Before COVID-19 appeared it was very hard to imagine most of the globe being put under lockdown restrictions that differed in type and tightness country by country right? The last instance the world experienced something similar in terms of mortality, lockdowns, quarantines, and consequent economic disruptions created by all those factors combined was during the “Black Death” years when the Bubonic plague wreaked havoc across the World between 1346 and 1353. From a probabilities perspective, if you tried to calculate the chances of all those events happening at the same time before 2020 the result would be in the region of 1 in a million.

However, not even during the pandemic, all #Boeing airplanes were grounded, think about that. Now it looks like the event is starting to be taken into serious consideration, and not just as a hypothetical exercise, by banks and insurances. This topic surprisingly came up in a conversation I had last week and I decided to write about it because, despite so many articles being churned out on #Boeing for a while now, I hardly came across anyone addressing this aspect of the whole Boeing mess that, you will see, is quite of great importance.

First of all, it is important to understand why Airplanes, airlines, and all the businesses connected to Air Travelling are such a cash cow for both banks and insurance companies.

1- Airplanes are a great financial collateral asset (on paper)

Commercial airplane engineering is a mature sector that achieved incredible standards of quality, reliability, and safety in the past decades. Furthermore, airplanes are subject (in theory) to rigorous certification standards before any civilian passenger sets foot into them. What I described created a perfect setup for banks and insurance to make money:

- Airplanes are highly valuable assets with decades of expected life and very low depreciation

- Even if they fly in the sky, thanks to all the safety standards enforced (or believed to be enforced), airplane crashes are statistically extremely rare, consequently the chances of the asset being lost in an accident are very low. Furthermore, the event that the cause is a technical failure so far was more unique than rare.

- Airplanes are highly fungible, if the airline operator doesn’t do a good job in operating them and running a profitable business the asset can quickly be sold or leased out to another operator that will just need to apply fresh paint before starting to fly it under its company flag.

- Airplanes are a scarce asset, not only between placing the order to purchase and its delivery an operator easily has to wait years, but there is only just a handful of commercial airplane manufacturers (Boeing, Airbus, Embraer, and COMAC)

2 – Thanks to decades of “free money”,Banks inflated (directly through their subsidiaries or indirectly through lending and guarantee agreements) their exposure to Airplanes as an asset.

A great study published in 2023 in the Journal Of Air Transport Management titled: “Is the aircraft leasing industry on the way to a perfect storm? Finding answers through a literature review and a discussion of challenges”. Not surprisingly the study didn’t really make any MSM front page, why?

