The Q4-2024 banks earnings season officially started with JP Morgan, Wells Fargo, Goldman Sachs, BNY Mellon, and Citigroup kicking off the “beat expectations” parade:

- JPMorgan notches another record year of profits

- Wells Fargo shares jump after earnings beat, strong 2025 guidance

- Goldman Sachs shares rise after topping estimates on strong trading results

- Citigroup soars as Fraser plans to buy back $20B of stock

- Bank of New York Mellon beats Q4 estimates, shares rise

Between one “Kumbaya!” and a “High Five!”, one small detail across all these earnings reports clashes significantly with reality: provisions for expected credit losses.

Before diving into the banks’ reports, let’s first examine what’s happening in the real world where real people live:

- US corporate bankruptcies hit 14-year high as interest rates take toll

- Bankruptcies in Germany at highest since 2009 financial crisis

- UK Business Closures Surge After Budget Hit to Employers

- Japan’s bankruptcies set to hit 11-year high in 2024, data shows

I can imagine the uneasy feeling starting to spread in your body after reading the first two paragraphs of this article. Please accept my apologies because what comes next will make you feel even more uncomfortable. However, before that, let’s refresh our memory on what “provisions for expected credit losses” [ECL] are:

“Provisions for expected credit losses” in a bank’s financial report refer to money the bank sets aside to cover potential losses from loans and other credit that might not be repaid. Banks estimate how much of their loans could go bad in the future, based on things like the borrower’s financial health, economic conditions, or past repayment patterns. By putting this money aside in advance, the bank prepares for these losses and ensures it stays financially stable, even if some loans aren’t paid back. It’s like setting up a safety net for potential risks.

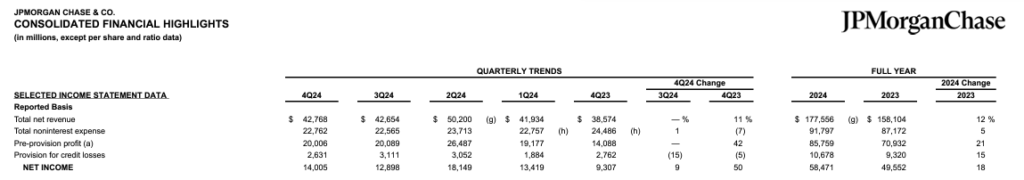

All right, it’s time to dig in now. Let’s start with the almighty JP Morgan. JPM put aside ~2.6bn USD of Provisions for ECL in Q4-24, a 15% decrease from Q3-24 and a 5% decrease from the same quarter last year. Overall in 2024, the total for this item stands at ~10.6bn USD, only 15% higher compared to 2023’s total. When compared to the total amount of loans in the bank’s balance sheet (~1.3 Trillion USD), only one word can describe these ECL: peanuts.

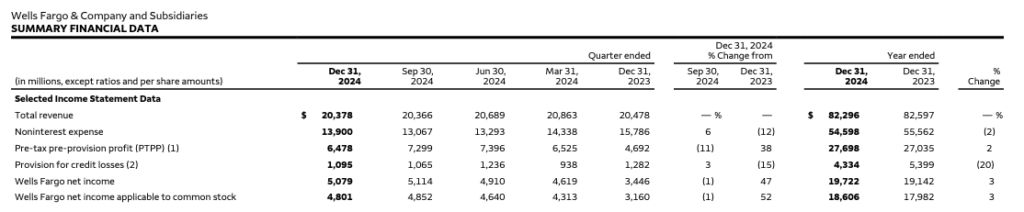

What about Wells Fargo? Incredibly, the total amount of provisions for ECL in 2024 at ~4.3bn USD is about 20% LOWER than 2023 against a total of ~900bn USD of loans. Again: peanuts.

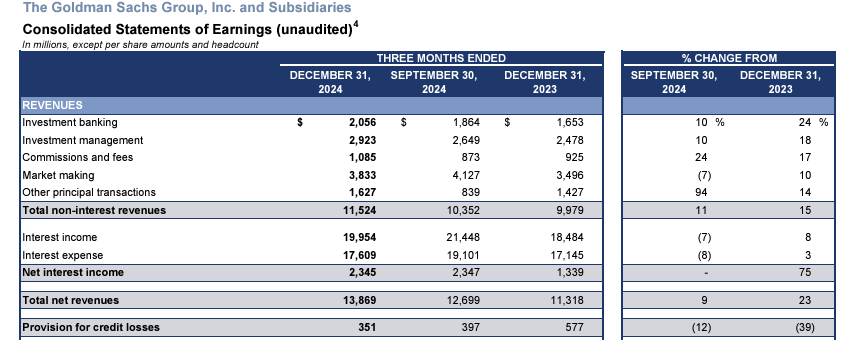

Goldman Sachs isn’t a commercial lender, fair enough, but its 351m USD of provisions for ECL, down 39% from the same period last year, is quite a strong statement about its view of credit risk in the current financial environment.

