One month ago in the article “DEAR DONALD, THIS BATTLE IS LOST” this is what I suggested the US administration should have done to salvage the situation:

“What should the US do now? Instead of borrowing a page from -The Art Of The Deal-, Donald Trump should consider reading Sun Tzu’s -Art Of War-. This battle is clearly lost, and it would be wiser to retreat to a safer position, reconsider the strategy, and resume fighting the war from a stronger position”

Hasn’t this been the outcome of the first round of tariff negotiations between the US and China? Forget about the charade of misleading headlines about a “deal”; the real outcome has been the US agreeing with China for a 90-day pause in commercial hostilities that both parties could claim as a victory. What’s the reality instead? Objectively speaking:

- The US administration dialed back all actions taken after April 2nd with the exception of Auto, Steel, Pharma, and “de minimis” exemption removal;

- 30% tariffs on imports from China will stay in place;

- China will keep a 10% reciprocal tariff on US goods instead;

- Trade restrictions and bans from each side will remain in place.

I will leave it to your own personal judgment to say who won and who lost here, eventually, because what matters most now are the consequences. Stocks, of course, rejoiced when the news broke and closed the day roaring with the Nasdaq now officially back in a “bull market” and Apple, Microsoft and Nvidia back in the 3 trillion USD value club. What about bonds? Well… things there did not go as many, surely starting from the US administration, expected they would. Interest rates across the board started to run higher with those of several countries like the UK and Japan back at warning levels. Was this reaction just a “risk-on” move with Hedge Funds leading the crowd-dumping safer US Treasuries and other government bonds to rotate mainly back to stocks? I didn’t say “hedge funds” randomly here because retail investors have been on a BTFD spree for the whole past month already, buying the stock dip with both hands and feet, increasing positions they did not scale back during the April 2nd chaos. What happened yesterday in yields was the result of fixed-income traders adjusting their positions in the rates derivative market to reflect the expectations of a more hawkish Fed going forward since the pressure to cut rates to rescue a fast-deteriorating economy is expected to be lower. Once upon a time, such a move in interest rates would have curbed stock traders’ euphoria, but clearly not anymore, and the reason for that is the abundance of liquidity in the financial system that reduces investors’ and companies’ concerns about refinancing their respective debt no matter the interest cost.

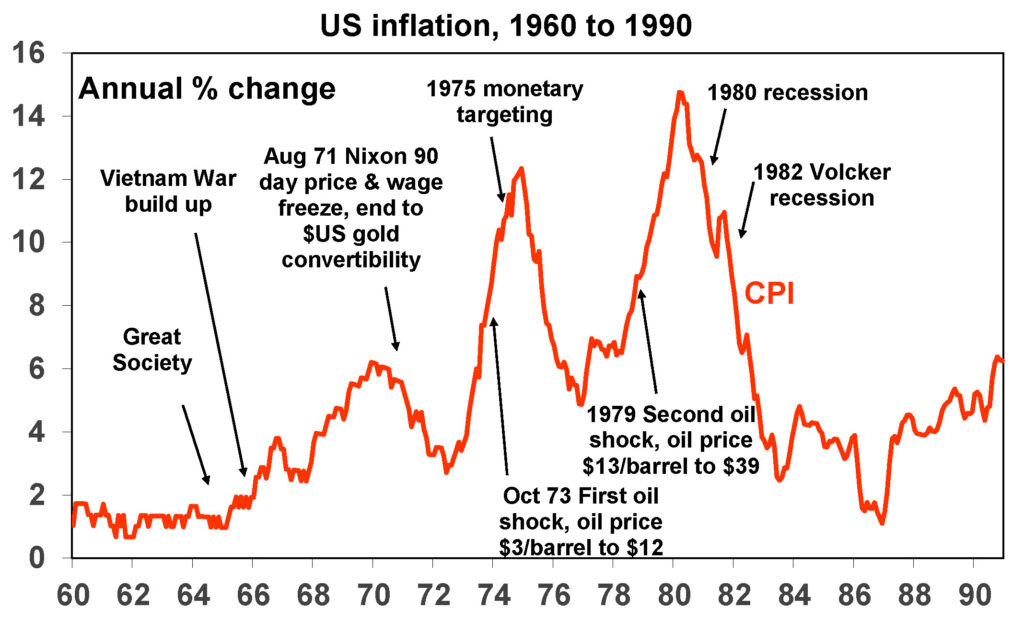

As I write, the US Treasury 10-year yield is back to ~4.5%, the UK GILT one is already at ~4.7%, and the Japan JGB is coming back fast at ~1.5%. What do you think is going to happen to inflation and, as a consequence, to government bond yields once corporations start transferring to consumers the cost of the various tariffs that will be in place and potentially go back up in 60 days for everyone but China? Let me share once again the chart of what happened to US inflation during the 1970s to help answer this question.

History does not repeat, but it rhymes all the time, and nowadays we have a combination of factors that can prompt inflation to jump back up by a lot as it did in the 1970s:

- Tariff wars;

- Corporates considering repositioning their supply chain to mitigate geopolitical risks in a move that will require CAPEX investments that will deter ROIs, not the opposite;

- Relentless monetary inflation fueled by non-stop central banks’ money printing in aggregate (with BOJ currently accounting for the lion’s share of that followed by the Swiss National Bank);

- Out-of-control government deficit spending;

- Significant debt refinancing needs in the US and massive debt fundraising plans in Europe.

Furthermore, as I explained a while ago in “FINANCIAL MARKETS REACHED A SINGULARITY NO ONE WANTS TO DEAL WITH“, GDP growth in major economies is now strictly dependent on government spending financed via government deficit that is monetized by central banks’ money printing. Some might argue the Fed has not been doing this for a while now, but they fail to recognize how global and interconnected the financial system is nowadays. As a consequence, if a central bank like the BOJ keeps printing JPY as if there is no tomorrow, more than compensating for Fed tightening efforts, the overall result is an increase of liquidity in the whole system that is then being channeled where there is a shortage of this very same liquidity. Paradoxically, if inflation rises, governments will have to increase spending even more to maintain positive real GDP growth (because inflation has a negative impact on the equation), but then if government spending increases while government finances are chronically in deficit, then debt will keep rising and its financing will require more money printing for the whole to remain sustainable. Money printing, though, causes more inflation and on and on in an out-of-control spiral that can only be broken by a Volcker-style type of intervention that nobody nowadays is remotely willing to consider.

Even if Donald Trump is trying all he can not to fall back into “Bidenomics”, after all I said and considering the latest government budget proposal currently in US Congress, isn’t this what is happening? Perhaps because he has little room for maneuvering as I warned many months ago in “HOW THE BIDEN ADMINISTRATION SET UP MINE FIELDS ALL OVER THE US ECONOMY TO UNDERMINE THE FUTURE GOVERNMENT IN CASE THEY LOSE ELECTIONS” and we indeed saw the consequence of that in the tantrum markets threw at him on April 2nd. Europe and Japan have been already dealing with stagflation for several years now with both ECB and BOJ having very little room to keep monetary conditions loose to support the economy and their respective financial systems. This is where the Achilles’ heel of the whole bull market lies; not only governments but also banks cannot sustain increasing yields because of the mounting losses this creates. At some point, something will break, but in the meantime, stock traders will keep enjoying the moment until the brutal reality hits, and at that point, there won’t be lifeboats for everyone.

JustDario on X | JustDario on Instagram | JustDario on YouTube