please let me know in the comments what do you thinks is the reason that pushed the #FED to do what they just did. Nevertheless, the outcome is not going to change, and this is what’s coming.

THE #FED WILL STOP “LEAKING” LIQUIDITY

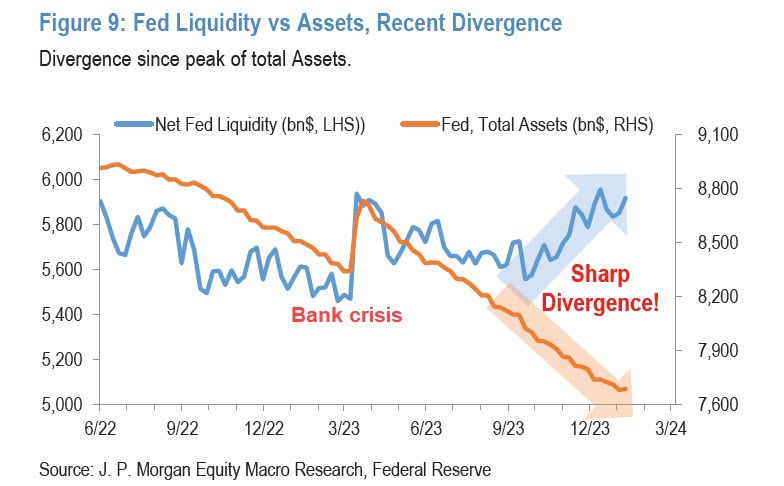

As you can see in Picture 2, the #BTFP was effectively #FED QE in disguise, and it is not a coincidence that the #stocks bubble re-inflated once the net liquidity in the system resumed its climb.

THE #FED WANTS (TO TEACH) BANKS TO USE THE DISCOUNT WINDOW

There are two reasons why banks don’t like to go (and beg) at the #FED discount window:

- Makes their liquidity issues manifest.

- The discount applied to the assets they want to pledge for liquidity (usually the best they can offer) will reveal the true value of their HTM books and, likely, their insolvency.

Now here is where the #FED is making a big mistake. Many US Regional Banks right now have an insolvency problem, hence they need capital. Accessing liquidity at the discount window won’t have any impact on the radioactive defaults in their Loans books. Imagine my shock if they already have a new TARP plan drafted out at the #FED but they hope there won’t be a need to disclose it before November.

INVESTORS WILL NOW SCRUTINISE BANKS’ BOOKS MORE SERIOUSLY

So far this year, the US banks’ earnings season has been horrible, to say the least. Ask anyone working in a bank how’s the mood there and what do they expect the business to go in the near future; while in #stocks, the morale is through the roof, bankers’ one is through the floor.

Despite this, bank #stocks have been doing okay since the Q4-23 earnings season started. Why? Because the #FED “got it covered” with its magic wand that could fix everything like, for example, empty shopping mall loans stuck in the books of a bank somewhere and now worth not even the cost of the material build that shopping mall to begin with. Management at banks like $BAC totally embraced this thinking to the point there is barely a trace of CRE crisis in their results: TwitterX.

Personally, I couldn’t believe my eyes 1 hour ago when the #FED announcement popped up on my screen, I even went to check if it could have been a deep fake or, like what happened to their #SEC cousins, the #FED too didn’t use a 2FA to protect their X account. But no, the official announcement was there on their website (Picture 3) and all it missed were 2 words at the end of it: “GAME OVER”.