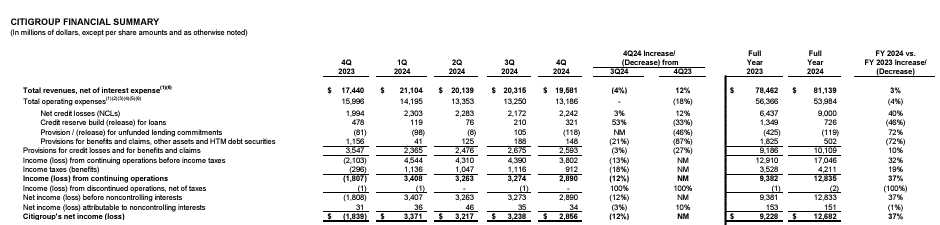

Moving on to Citigroup, it almost feels like reading a copy-paste of JPM data with ~2.6bn USD of provision for ECL (down 3% from Q3-24 and down 27% compared to Q4-23) that brings the total for 2024 to ~10.1bn USD or a 10% overall increase compared to 2023. However, let’s consider that Citi’s loan book size stands at ~700bn USD. Their ECL provisions are effectively double in relative terms compared to JPM, indicating that the bank is not doing as well (at least on paper) compared to its peers.

Finally, we look at BNY Mellon, which isn’t heavily involved in lending money (they are in the business of asset custody). As a consequence, their 20m USD of provisions for ECL against their ~70bn USD loan book is fairly understandable.

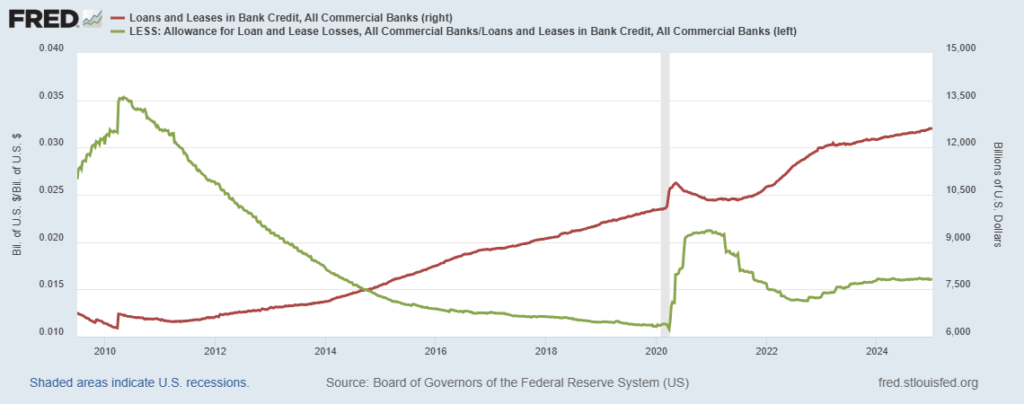

By now, it is crystal clear how disconnected the world portrayed by banks’ figures is compared to what’s happening in the real world, where a deteriorating economic environment paired with rising yields as a result of reigniting inflation is wreaking havoc in the corporate space with bankruptcies piling up and little sign this trend will slow down anytime soon. The chart below best portrays the overall situation with the proportion of allowances for credit losses effectively stable, and far below the peaks of 2020 or 2010.

How do you navigate this environment? As I explained in my last podcast of 2024 “Understanding central banks’ madness and why paying attention to JP Morgan is important,” the regulators are currently allowing banks to keep the real losses on their loans and credit lines buried in their “Hold To Maturity” assets, as they always do before every financial crisis, in the interest (as they always claim) of financial stability and to avoid creating unnecessary panic in the market. However, the can cannot be kicked down the road forever, especially now when central banks’ bandwidth to bail out everyone is becoming limited. These losses will have to surface sooner or later (as they always do), which is why it’s important to pay attention to this since it will be the ultimate signal that the game is over. At that point, it will be time to move to the safety of T-Bills (not bank deposits) to weather the storm that will impact every risk asset out there in markets, regardless of its fundamentals.

JustDario on X | JustDario on Instagram | JustDario on YouTube