More than one year ago in the article “IS THIS HOW BANKS ARE CONCEALING THEIR LOSSES ON SILVER SHORT POSITIONS?” I first tried to bring attention to several anomalies happening in the Silver market that could only be explained by active price manipulation activities on LBMA and COMEX contracts. Why was a group of banks, already caught with their hands in the cookie jar back in 2014, so interested in holding back the price of Silver from rising? Because they all held significant short positions on Silver. Fast forward to today, the situation is very similar if not worse, but banks have grown smarter in hiding their troubles.

Before moving forward, I feel it is important to explain why banks are so adamant about short-selling silver. The answer is paper versus physical arbitrage. While the paper-to-physical ratio in silver is estimated to be not so different from gold at ~100:1, the silver market is in volumes (not in value) and turnover much larger than the gold one. As per recent data, it is estimated that ~56 billion ounces of silver have been mined so far compared to ~10 billion ounces of gold. However, unlike gold, of which ~45% is held in central bank reserves and ~40% in jewelry with the remaining portion split between private investors and industrial use, only ~2% of silver is kept in bullion as an investment while the rest is used in various industrial productions. Companies that use silver in their industrial production purchase futures contracts from banks to hedge the price of the commodity and limit their volatility risk in production costs. Companies almost never ask for delivery from banks, and the futures contracts tend to be settled in cash at maturity. As a result, as long as Silver futures prices remain in “Contango” (meaning future prices trade higher than spot) with the almost certainty of no delivery at maturity, this is an incredibly profitable business for banks that only have to sell long-term contracts and hedge with very short-term ones, then simply wait until maturity to pocket a big premium.

What if industrial companies that need silver cannot source the commodity from usual suppliers and instead turn to banks asking for delivery? This is where the problems begin because banks hold a tiny amount of physical reserves compared to the amount of contracts they write. Silver faces a 5th consecutive annual supply deficit in 2025 (117.6M oz), despite supply growth due to industrial demand (e.g., solar panels, AI chips) consuming 680M oz/year. It should not come as a surprise to see COMEX silver warehouse stock rising sharply in recent times since most of the futures contracts that trigger delivery are traded on that market.

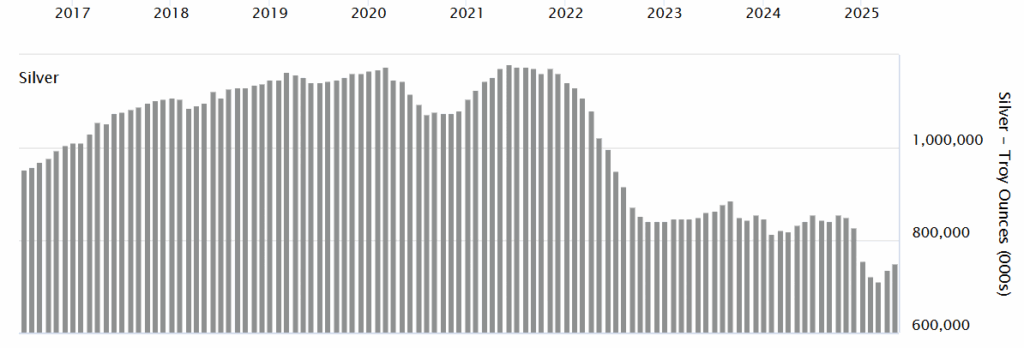

Where can bullion banks operating on the COMEX quickly find silver bars and ship them to the US to meet delivery requests? LBMA is usually their favorite venue, and as a result, the inventory of silver on the other side of the Atlantic Ocean is falling at a fast pace.

Pressures from industrial demand are being joined more and more by pressure from retail investors who are starting to buy physical silver as a hedge against rising inflation. Why? First, silver is simply much cheaper than gold, hence more accessible to a larger audience; second, silver is easier to find and cheaper to store safely for retail investors. Why aren’t investors simply buying physical silver ETFs that in theory would serve the same purpose but be more convenient to handle? For the same reason why physical gold is more and more in demand by retail compared to investment vehicles: these instruments are rarely backed by real silver bars stacked in warehouses but are often backed by IOUs against bullion vaults. When the paper-to-physical ratio is 100:1, it is intuitive that in aggregate there is simply not enough silver stored in vaults to back all the IOUs issued to these financial instruments. Considering only ~2% of the total silver supply is currently held for investment purposes, growth in this space combined with the demand for physical delivery will surely put a ton of pressure on bullion banks.

