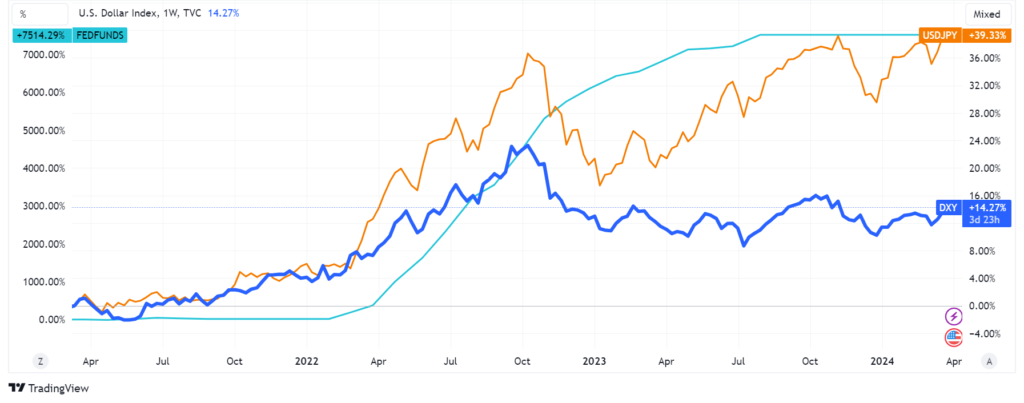

The USD dollar keeps strengthening and currently, the $DXY index is trading again above 105 or up ~0.77% in the past 5 days. What about the $USD / $JPY exchange rate? It’s only up ~0.14% while, instead, it should already be trading above 152, also considering the move in US Treasury yields in the past 24 hours.

152, for reasons yet unknown, is clearly a key level as we observed last week in “WHY IS #JAPAN SO SCARED ABOUT $JPY CROSSING 152 AGAINST THE $USD?”. However, what is becoming clearer and clearer to a larger number of people now is that all the reckless economic decisions taken by Japan in the past 30+ years are now starting to show their ugly faces altogether at the same time.

The drop that clearly sealed Japan’s economic fate was the incredible Bank of Japan’s stubbornness in keeping its monetary policy ultra-loose despite every other central bank in the world starting to increase rates at the fastest pace ever experienced after the inflation danger could not be ignored anymore.

That decision triggered the monstrous pick-up in JPY carry trades that kept fueling the speculative mania in the US and Europe, making FED, ECB, and other major central banks’ “restrictive” policies completely ineffective. Incredibly, Japanese stocks did not benefit from the flood of extra liquidity injected by the BOJ till the first big currency intervention in late 2022. Why? Because till that moment, liquidity was constantly leaving Japan, and selling US treasuries in the market for USD effectively put a ceiling on JPY devaluation and made it more convenient for foreign investors to use JPY leverage to buy Japanese stocks that at that time still offered a real yield compared to the deeply negative one reached by foreign investments (less attractive the more they increased in price).

The flow of money from foreign investors, addicted to leverage, was so powerful that Japanese stocks increased well above Wall Street banks’ already optimistic forecasts. For example, Goldman Sachs predicted the Japan TOPIX index would reach 2,650 by the end of 2024 (Japan’s stock market is forecast to have a transformational year in 2024). Where is the TOPIX index trading right now? 2,720!

As I showed in the article “WHY A HISTORICAL $JPY CURRENCY CRISIS IS AT THE DOORSTEP OF #JAPAN”, little to nothing of all that monetary stimulus from the BOJ trickled into the real Japanese economy that is now dealing with rising inflation not reflected in an increase in neither corporate nor country revenues. Suppose you think about Japan in terms of assets and liabilities. In that case, you can easily realize that “Japan Co.” is inexorably falling into negative equity (debts rising much faster and beyond sustainable amounts compared to the asset side of the equation).

The current situation is not very different from the one that led to the British Pound crisis in the early ’90s. In October 1990, the UK joined the ERM, a system designed to stabilize exchange rates between European currencies in preparation for the eventual adoption of the Euro. At that time, the UK pledged to keep the value of the pound within a certain range relative to other European currencies. 2 years later on September 16, 1992, the UK government under Prime Minister John Major was forced to withdraw the pound from the ERM after spending billions of pounds trying to prop it up (triggering the famous “Black Wednesday”).

Suppose we consider the first monetary intervention when the BOJ had to avoid the JPY breaking the 152 level against the USD. In that case, it is almost 2 years since the BOJ is effectively into an unsustainable “Exchange Rate Mechanism” similar to the one that broke the BOE back in 1992. This is why we can reasonably be months, if not weeks or days away from an incredibly sharp and uncontrollable devaluation of the JPY where the FED has little room to keep helping Japan now that their efforts of doing that so far reignited inflation back in the US and pressure on US yields to increase is back. FED rate cut expectations in June are already tumbling (now below 50% chance) after the latest US PCE data. Remember, we started the year with the market expecting 6 cuts of Fed Fund rates. Any honest macro observer knows that right now there are no reasonable chances the FED will cut rates at all in 2024 unless a huge liquidity crisis hits the financial system and that is what is potentially going to happen very soon when a JPY currency crisis will force many financial institutions to unwind their carry trades (as I explained many times, JPY carry trades, because of hedging trades in place, do require increasing collateral to be posted the more JPY devalues). If this happens, are you still sure FED rate cuts will be bullish for the economy and the stock market? Obviously not.