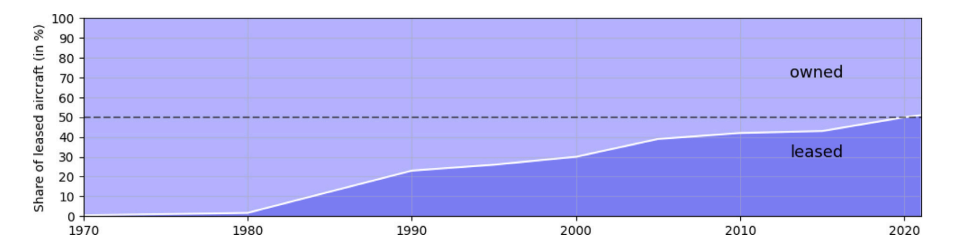

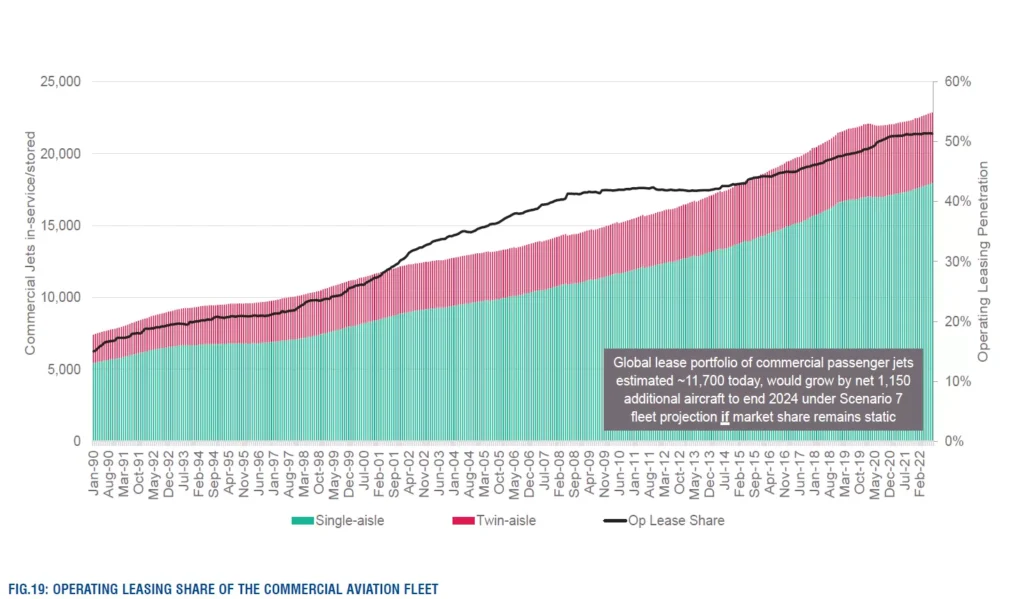

- Today more than 50% of the aircraft are leased instead of being owned by the airlines.

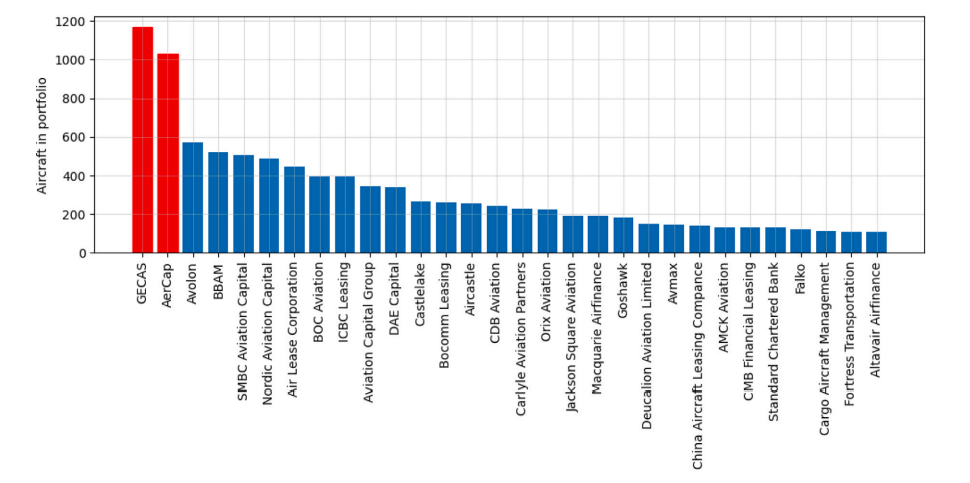

- Hundreds of aircraft are directly owned by leasing companies controlled by big financial conglomerates. Among these, 2 leasing companies own thousands of aircraft each: GE Capital Aviation Services and AerCap Holdings N.V.