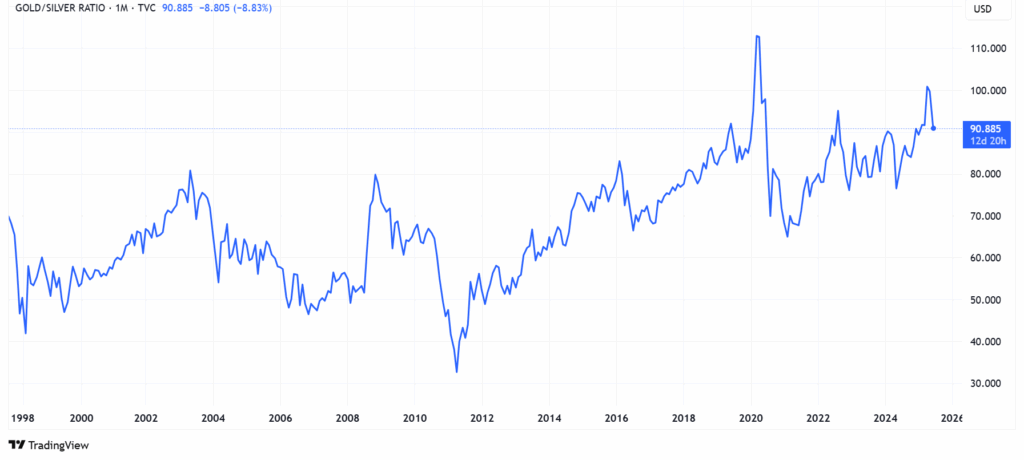

Because of the short-selling activity perpetrated at an industrial scale for many years by banks, the price disconnect between gold and silver has reached absurd levels, as you can see here.

How deep in the hole are banks currently? While the situation doesn’t look so dramatic at the COMEX with ~210 million ounces of silver net short positions, the real problem is in London where the silver market is mostly OTC and obscure. Recent estimates put at ~5 billion ounces the net claims for silver physical delivery in the London market, most of it leveraged through unallocated accounts and forward contracts. Silver “free-floating” held at the LBMA dropped 40% since 2020 to the point that today all the silver left in the vaults has a 1:1 ratio against all physical silver ETFs that supposedly hold their physical storage with the LBMA. This is a sign of extreme scarcity. Last month, COMEX requests for delivery hit a peak last seen in 2008, and dealers triggered forced cash settlements on 23% of the contracts to avoid default.

For every $1 increase in the price of silver, banks face 210 million USD of losses on COMEX alone, but if we include the OTC market, losses potentially balloon to more than 5 billion USD, on paper, for every $1 increase. JP Morgan is the bank with the largest known exposure to short silver contracts on the COMEX but is also known to tend to be net long in the OTC market to hedge it. Two banks instead are known to be large holders of short positions in the OTC market: UBS and Bank of America, with analysts estimating the latter held at some point an 800 million ounces silver short position (What Bank is 800 Million oz Short on Silver?).

These are paradoxically the 2 banks with their balance sheets most in trouble on their respective sides of the ocean, as I warned about so many times until recently:

- HOW THE UBS TITANIC KEEPS FLOATING DESPITE THE HOLE IN ITS HULL

- BANK OF AMERICA’S Q1-25 EARNINGS: MORE SMOKE AND MIRRORS TO HIDE ITS INSOLVENCY

UBS is also a major “market maker” and a full member of the LBMA, and as we discussed earlier, the LBMA is where signs of significant distress in the silver market are surfacing the most, with leasing fees to borrow silver recently spiking to ~7%.

Simply connecting all the dots now, everything points toward UBS as potentially the cause of the recent sharp increase in silver prices. This pressure on the bank joins the one the lender inherited from the reckless merger with Credit Suisse the bank was forced into a couple of years ago. It should not come as a surprise that the Swiss regulator is literally freaking out and asking the bank to substantially raise capital as fast as possible; however, the bank is pushing back because that will surely cost its current shareholders dearly. If we just take a look at UBS’s stock chart in the past year, it is quite clear something is off with the bank which is significantly lagging behind its peers.

The signs of a brewing short squeeze on silver are clearly mounting from many fronts; UBS might be the weakest of the pack here, but surely many banks will likely face troubles if this scenario unfolds. Paradoxically, central banks’ money printing isn’t helping here because extremely loose financial conditions now perpetrated for an extended period are fueling monetary inflation both in the real economy and across asset classes, with silver, incredibly, being the asset among the major ones that benefited the least so far and is still trading well below its recent peak in 2008. Pressures are mounting on the LBMA too, as I warned about a few months ago in “THE CONSEQUENCES OF A GOLD TSUNAMI HITTING THE LBMA“. How is this whole story going to end? I expect a credit event to trigger sooner or later and a sharp repricing in silver prices along with gold; however, not all investors will benefit from it. Those holding long futures contracts or ETFs backed by IOUs will see their investment value significantly impaired simply because creditors won’t be able to repay them in full. There is only one way one person can be sure to get through this incoming mess unscathed: holding physical.

JustDario on X | JustDario on Instagram | JustDario on YouTube