Have you noticed how large companies are increasingly announcing initiatives and projects without well-defined business plans or existing funding, which are expected to generate results several years in the future? Have you observed how many large companies are launching products with claimed huge sales potentials that never materialize?

The beyond ridiculous “Stargate” project announced by the one and only Jedi Scam Master Masa Son (Masaponzi for friends) and his new Padawan S(c)am Altman (who replaced Adam Neumann) yesterday at the White House, along with Larry Ellison – who, let’s not forget, was Elizabeth Holmes’ “Advisor” and investor in the Theranos fraud – is the latest in a list of recent examples of “great announcements” that will surely be followed by “great disappointments” I can provide:

- Google’s best Gemini demo was faked

- The Complete Failure of Microsoft Copilot

- Apple’s new AI iPhones aren’t yet moving the dial

- Apple’s Vision Pro Production Reduced: A Failure Admission?

- NVIDIA’s Blackwell AI Servers Faced With Overheating & Glitching Issues; Major Customers, Including Microsoft & Google, Start Cutting Down Orders

- Dell Stock Sinks. Does It Actually Make Money Selling AI Servers?

Let’s be honest here: these companies are valued by the market at trillions of USD, employ thousands of incredibly smart people, and yet they keep accumulating one failure after another. In the past, companies that failed to deliver were ultimately “punished” by investors who withdrew their support and reassessed their positions on the stock. Why doesn’t this happen today anymore? The answer is simple: active investing is going extinct.

Let me explain how companies have learned to exploit the “announcement effect” to inflate their share values:

- First, the larger the number of indexes tracked by ETFs and passive funds, the higher the buying pressure triggered by an increase in price relative to other stocks in the basket.

- Second, companies create hype to trigger “momentum” ahead of the announcement. As more investors buy options to bet on a potential upward jump in stock price due to the incoming announcement, brokers buy more shares in the market to delta hedge. This buying starts lifting the price and triggers additional passive investor buying as the weight in the tracking indexes basket increases.

- How do companies prevent the “sell the news” effect once the announcement is made? Through stock buybacks. These large companies know they could face price manipulation charges if buybacks occur before an announcement, but this isn’t the case when resuming after an announcement when option traders cash out their profits and brokers trim their delta hedging positions by selling shares. Here’s the catch: thanks to buybacks, these sold shares don’t return to the stock’s float, which effectively keeps shrinking.

- By repeating this process while catching overall positive market momentum and, potentially, exploiting the support of traders actively profiting from gamma squeezing the options on a stock, the number of shares moving into passive investors’ portfolios increases almost exponentially.

- It should now be clear why stocks barely react to “bad news” nowadays (and the bigger the market cap, the smaller the reaction): passive investors don’t sell shares unless their weight in the various index baskets decreases significantly enough to trigger a rebalance.

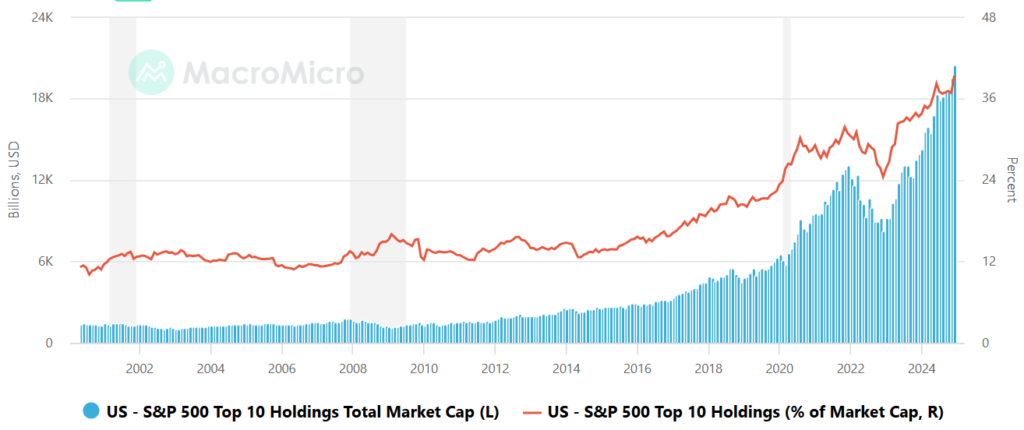

All these very large companies need to do to exploit this market inefficiency is continue announcing grand future plans to boost expectations and feed the FOMO of investors who keep seeing an influx of liquidity constantly printed by central banks. It shouldn’t surprise anyone that market cap concentration in the largest stocks has reached historic highs.

Be careful though – while everything I’ve described works well in bullish markets, what happens if the general momentum turns bearish? Passive investors won’t sell unless the weight in the index basket changes, meaning sellers will face an incredibly thin float in the market when there are few buyers willing to show a bid (because sentiment is bearish). Furthermore, if option traders turn bearish, brokers will start short-selling shares in a market without buyers, potentially triggering significant price drops similar to what we saw in mid-2024 when, “for no reason,” NVIDIA shares fell from ~140$ to under 100$ in a very short period. This risk is particularly acute for companies like APPLE that have spent more than half a trillion USD on share buybacks, disproportionately reducing their real float compared to peers (rather than properly investing in their business to maintain true long-term organic growth).

To conclude, it’s evident that the overwhelming growth of passive investing and derivatives volumes isn’t just distorting the market – large companies have been actively exploiting these conditions to inflate share prices in the short term, benefiting insiders who continue dumping billions of USD of shares, even though this trend should raise eyebrows as it objectively contradicts their consistently bullish announcements.

JustDario on X | JustDario on Instagram | JustDario on YouTube