Honestly, at first glance, what #WFC reported for Q4-23 didn’t seem great, but not particularly bad either. Overall, their Q4 seemed quite dull. I was tempted to move on, but as an old habit, I had to read the footnotes first and here we go, I finally came across something interesting!

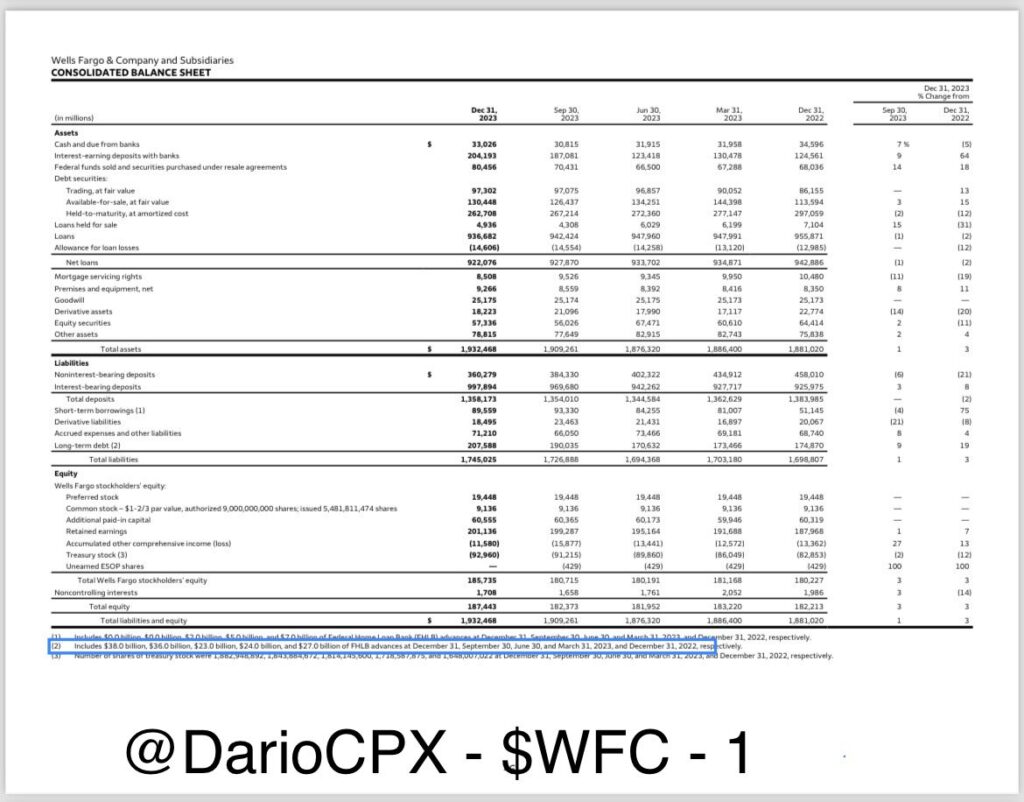

As you can see highlighted in Picture 1, #WFC borrowed 2bn$ more from the #FHLB in Q4 after borrowing a significant 13bn$ in Q3

So, while #stocks were running towards new All Time Highs, yields were crashing (in theory helping banks reduce their “paper losses”) and we even got #FED Jerome Burns cherry on top of the cake “pivot”, #WFC still had issues financing itself in the open market and had to rely on the #FHLB. For the record, they were the ONLY one among the top 4 banks that reported on Friday that disclosed additional FHLB lending. This stinks.. so I started digging deeper.