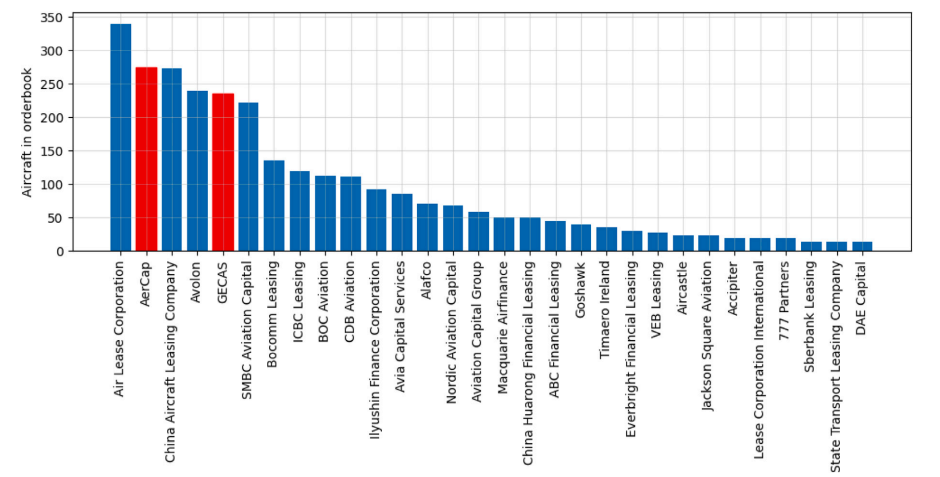

- As if this wasn’t already a high enough number, Aircraft leasing companies already ordered hundreds of airplanes waiting to be delivered

- Leasing airplanes is a very profitable, stable business, and at the end of the contract the lender often doesn’t need to bother about the asset anymore since this is often purchased for its residual value by the lessee airline

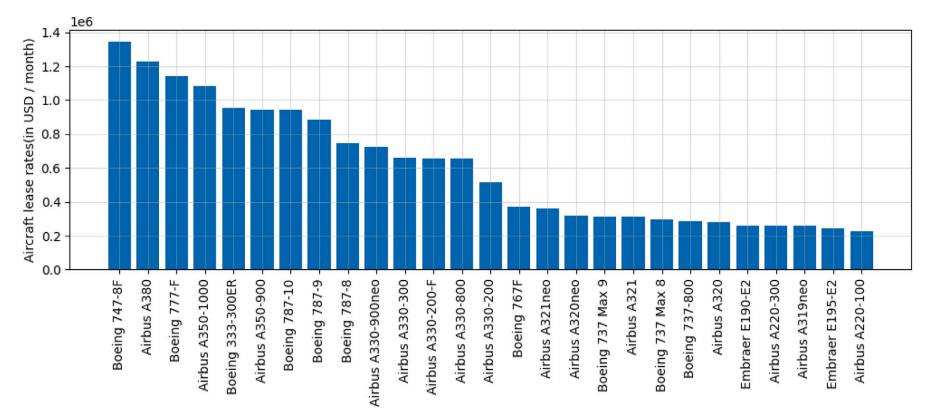

The table below is a great snapshot of the rates lessors apply to aircraft leasing every month (in millions of dollars)

3 – For the same reasons described in point 1, even despite COVID-19 events, insurance companies kept growing their aircraft insurance business

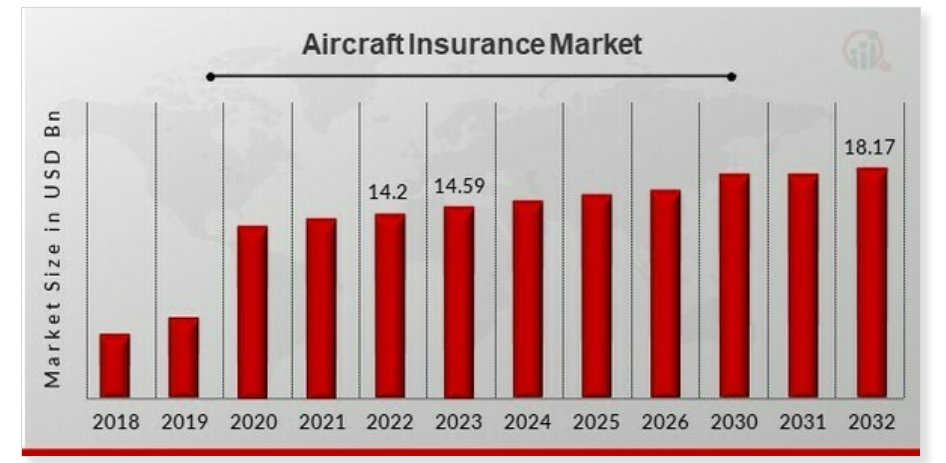

A Market Research Future(r) report published in 2022 provides a great snapshot of the sector and its future growth projections

- 14.2bn$ in premiums were collected in 2022 and the total is expected to grow to 18.17bn$ by 2032 for aircraft insurance alone

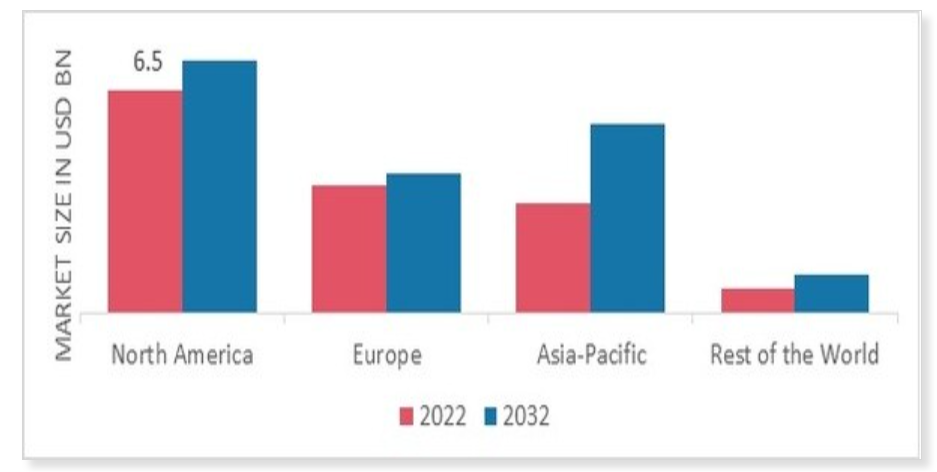

- Almost 50% of the market is concentrated in North America

- Major players in the market are also North American companies: American Financial Group Inc., American International Group Inc. and, Berkshire Hathaway Inc.

Now that we have a better understanding of the size and ramifications of this market it is important to understand the “financial supply chain” to map all the related risks.

1- Negotiating Lease Terms: The airline negotiates lease terms with aircraft leasing companies. These terms include the duration of the lease, monthly lease payments, maintenance responsibilities, return conditions, and other contractual terms. Negotiations may also involve discussions on lease rates, security deposits, and lease-end purchase options.

2- Due Diligence and Documentation: Once lease terms are agreed upon, both parties conduct due diligence. This involves verifying the aircraft’s maintenance history, regulatory compliance, and overall condition. Legal teams from both the airline and leasing company work together to draft and finalize lease agreements and related documentation.

3- Financing Arrangements: The airline secures financing for the lease through various means, including commercial banks, export credit agencies (ECAs), or capital markets. Banks may provide loans or lines of credit to cover lease payments or collateral requirements.

4- Insurance Coverage: The airline obtains insurance coverage for the leased aircraft, including hull insurance (covering physical damage to the aircraft) and liability insurance (covering third-party damages). Insurance providers assess risk factors and premiums based on factors such as aircraft type, usage, and operating environment.

5- Lease Management and Compliance: Throughout the lease term, the airline manages the leased aircraft’s operations, maintenance, and compliance with regulatory standards. The leasing company may monitor the aircraft’s performance and adherence to lease agreements, including maintenance schedules and insurance requirements.

6- Maintenance and Support: The airline arranges for ongoing maintenance, repairs, and technical support for the leased aircraft. This may involve maintenance contracts with OEMs (Original Equipment Manufacturers), MRO (Maintenance, Repair, and Overhaul) providers, or in-house maintenance teams.