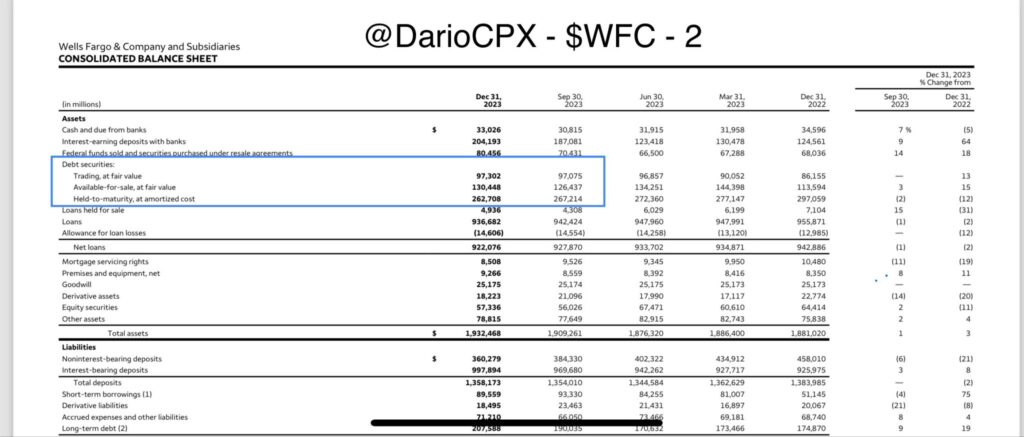

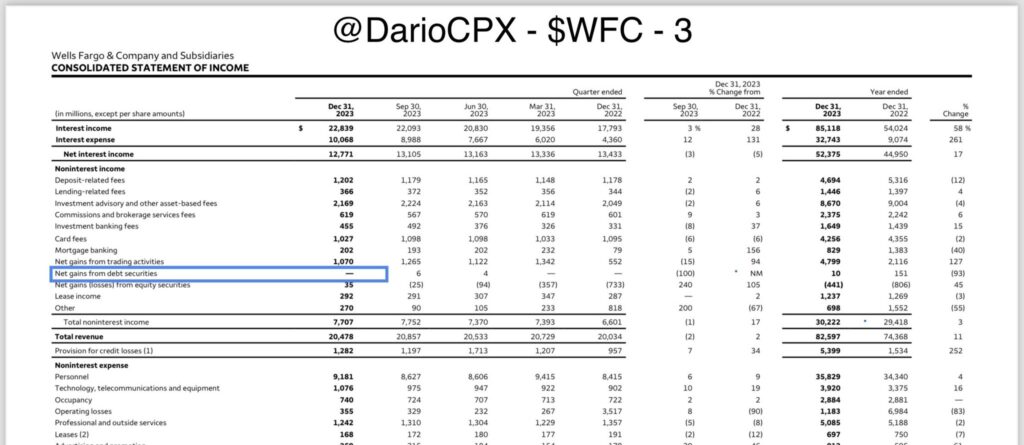

The second step about #WFC financial is that the total value reported for “Debt Securities” adding together Trading, AFS and HTM books is IDENTICAL between quarters: 490bn$ in Q4 vs 490bn$ in Q3 [Picture 2]. Furthermore, #WFC reports zero net gains from debt securities in its Q4 income statement [Picture 3]. So basically, all #WFC did in Q4 with regards to its Debt Securities was to spread 4.5bn$ assets from HTM books between AFS and Trading books without any impact on their income statements? This despite the massive moves in rates in Q4? Oh dear, it stinks even more..

So #WFC needs to continue borrowing from the #FHLB and somehow barely touches its Debt Securities books. Did they do that by choice or because perhaps they cannot touch them?

Well… to answer this question I had to go back digging in #WFC 10-Q SEC filing for Q3 because in the current documents just released they are only required to disclose the bare minimum (since they aren’t regulatory filings) and for the rest, they can cherry-pick what to show and what to hide.

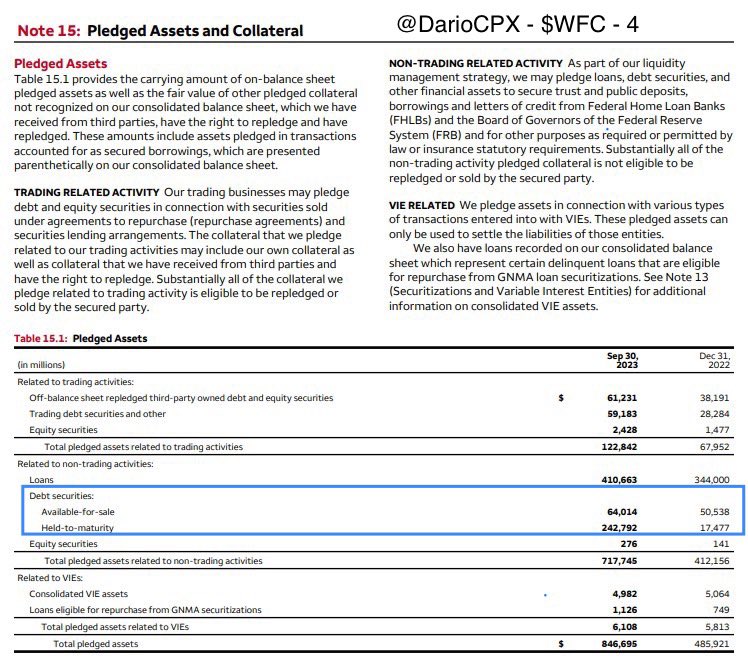

Now please have a look at picture 4 from #WFC Q3-24 10-Q, the amount of HTM + AFS Debt Securities “Pledged Assets” (hence showing in their balance sheet, but #WFC cannot freely move) jumped from 68bn$ in Q4-22 to 307bn$ in Q3-23! So out of a total of 393.5bn$ of HTM+AFS Debt Securities #WFC held on balance sheet in Q3, 78% was either pledged as collateral or collateral due to be given back to their counterparts in the future.

Well… considering what we discussed above we can confidently say 2 things:

- the amount #WFC “cannot move” is similar (if not higher) in Q4

- the amount #WFC didn’t pledge as collateral might not be collateral worthy (i.e. “toxic”) hence they exhausted their options in the open market forcing them to continue borrowing from the FHLB

As if what I just described wasn’t already concerning, if you look again at Picture 3 you can quickly see how the total of 845bn$ of assets #WFC pledged in Q3 was equivalent to almost 45% of its entire Balance Sheet

Why is this last red flag concerning? Because if you consider that the bank already pledged almost all its HTM+AFS debt securities and “only” 410bn$ in Loans while still borrowing from the FHLB, it puts the remaining ~500bn$ in loans they hold under a very bad light… red to be precise… meaning they are likely “bad loans” and there is no market to finance them directly

Furthermore, after all I described, it’s fair to question whether the 317bn$ of “cash equivalent” assets #WFC reported in Q4-23 are truly theirs or a good chunk of them is the result of a highly sophisticated house of cards of pledging and re-hypothecating agreements set in place to make the bank look healthier and more liquid than what it truly is.

Unfortunately, to answer these last open questions we will have to wait for Wells Fargo’s 10-Q SEC filing for Q4-23. In the meantime, we better hope the picture we see through the fog won’t be as bad when the fog dissipates…