7- End of Lease: As the lease term approaches its end, the airline prepares to return the aircraft to the lessor in accordance with lease agreements or to pay the residual value of the contract to obtain full ownership of the airplane.

Now, what are the circumstances airlines can terminate a lease agreement in advance, return the aircraft to the lessor, and leave them to deal with the financial loss associated?

- Early Termination Clause: The lease agreement may include an early termination clause that allows the airline to terminate the lease before the end of the agreed-upon lease term under certain conditions.

- Default: If the airline fails to meet its obligations under the lease agreement, such as failure to make lease payments, maintain the aircraft according to agreed-upon standards, or comply with regulatory requirements, the lessor may have the right to terminate the lease due to default.

- Force Majeure (FM): In cases of force majeure events such as natural disasters, political unrest, or regulatory changes that significantly affect the airline’s ability to operate the aircraft or fulfill its obligations under the lease agreement

- Material Adverse Change (MAC): The lease agreement may include a clause allowing either party to terminate the lease if there is a material adverse change affecting the aircraft’s value, operational capability, or the airline’s financial condition.

- Repudiation or Insolvency: If the airline becomes insolvent or enters bankruptcy proceedings.

What’s happening at the moment with #Boeing continuous stream of incidents and technical failures is obviously increasing “Force Majeure” and “Material Adverse Change” risks substantially. Why?

- The FAA and other regulatory bodies might decide to pull the safety certification to various airplane models grounding the fleet till the safety standards are not satisfied again by the manufacturer and/or the airlines. Personally, I see low chances of this happening not because the airplanes are safe and the incidents were isolated events, but because #Boeing and Airlines have a big “lobbying firepower” with politicians and regulatory agencies considering the vast amount of GDP and Jobs they do represent in an economy

- The public concern to fly on a #Boeing plane will inevitably increase, airlines operating a Boeing aircraft will start experiencing a growing number of cancellations (triggering requests for refunds) and loss of future reservations (hence revenues plus cash advances). Do you think such an event is unlikely to happen? Then you might have missed what has been the consumers’ reaction towards Malaysian Airlines after the infamous MH17 and MH370 incidents or prior to that the events that led to the early retirement of the supersonic Concorde airplane. Personally speaking, I am one of those who feels more and more uncomfortable flying on a #Boeing airplane and I can see from social media a growing audience is sharing the same sentiment

By now it should not come as a surprise anymore that many financial institutions and insurance companies out there are taking seriously the event of a large number of FM and/or MAC clauses included in #Boeing airplanes leasing contracts to be triggered. Insurances are even revising the projections of potential accidents and technical failures to occur with a high chance of a sharp increase in insurance premiums requested to cover risk related to a #Boeing airplane.

How big of a financial risk this is? It is estimated that the Aircraft Leasing Market Size reached 173bn$ in 2023 (research report) and according to KPMG research “The Age of Leasing”, the estimated portfolio value of the top30 aircraft leasing companies is 260bn$+ worldwide with more than 20,000 airplanes currently in operation being leased.

How many of these airplanes are estimated to be #Boeing ones? About 40% or 100bn$. Beware this value does not include the orders backlog.

To conclude, how much residual value do you expect all these #Boeing planes will have in the extreme scenario no passenger will be willing anymore to fly on one of them? 50% lower? 75% lower? You decide. Who is going to take the burden to do all necessary repairs for these airplanes to be compliant with safety standards again? No chance the airline companies can take this burden since many of them will be sent to bankruptcy right away. According to my conversation last week, some “worst case scenario” projections do see losses mounting to 200bn$+ across assets loss of value, and missing future revenues.

Now it should be clear why it is in many people’s interest not to trigger a “Boeing financial nightmare”, but this will surely come at the expense of public safety (likely considered a risk still worth taking in the grand scheme of things). Will the public be ok with that? I do not have a crystal ball, but it is reasonable to expect a growing concern for the overall situation in particular after the Boeing whistleblower was clearly “suicided” this last week.